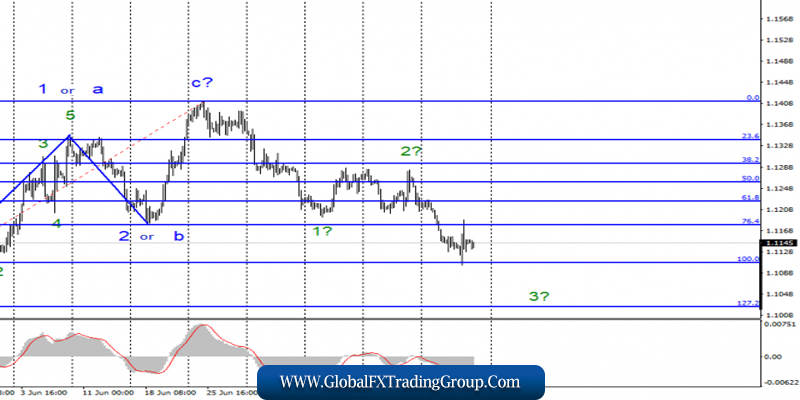

EUR / USD

On Thursday, July 25, trading ended for the EUR / USD pair with an increase of 10 basis points, although during the day, the instrument made jerks both up and down by 40 bp. However, at the end of the day, there were no grounds for assuming a change in the current wave pattern.

The euro-dollar pair is still prone to decline as part of wave 3. The ECB meeting is over, and today, markets will closely monitor the GDP report for the second quarter of 2019. The value of GDP will not be final, but the current forecast of + 1.8% is already much lower than the previous value of + 3.1%. However, at the same time, the markets will not look at the compliance of the real value with the previous, but at the compliance of the real value with the forecast.

Thus, any real numbers above 1.8% will be perceived by the market as a positive factor. The news background is not in favor of the euro, from my point of view, as the ECB took the “pigeon” position, and in the future showed willingness to reduce rates and reanimate the program of quantitative easing. Such a news background perfectly “fits” the current wave marking.

Purchase goals:

1.1412 – 0.0% Fibonacci

Sales targets:

1.1106 – 100.0% Fibonacci

1.1025 – 127.2% Fibonacci

General conclusions and trading recommendations:

The euro-dollar pair has moved away from its lows against the background of the ECB meeting and its results. However, the downward mood in the forex market remains. Thus, I recommend selling the pair with targets near the levels of 1.1106 and 1.1025, which equates to 100.0% and 127.2% Fibonacci, when the MACD signal is down.

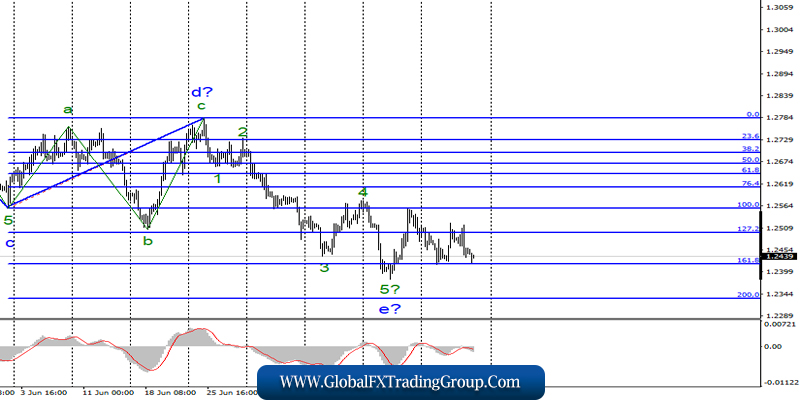

GBP / USD

The GBP / USD pair fell on July 25 by 25 basis points, thus preserving the integrity of the current wave counting, involving the construction of at least three upward waves. At the same time, the pound-dollar instrument leaves the current lows very reluctantly, since it does not allow it to make a negative news background.

EU officials have reported over the past two days three times that there will be no new negotiations with the new British Prime Minister under the terms of Brexit, that all of Boris Johnson’s demands will not be met, and there are no grounds for a new dialogue at all.

Moreover, the European Union does not fear Brexit without an agreement and believes that it is London that will suffer much greater losses from such an outcome of a 3-year epic than the EU. Thus, markets can rightly decide that there is no reason to buy a pound, therefore, need to resume sales. It is this factor that can break the current wave marking and lead to its complication.

However, much will depend on the decisions of the Fed next week and the rhetoric of Jerome Powell.

Sales targets:

1.2334 – 200.0% Fibonacci

1.2194 – 261.8% Fibonacci

Purchase goals:

1.2783 – 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound-dollar instrument implies the completion of the construction of the downward wave e. Thus, I recommend small purchases of a pair with targets located above 1.2550 and with an order restricting losses below the minimum of wave e, with the MACD signal up. I recommend to return to sales no earlier successful attempt to break through the minimum of wave e.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom