EUR / USD

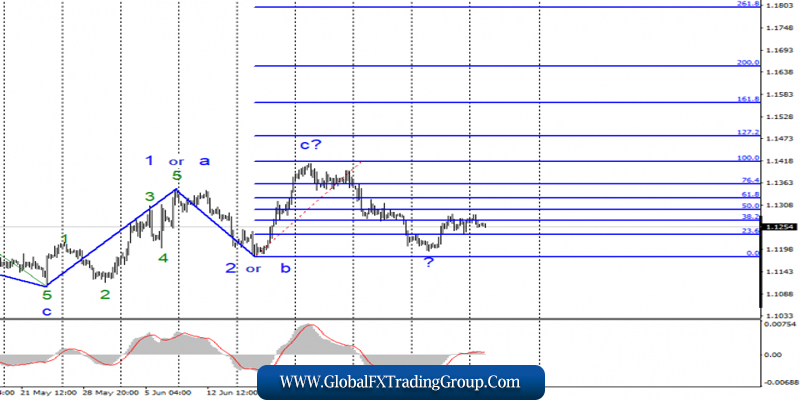

On Monday, July 15, trading ended for EUR / USD by a 10 bp decline. However, in general, quotations move away from the lows reached on July 9. As to the wave marking, the question is if it’s still open after July 18.

It’s either the wave c is already completed, and we are seeing the construction of a new downward trend, or if the wave will take a long and complex look. July 9 is at least the minimum of its internal wave 2.

The news background after Jerome Powell’s speech again changes to negative for the euro-dollar. This is because the markets are not too impressed with the information on the Fed’s readiness to calm down the monetary policy.

The probability of this during the meeting by the end of the month is almost 100%, but the dollar is again in demand. I believe that it is not important for the market now whether the Fed will lower the rate or not, but what is important is whether the ECB will lower the rate.

If the European Central Bank will likewise ease monetary policy, the US dollar may move to a new growth segment. Today, I draw attention to the speech of Jerome Powell and macroeconomic data on industrial production and retail sales in America.

Purchase goals:

1.1417 – 100.0% Fibonacci

1.1480 – 127.2% Fibonacci

Sales targets:

1.1180 – 0.0% Fibonacci

General conclusions and trading recommendations:

A pair of euro / dollar presumably remains in the upward trend. I recommend to buy euros with targets located near the estimated marks of 1.1417 and 1.1480, which equates to 100.0% and 127.2% of Fibonacci, and an order restricting possible losses, under the minimum of wave 2 or b. Leaving the tool below the 0.0% level will require making adjustments to the current markup.

GBP / USD

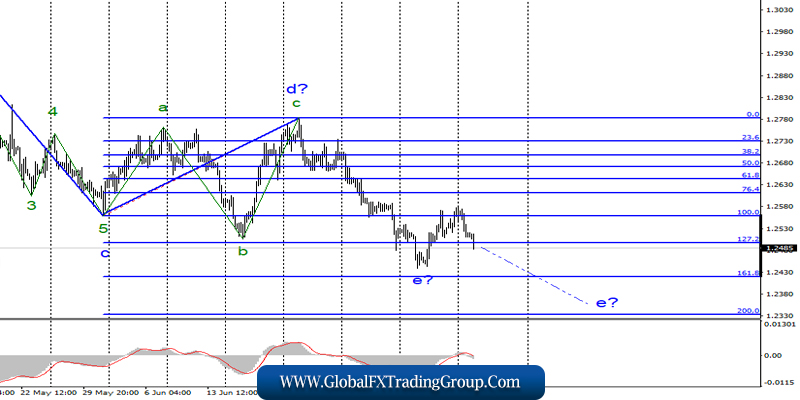

The GBP / USD pair fell by 40 basis points on July 15, and today it has lost another 50 bp. Thus, there is every reason to assume that wave e is not completed and will continue its construction with targets located below the 24th figure.

News background remains unfavorable for the pound sterling. The choice of the Prime Minister in Great Britain is reaching the final stage, and only two candidates will remain. According to many, the victory will be won by Boris Johnson, but so far this has no positive effect on the pound.

The market needs a change the situation for the better – the political situation, the economic one, and the situation with Brexit. Since this is still not observed, then there is simply no reason for the pound sterling to buy the currency market.

Today, we are watching the performances of Mark Carney and Jerome Powell.

Sales targets:

1.2418 – 161.8% Fibonacci

1.2334 – 200.0% Fibonacci

Purchase goals:

1.2783 – 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound / dollar instrument suggests the continuation of the construction of the downward wave e. Thus, I recommend selling the pair with targets located near the estimated marks of 1.2418 and 1.2334, which corresponds to 161.8% and 200.0% in Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom