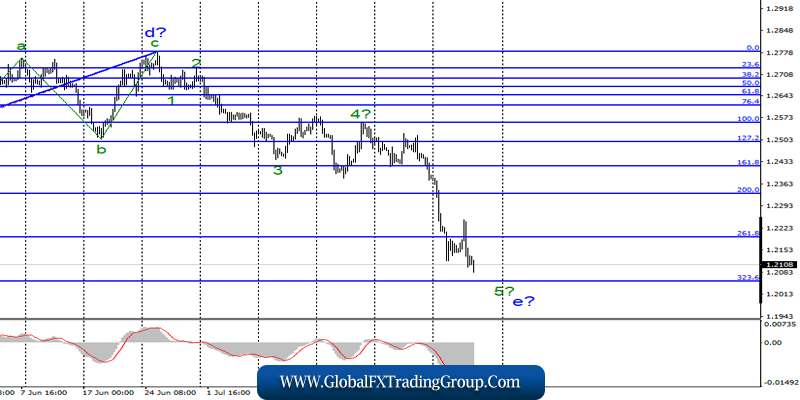

EUR / USD

On Wednesday, July 31, the EUR/USD pair ended by a decrease of 80 basis points. Such reaction of the foreign exchange market was due to the Fed’s decision to lower the key rate by 0.25%, as well as the speech of Fed Chairman Jerome Powell, who hinted that in the future there might be no new rate cuts.

Everything will depend on the political and economic situation in the world, as well as on US economic indicators. Thus, the markets “heard” the Fed’s unwillingness to immediately and systematically reduce the rate Donald Trump wants. The Federal Reserve has once again demonstrated its independence from the American president.

Trump can somehow criticize the Fed but will not do in the wake of Trump. Today, the eurozone business activity index in the industrial sector has already been released. Although its value has exceeded market expectations (46.5 vs. 46.4), it still remains far below the level of 50.0, which is a determining trend in a particular area. Thus, the value of 46.5 allows concluding about the decline in the manufacturing sector of the European Union. An unsuccessful attempt to break through the level of 127.2% Fibonacci may lead to a departure of quotes from the lows reached.

Purchase targets:

1.1412 – 0.0% Fibonacci

Sales targets:

1.1025 – 127.2% Fibonacci

1.0920 – 161.8% Fibonacci

General conclusions and trading recommendations:

The euro/dollar pair continues to build the downward trend, which lowers the sentiment in the Forex market remains. Thus, I recommend selling the pair with targets located near 1.1025 and 1.0920, equating to 127.2% and 161.8% Fibonacci. An unsuccessful attempt to break the 1.1025 mark could lead to the construction of a correction wave.

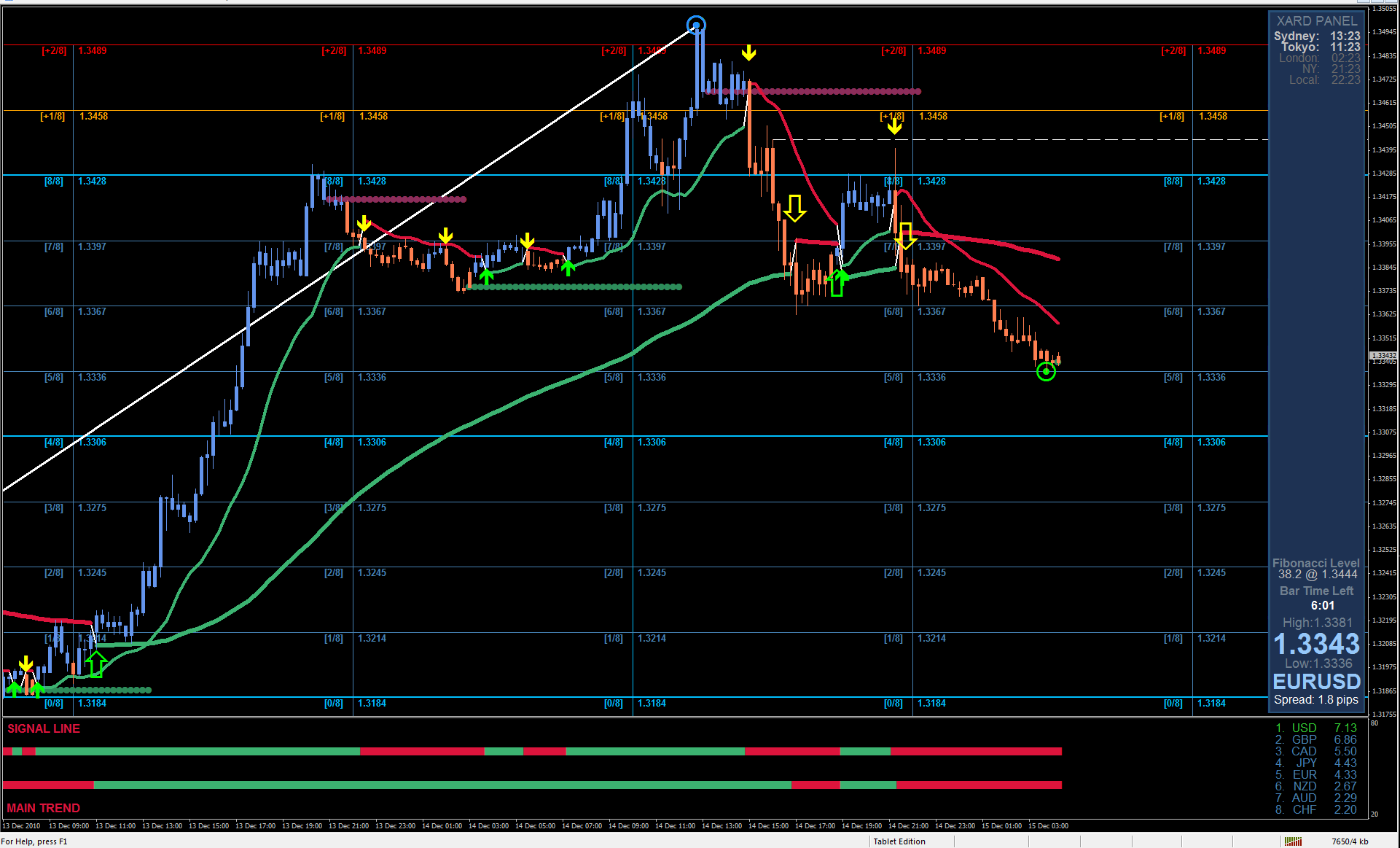

GBP / USD

On July 31, the GBP/USD pair “managed” to add a few base points, while, for example, the euro/dollar dropped by 80. However, the wave pattern of the pound’s unexpected behavior is not broken as the instrument still resumed building a downward wave, which may be the fifth part of the fifth wave of the downward trend.

If this is true, then an unsuccessful attempt to break through the 323.6% Fibonacci level can lead to a departure of quotes from the reached minimums and the beginning of building at least three waves upward. At the same time, the news for the pound sterling is not in his favor.

Just half an hour ago, the results of the meeting of the Bank of England became known, wherein the monetary policy did not change and the rate remained the same. Furthermore, we can only expect disappointment in the speech of the head of the Bank of England. The hopes of the pound are now associated only with those.

Purchase targets:

1.2783 – 0.0% Fibonacci

Sales targets:

1.2056 – 323.6% Fibonacci

1.1830 – 423.6% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound/dollar tool now implies a complication of the downward trend. Thus, I recommend selling the pair for each downward signal on MACD with targets located near the estimated level of 1.2056. In the case of a successful attempt to break through, targets will likely be around 1.1830, which corresponds to 423.6% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom