Globally, the EUR/USD continues to build an upward trend. However, it is unclear whether there will be a complication of the upward part of the trend, which began on March 20. At the moment, it looks as if the upward trend is over, but it can easily transform into a five-wave. The main thing is that the internal wave structure of each global wave looks quite convincing and does not cause any special doubts. This allows you to focus on lower order wave counting.

A smaller scale wave marking shows that the pair has built two new waves after the completion of wave 3 or C. thus, the decline in quotes should resume today in almost any case, except for force majeure. If wave 3 or C is the peak of the upward section of the trend, then a new downward section has begun its construction, therefore, we should expect to build a new impulse downward one after the correction wave. If wave 4 is currently being built, then waves a and b are completed inside it, so we should expect to build wave C with targets located near the 23.6% Fibonacci level.

There was not much news yesterday. Perhaps, I could only highlight the report on claims for unemployment benefits in America, which turned out to be quite optimistic. According to the latest data, unemployment continues to decline in America and the country’s top officials are confident that the economy will recover quickly enough. At least this is regularly stated by Donald Trump and all his subordinates. Jerome Powell, chairman of the Fed, has different opinion, and it is not yet clear who to believe.

The fact that the numbers are improving does not mean anything, since it is logical that after the strongest fall of the economy, its recovery follows. The question is, is the US economy recovering fast enough? Judging by the fact that the dollar is not growing, the markets do not believe that the growth rate of the US economy is enough.

On Friday, August 14, the markets will be looking for reasons to sell the instrument. This can be helped by the report on GDP in the second quarter of the Euro zone, as well as reports on changes in retail trade in the United States and changes in industrial production there. To increase demand for the dollar, it is necessary that GDP in the Euro zone was weaker than forecast, meaning the European economy should contract by more than 12.1% QoQ.

Well, American news should not put “sticks in the wheels” of the dollar. In the past few weeks, the incidence of coronavirus in America has begun to decline, which gives hope that the epidemic will go down. Nevertheless, yesterday in America, 51.5 thousand new cases were recorded, and the day before – 56 thousand. So far, we can only talk about a slight decline.

General conclusions and recommendations:

The euro/dollar pair has presumably completed the construction of the upward wave C in B. Thus, at this time, I do not recommend new purchases of the instrument, and I recommend closing the old ones at least until a successful attempt to break through the 0.0% Fibonacci level. I also recommend considering the possibility of selling the instrument with the first targets located near the calculated levels of 1.1634 and 1.1465, which equates to 23.6% and 38.2% Fibonacci, based on MACD downward signals.

GBP/USD

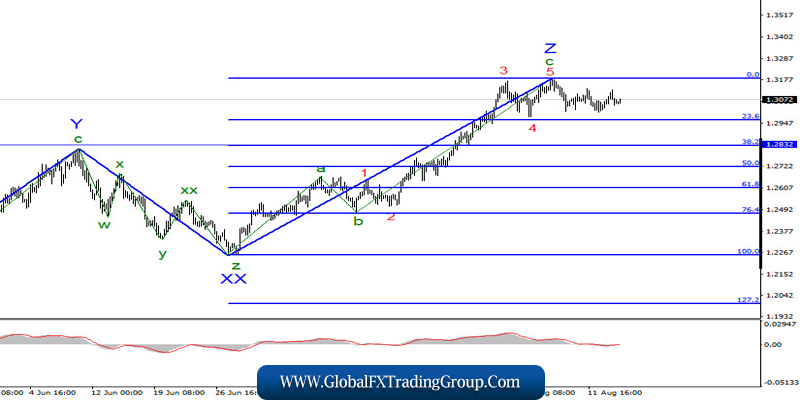

The wave pattern for the pound/dollar instrument has not changed and everything also assumes the construction of a new downward trend section. However, the currently completed upward part of the trend may become even more complicated, which will lead to the need to make adjustments and additions to the current wave counting. Meanwhile, a successful attempt to break the 0.0% Fibonacci level will indicate that the markets are ready for new purchases by the pound.

General conclusions and recommendations:

The pound/dollar instrument has supposedly completed the upward wave Z around 1.3183. Therefore, I recommend at this time to close all purchases at least until a successful attempt to break through the 0.0% Fibonacci level and tune in to a possible long-term decline in quotes within a new downward trend section with the first targets located around 1.2832 and 1.2719 which equates to 38.2% and 50.0% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom