Here are the details of the economic calendar for Sept 8:

The number of open vacancies in the US JOLTS labor market was published yesterday, where an increase was recorded in their volume from 10.185 thousand to 10.934 thousand in July, instead of the forecasted decline. The market reacted right away, and the US dollar continued to strengthen its positions.

* The number of open vacancies in the labor market JOLTS is a monthly report on open vacancies in the retail, manufacturing, and office sectors of the United States. This report is prepared by the US Bureau of Labor Statistics, which is created on the basis of surveys of employers.

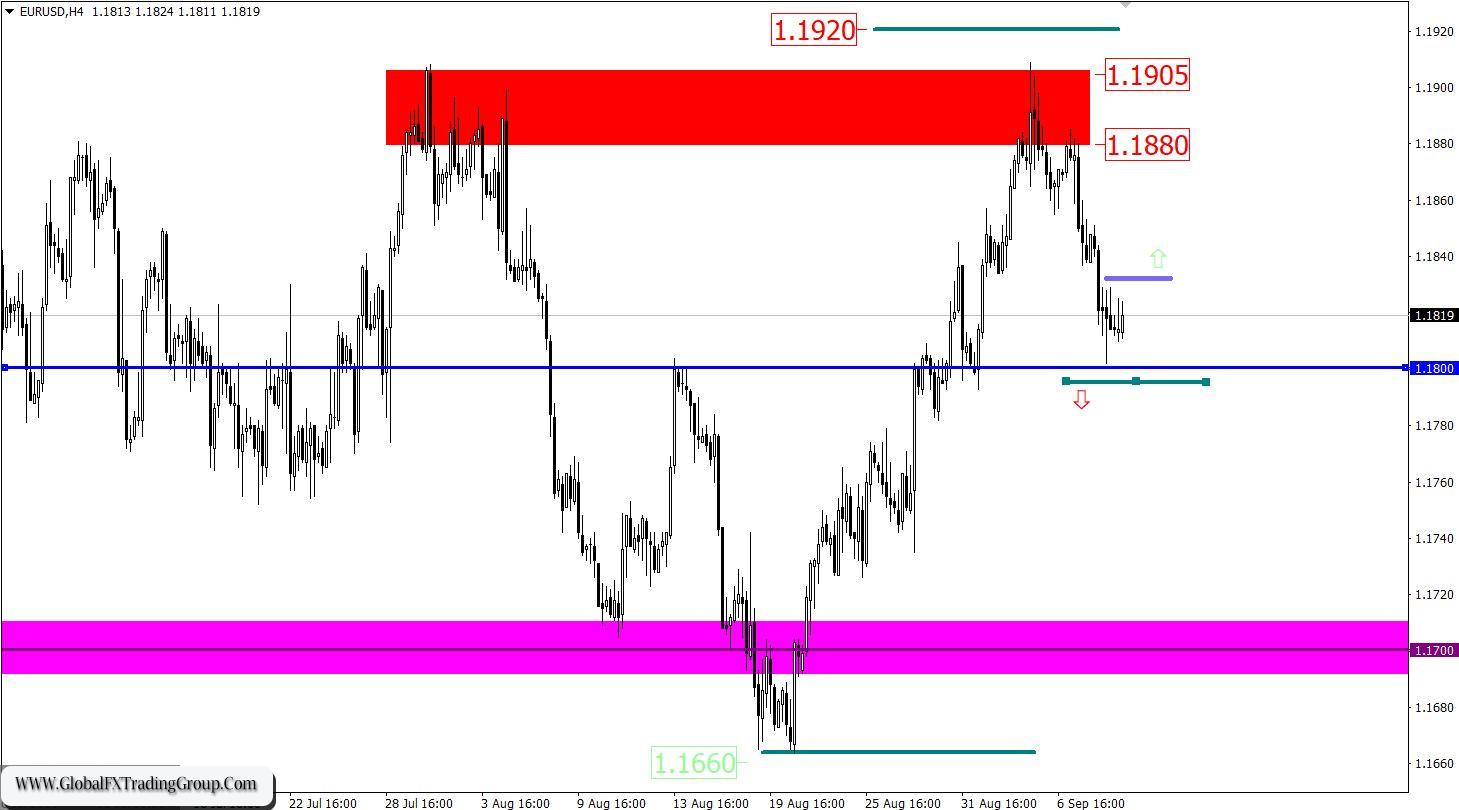

Analysis of trading charts from September 8: EURUSD:

The price rebound from the resistance area of 1.1880/1.1905 returned the quote to the level of 1.1800. This signals the end of the correction from August 20 to September 3. At the moment, traders are trading based on the restoration of the volume of dollar positions. On the fourth day, our trading plan indicates the superiority of short positions. This has already led to a possible profit of more than 50 points.

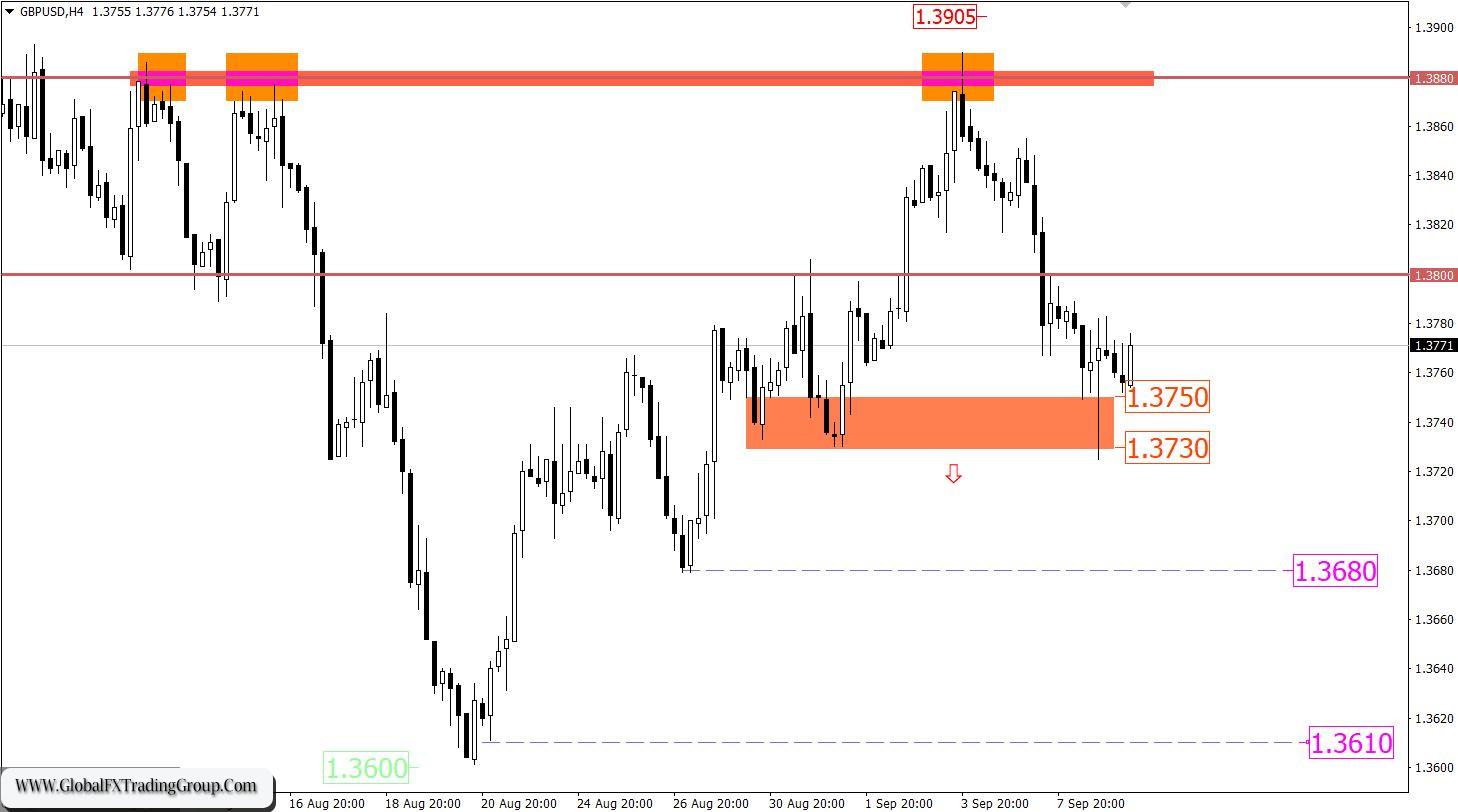

During the recovery movement from the resistance level of 1.3880, the GBP/USD pair approached September 1’s local low of 1.3730, where there was a slight stagnation. In this situation, the downward cycle from the level of 1.3800 is still relevant among traders. This is due to the fact that there has been a downward trend in the market since the beginning of June.

Trading recommendations as early as September 3 indicate the superiority of short in the market. Therefore, the trading plan analyzes the positions to sell the pound day after day.

Short positions or Short means sell positions.

* The resistance level is the so-called price level, from which the quote can slow down or stop the upward movement. The principle of constructing this level is to reduce the price stop points on the history of the chart, where the price reversal in the market has already occurred earlier.

September 9 economic calendar:

Today, everyone’s attention is focused on the results of the European Central Bank (ECB) meeting, where the parameters of monetary policy will most likely remain unchanged. However, investors hope that the regulator will somehow react to the rapid growth of inflation, and still announce plans to tighten monetary policy. If this happens, the US dollar will be under strong selling pressure.

If the ECB, just like before, does nothing, it will benefit the US dollar.

ECB meeting results – 11:45 Universal time

ECB press conference – 12:30 Universal time

In this situation, traders will not be interested in the result of the meeting, but in the subsequent press conference, where price speculations are likely to arise.

Along with the press conference, the United States will publish weekly data on unemployment benefits, where they forecast a slight decrease in their volume. This data may be ignored due to the fact that the publication coincides with the press conference.

Details of statistics:

The volume of initial applications for benefits may fall from 355 thousand to 335 thousand.

The volume of repeated applications for benefits may fall from 2 748 thousand to 2 744 thousand.

* Price speculation is a sharp price change in a short period of time. They often occur at the moment of unexpected information for the market.

* Applications for unemployment benefits reflect the number of currently unemployed citizens and those receiving unemployment benefits.

This indicator is considered to be the state of the labor market, where the growth of the indicator negatively affects the level of consumption and economic growth. The reduction of applications for benefits has a positive effect on the labor market.

Therefore, a decrease in the number of applications for benefits may lead to a strengthening of the national currency – USD.

Trading plan for EUR/USD on September 9:

The downward movement is still relevant among market participants. In order for the growth of the volume of short positions * to occur, the quotation must hold below the value of 1.1800. In this case, movement in the direction of 1.1740-1.1700 is possible. It is worth considering that the ECB meeting with a high degree of probability will lead to speculation in the market, so be prepared for sharp price jumps. In view of the time positions, we can consider an upward move from the value of 1.1835 towards 1.1855.

Trading plan for GBP/USD on September 9:

The price area of 1.3730/1.3750 negatively affected short positions in the form of their reduction. At the same time, the downward interest is still relevant in the market. To continue the downward cycle, the quotes must hold below the level of 1.3730. In this case, a path will open towards the 1.3680-1.3610 range.

An alternative scenario of the market development will become relevant if the price rebound from the area of 1.3730/1.3750. This may lead to a temporary movement towards the level of 1.3800.

Short positions or Short means sell positions.

What is reflected in the trading charts?

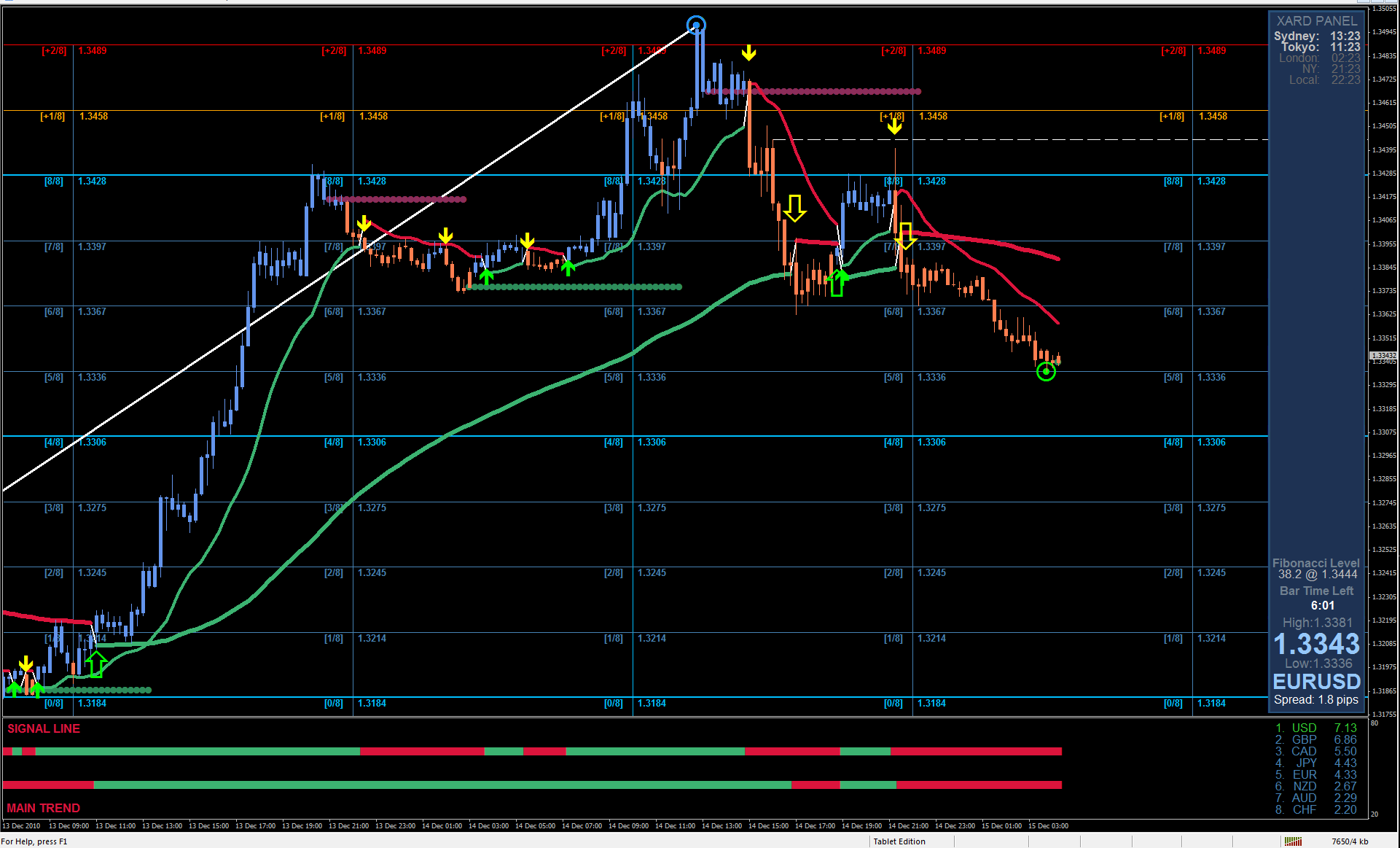

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices. Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future. Golden Rule: It is necessary to figure out what you are dealing with before starting to trade with real money. Learning to trade is so important for a novice trader because the market is constantly dynamic and it is important to understand what is happening.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom