Here are the details of the economic calendar for Sept 7:

The third estimate of Europe’s GDP in the second quarter was published yesterday, where economic growth was recorded at 14.3% instead of the expected 13.6%. The indicators are strong, but they did not stop speculators, the European currency continued to decline despite the positive statistics. Let’s pay attention to a number of important points – last Friday, the report of the US Department of Labor was published, which did not come out as well as the investor wanted. The situation in the US labor market is still not so bad.

Monday was a Labor Day holiday in the United States. It was impossible to win back the news about the decline in the unemployment rate in the United States due to the absence of the main player in the market – the United States. Tuesday opens with the strengthening of dollar positions, where the Euro currency stops the decline during the publication of GDP data for Europe. In fact, the GDP data was locally won back on the market, but the US dollar resumed strengthening already during the start of the US session.

Analysis of trading charts from September 7:

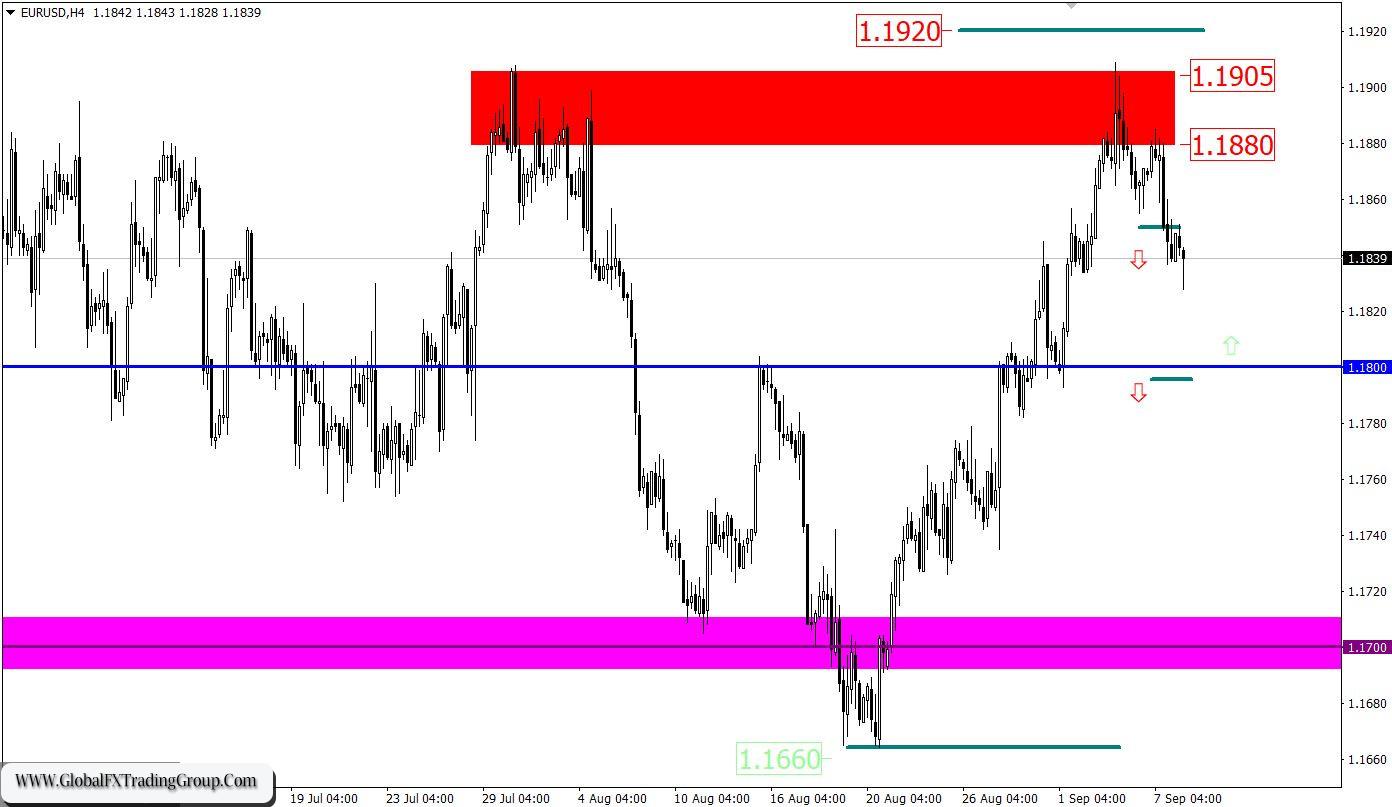

The correction of the EUR/USD pair from the base of 1.1660 was completed in the resistance area of 1.1880/1.1905, where a change of trading interests appeared. At this stage, market participants moved on to the process of recovering dollar positions relative to the recent correction. The trading recommendations from September 3, 6, and 7 indicated a possible price reversal relative to the resistance area of 1.1880/1.1905. Now, the positions to sell the euro are in profit.

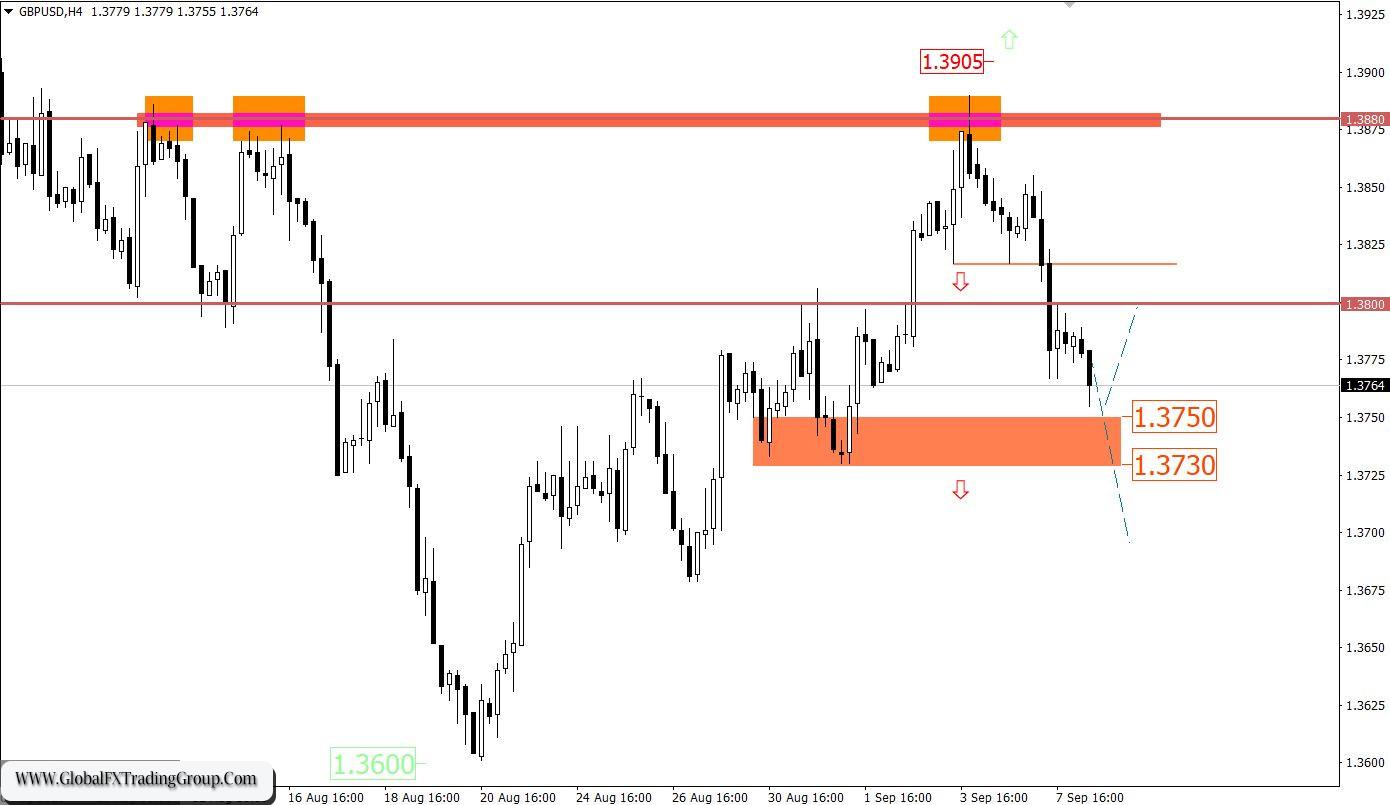

The GBP/USD pair completed the corrective move within the resistance level of 1.3880, where there was a reduction in the volume of long positions and a price reversal. The quotes’ recovery against the recent correction is about 46%. This is a signal that sellers have high chances of a full recovery of dollar positions.

The trading recommendations from September 3, 6, and 7 indicated a possible price reversal relative to the resistance level of 1.3880. Now, the positions to sell the pound sterling are in profit.

* A change of trading interests is when there is a change of direction in the market from ascending to descending or from descending to ascending. Long positions or Long means buy positions.

* The resistance level is the so-called price level, from which the quote can slow down or stop the upward movement. The principle of constructing this level is to reduce the price stop points on the history of the chart, where the price reversal in the market has already occurred earlier.

September 8 economic calendar:

In terms of the economic calendar, the number of open vacancies in the US JOLTS labor market will be published, where they forecast a slight decline from 10.073 thousand to 10,000 thousand in the period of July.

* The number of open vacancies in the labor market JOLTS is a monthly report on open vacancies in the retail, manufacturing, and office sectors of the United States. This report is prepared by the US Bureau of Labor Statistics, which is created on the basis of surveys of employers.

Trading plan for EUR/USD on September 8:

The downward trend is still relevant in the market. The first degree in the form of a pivot point 1.1800 is on the sellers’ path. In order to strengthen the downward cycle towards the 1.1660 base, market participants need to keep the quote below the level of 1.1800 for a four-hour period. Otherwise, the price may rebound from 1.1800, which will ultimately slow down the downward movement.

Trading plan for GBP/USD on September 8:

The price being kept below the level of 1.3800 will increase the interest in short positions for the pound. The subsequent increase in the volume of sell positions can be expected if the price is held below the level of 1.3730. In this case, the recovery move relative to the correction may move to the finish line, focusing on the local low of 1.3600.

To simply put it, the breakdown of 1.3730 will increase sellers’ chances to further weaken the pound.

An alternative scenario for the development of the market will become relevant in the event of a price rebound from the area of 1.3730/1.3750. This can lead to a slowdown in the decline.

Short positions or Short means sell positions.

What is reflected in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.

Golden Rule: It is necessary to figure out what you are dealing with before starting to trade with real money. Learning to trade is so important for a novice trader because the market is constantly dynamic and it is important to understand what is happening.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom