Here are the details of the economic calendar for Sept 30:

The UK’s final GDP data for the second quarter was released, which suddenly turned out to be better than the preliminary estimate. As a result, the -6.1% economic decline was replaced by a 23.6% growth. The data is positive, but due to the panic sell-off of the British currency, the statistic was ignored by the market. During the US trading session, the US GDP in the second quarter was also published. The economy grew 6.7% year over year in the third final assessment. Together with the GDP, figures on applications for unemployment benefits in the United States were published, where the data turned out to be worse than expected.

Details of statistics: The volume of initial applications for benefits rose from 351 thousand to 362 thousand with the forecasted decline of 335 thousand. The volume of repeated applications for benefits declined from 2,820 thousand to 2,802 thousand, with the forecasted decline of 2,800 thousand. Considering the rapid growth in the value of the US currency a few days earlier, there was no reaction on dollar positions when the statistical data was published.

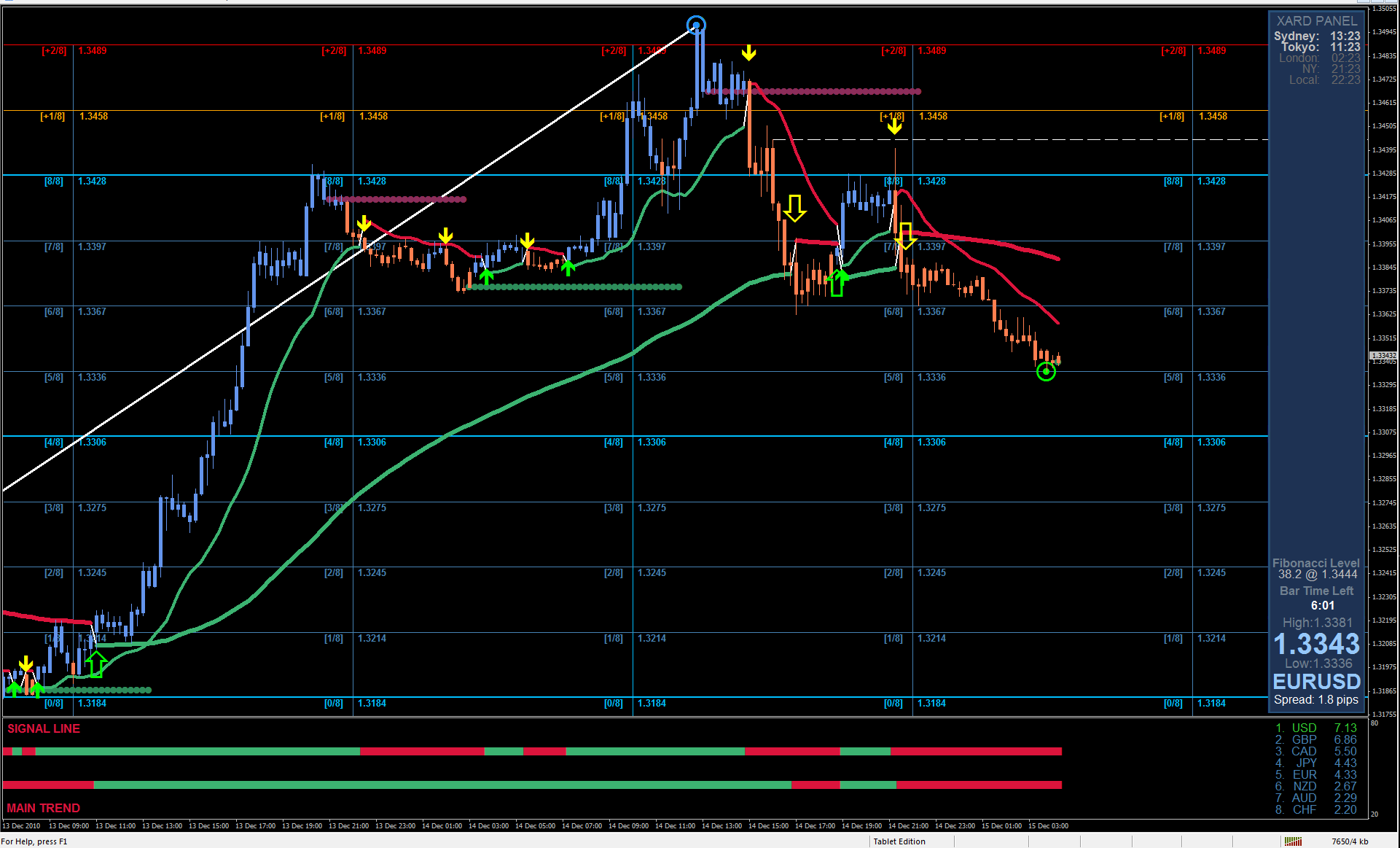

Analysis of trading charts from September 30:

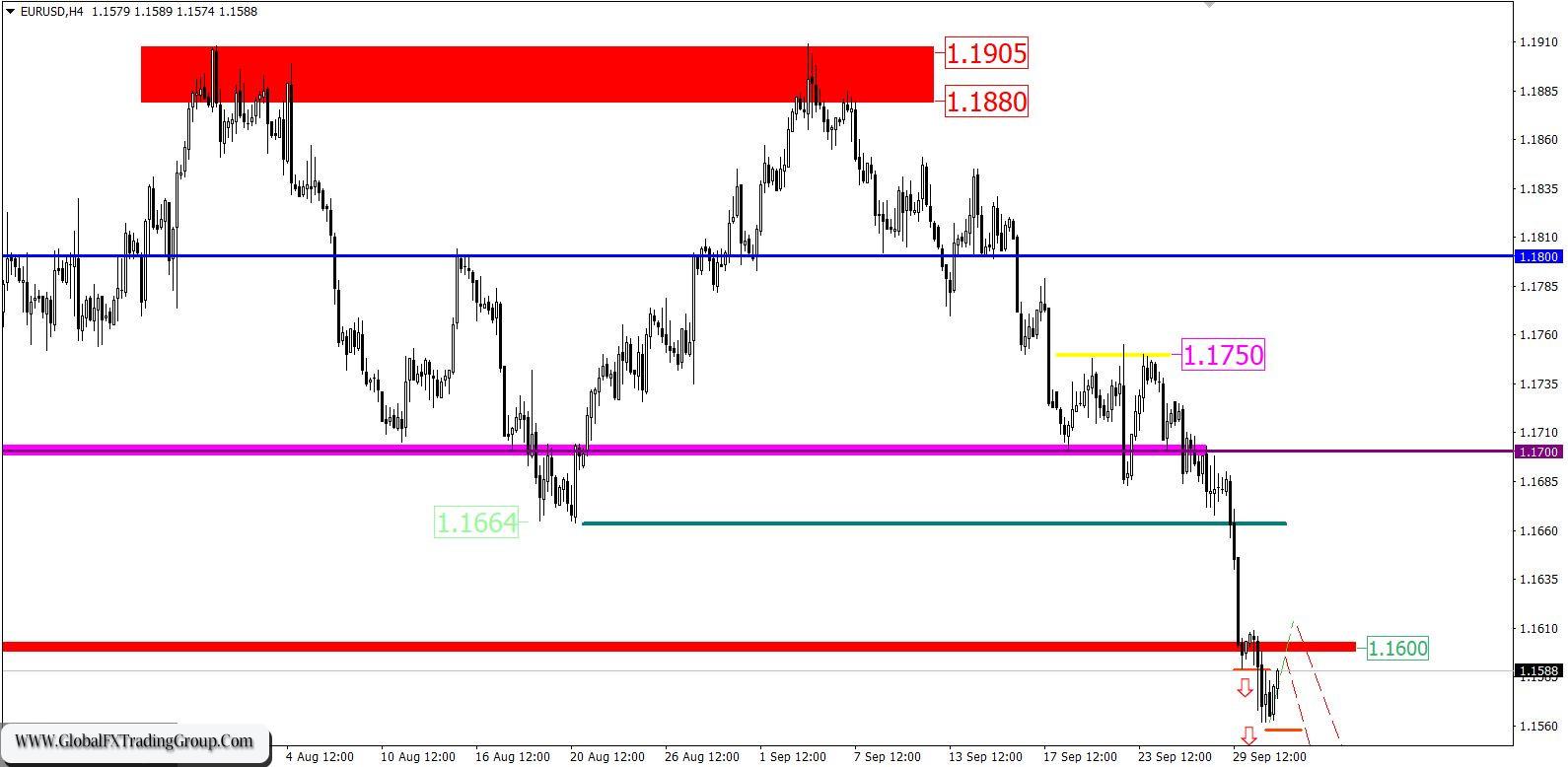

The EUR/USD currency pair continued to decline despite its oversold status. As a result, the local low of November 2020 in the face of the support level of 1.1600 was broken. The quote automatically appeared in the area of July last year, which is considered the first signal of a possible change in the market trend from ascending to descending. The trading plan on September 30 allowed for the possibility of further weakening the euro if the price kept below the level of 1.1590.

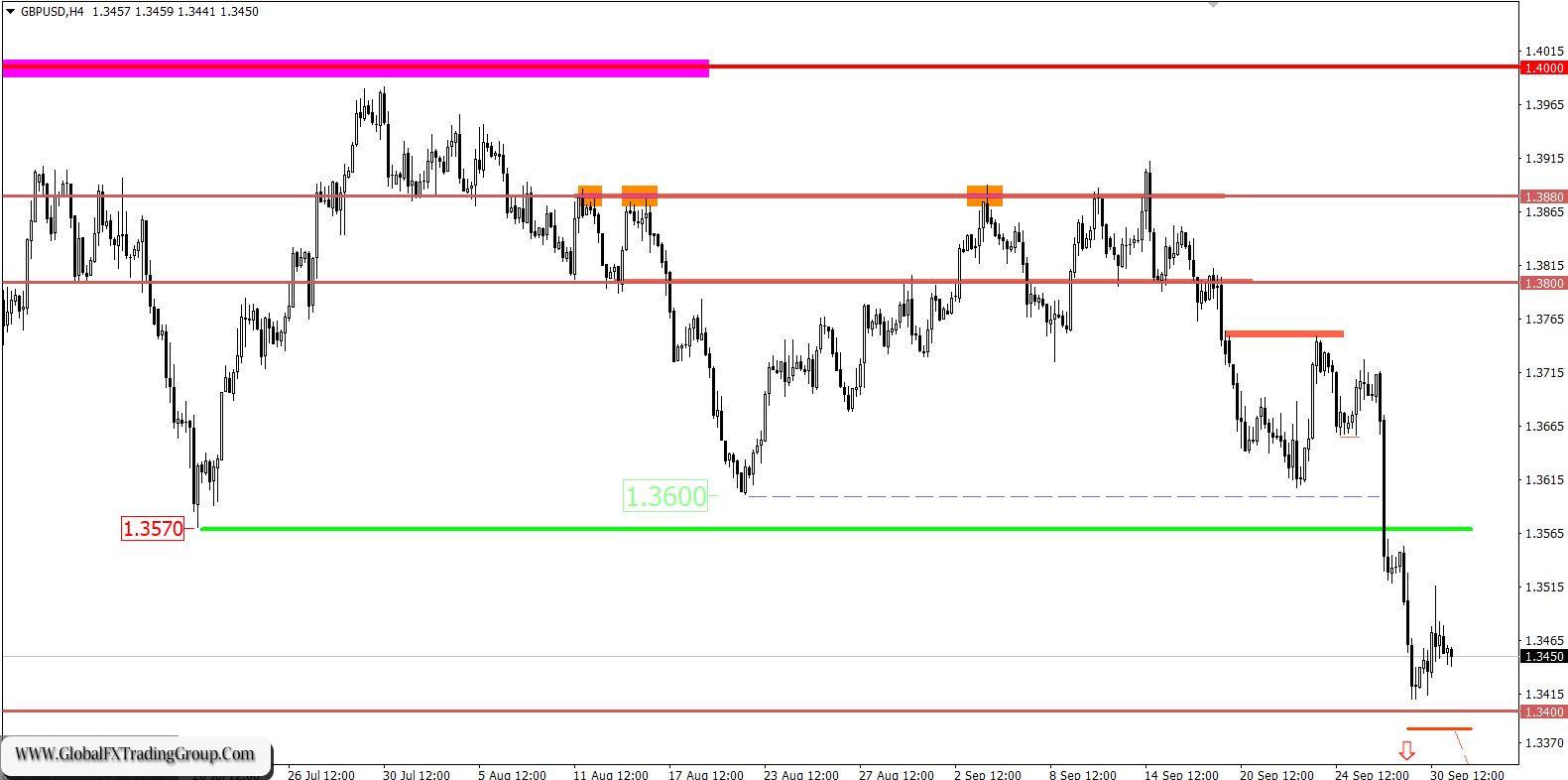

The British currency lost more than 300 points during the rapid decline, which led to a high level of oversold and a technical pullback. The level of 1.3400 serves as a variable pivot point, where there was a reduction in the volume of short positions. Taking into account the strong price change, there was a risk of a change of trading interests, where the quote was already at the levels of December 2020. The trading plan on September 30 considered the scenario of local strengthening of the pound from the support area of 1.3400 The trading recommendation coincided by 100%. The control values for taking profit from buy positions were in the area of 1.3500-1.3520.

* A change of trading interests is when there is a change of direction in the market from ascending to descending or from descending to ascending.

* Oversold market – a situation where prices have dropped too low and quickly. In this case, we are talking about the euro and the pound, which have lost almost 100 and 300 points from the value in a short period of time.

• Short positions or Short means sell positions.

October 1 economic calendar:

Europe’s preliminary inflation data will be published today at 9:00 Universal time, where inflation is predicted to rise from 3.0% to 3.1%. And this is the best case. There is every reason to believe that inflation will accelerate to 3.3%. It is also necessary to consider the fact that the ECB, unlike the Fed, has not yet announced specific plans to tighten monetary policy. Therefore, inflation growth will be perceived as a negative factor for the EU economy.

Trading plan for EUR/USD on October 1:

The EUR/USD pair continues to be under pressure from sellers, which leads to the price holding below the level of 1.1600. If speculative hype persists on the market, it is impossible to exclude a subsequent decline in the euro towards the range of 1.1500-1.1450, despite the high level of oversold. In turn, a technical pullback will appear in the market sooner or later, but it is unlikely to change anything.

Trading plan for GBP/USD on October 1:

The oversold status partially subsided at the time of the pullback, thereby sellers had a chance to increase the volume of short positions again. The subsequent sell signal will arrive when the price is kept below the level of 1.3400 in the H4 period. Until then, market participants are in the pullback stage.

What is reflected in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices. Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market. Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future. The up/down arrows are the reference points of the possible price direction in the future.

Golden Rule: It is necessary to figure out what you are dealing with before starting to trade with real money. Learning to trade is so important for a novice trader because the market is constantly dynamic and it is important to understand what is happening.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom