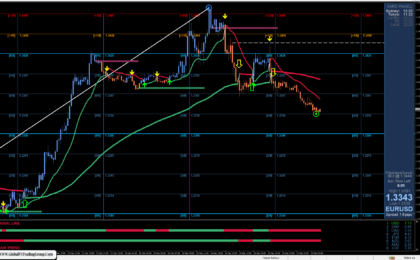

Forex Analysis – Forecast for EUR/USD on August 29, 2024

On Wednesday, according to the US business media, there was a broad market correction due to partial profit-taking in a calm external environment—there

Jeff Wecker