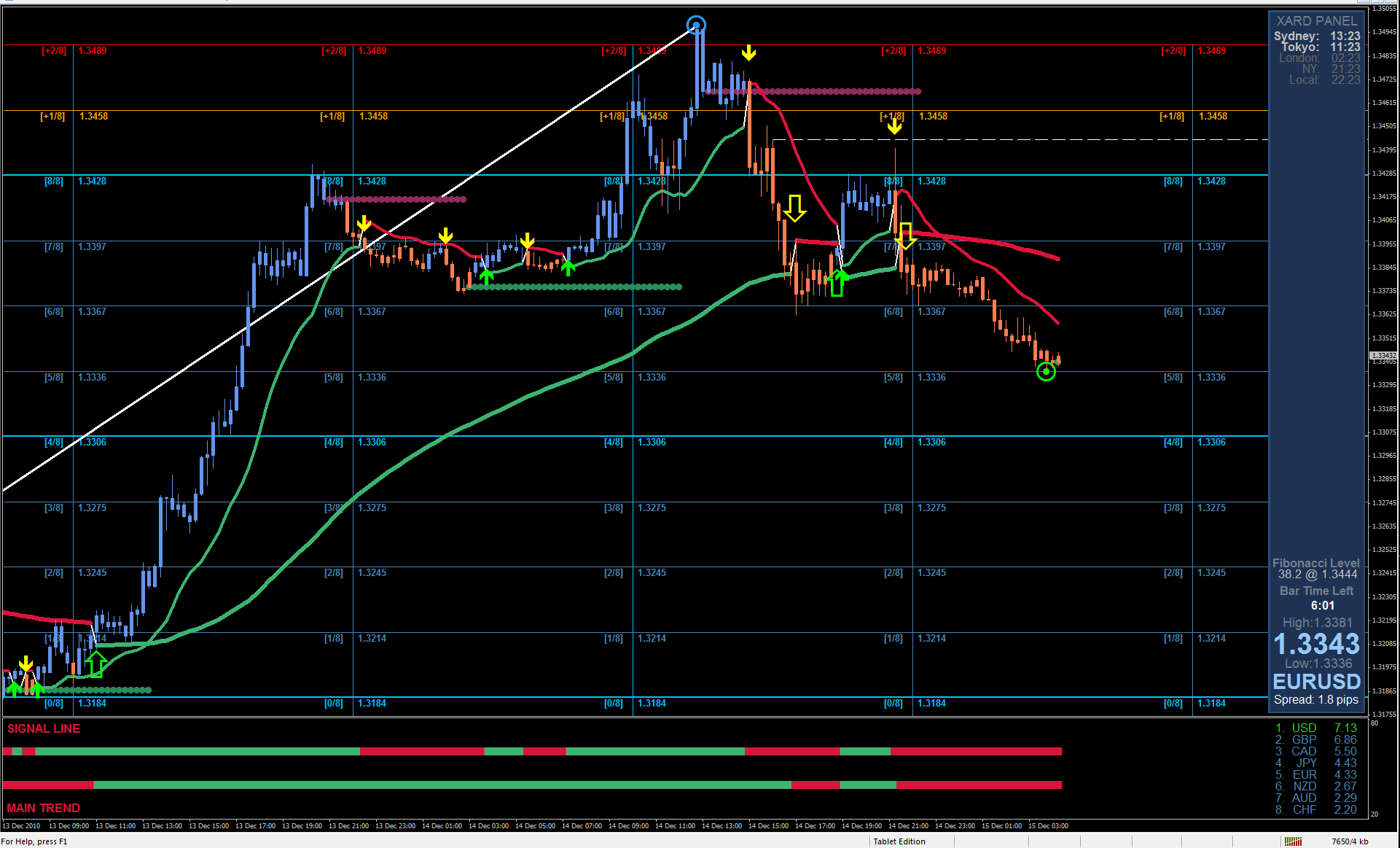

Buy and sell levels of EURUSD on November 12.

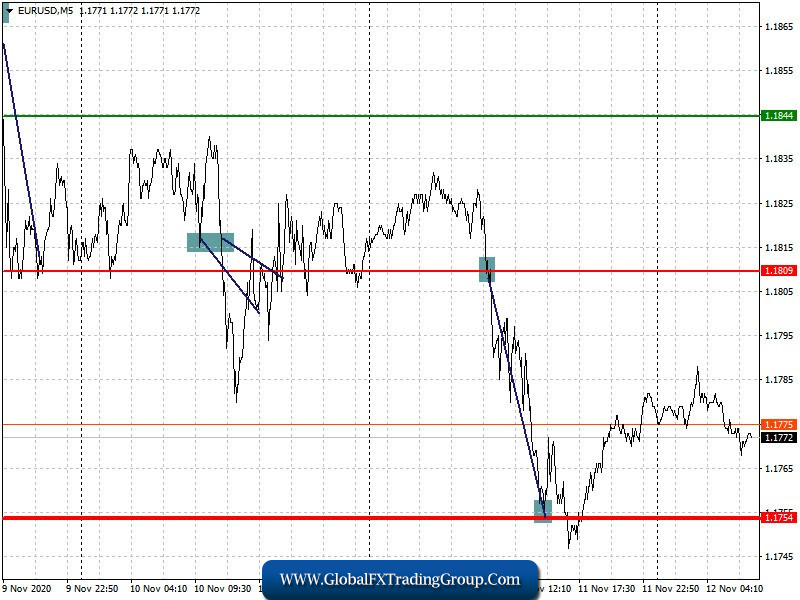

Analysis of deals Analysis of deals Yesterday, we could observe excellent short deals on the euro at the price of 1.1809, which brought more than 50 points of profit. Recommendation to sell the euro worked out by 100%. The main reason for the euro’s decline was the uncertain victory of the Democrats in the US House of Representatives, which put pressure on risky assets. The demand for the US dollar persists due to the spread of the coronavirus pandemic, which is now the main topic of conversation after the US presidential elections, which Joe Biden won by a large margin.

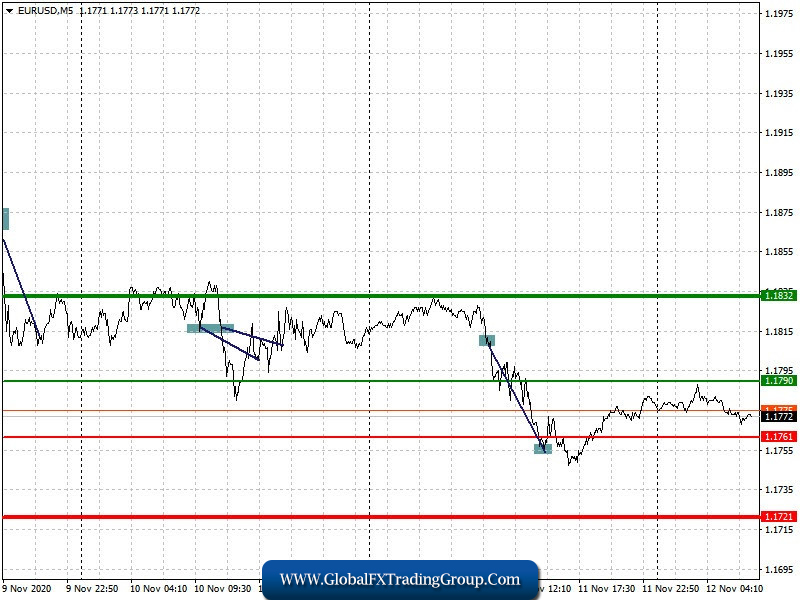

Today’s guidelines for going in and out A number of reports on Germany and the eurozone will be released today. Good inflationary indicators may cause the euro to strengthen in the first half of the day, but the data on industrial production of the eurozone countries will be a cold shower for traders. Take note that the US dollar’s growth in the afternoon will depend on the results of the US inflation data, which will show the state of the US economy. Speeches by representatives of the central banks of the US, UK and eurozone will also lead to a surge in volatility in the markets.

Today, you can buy the euro when the price reaches 1.1790 (green line on the chart), in hopes to rise to the 1.1832 level. Upon reaching 1.1832, I advise you to leave the market with profit. Growth can only happen in case we receive good data for Germany, which will indicate an increase in inflation. You can sell the euro after reaching the 1.1761 level (red line on the chart). The target will be the 1.1721 level, where I recommend leaving the market. I recommend selling the euro if Germany’s report turns out to be worse than economists’ forecasts, since it is not worth relying on the indicators of industrial production in the eurozone.

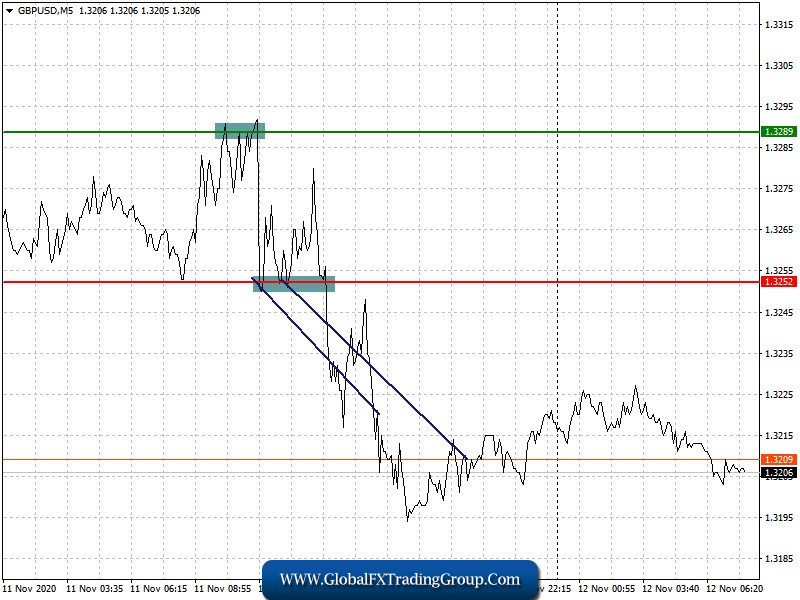

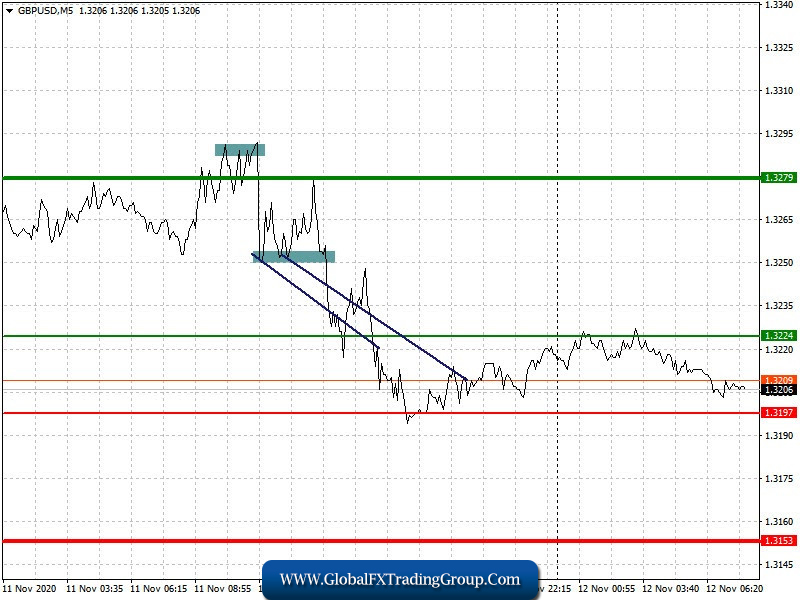

Buy and sell levels of GBPUSD on November 12.

Analysis of deals Analysis of deals The British pound presented a lot of problems for buyers yesterday morning, however, all their failures were offset by a large decline in the pound from 1.3252. I advised you to sell the pound at this price, with the expectation that it would fall within the day. The downward movement was more than 40 points. The fact that the House of Lords (Upper House) blocked Prime Minister Boris Johnson’s bill has prevented buyers of the pound from sustaining the bullish momentum.

Today’s guidelines for going in and out Traders will focus on today’s report on the growth of the UK economy in the third quarter of this year. The pound will remain under pressure if the data turns out to be worse than economists’ forecasts, and the GBP/USD pair will fall. If the data manage to please us, it is possible that big players will return to the market, who bet that the pound would strengthen in the medium term.

You can buy the pound today when it reaches the entry point around 1.3224 (green line on the chart), in hopes to rise to the 1.3279 level (thicker green line on the chart). I recommend leaving buy positions around 1.3279. Only good data on the UK GDP and the service sector can strengthen the pound. You can sell the pound today, but only when the 1.3197 level (red line on the chart) has been updated, which coincides with yesterday’s low. A breakout of this range will return pressure to the pair and pull down the pound o a low of 1.3153. This price will be the sellers’ target, so I recommend leaving the market at that point.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom