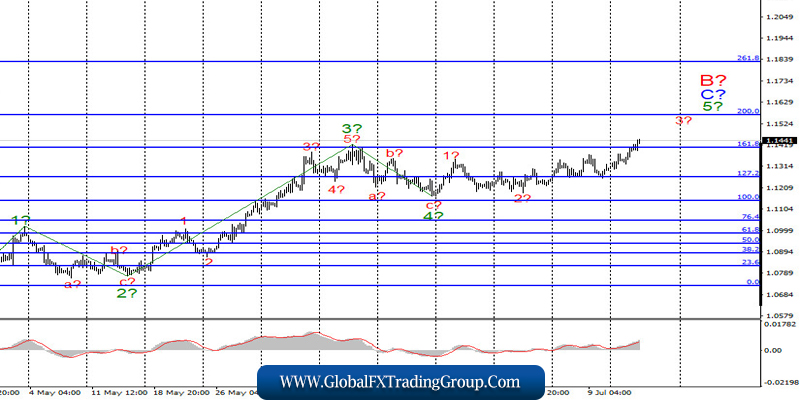

EUR/USD

On July 14, the euro/dollar pair gained about 55 basis points. It continues to build the expected wave 5 in C and B. A successful attempt to break the 161.8% Fibonacci level indicates that the markets are ready for new purchases of the single currency. Thus, the pair may continue advancing to the targets located near the 200.0% Fibonacci level. The entire wave 5 in C and B could be very extended.

Fundamental data:

On Tuesday, there was a lot of news from the US and the European Union. However, the markets’ reaction was not very strong. Thus, the single currency just continued to rise, according to the current wave pattern. In other words, all the news of the day is informative. For example, the Germany’s consumer price index in June, came in at 0.9% on a yearly basis, while industrial production in the European Union in May, declined by 20.9% on a yearly basis.

The US consumer price index in June, was at the level of 0.6% on a yearly basis. The inflation data almost met market expectations. Thus, markets showed a slight reaction as the final data almost met the preliminary estimates. How can we explain an increase of 55 pips in the euro? I believe that the markets continue to attach great importance to the coronavirus outbreak in the US, and there is really something to worry about. The US economy may start to slow down again if the coronavirus continues to spread throughout the country.

Congress, the White House, and the US Fed will have to adopt new and additional programs to help the economy. Each program enlarges the budget deficit. It is impossible to print a few trillions of dollars and hand them out to everyone in need. Thus, the coronavirus for the United States is not just a threat to the health and life of the nation, it is, first of all, the strongest threat to the economy.

Moreover, the US presidential election will be held on November 3. At the moment, the election campaigns are in full swing. Donald Trump is traveling around the country; Biden is sitting at home. However, the US people believe that in times of pandemic, it is Biden who behaves more reasonable.

General conclusions and recommendations:

The euro/dollar pair continues to build upward waves C and B. Thus, I recommend buying the instrument with targets located near the level of 1.1570, which acts as the 200.0% Fibonacci retracement level.

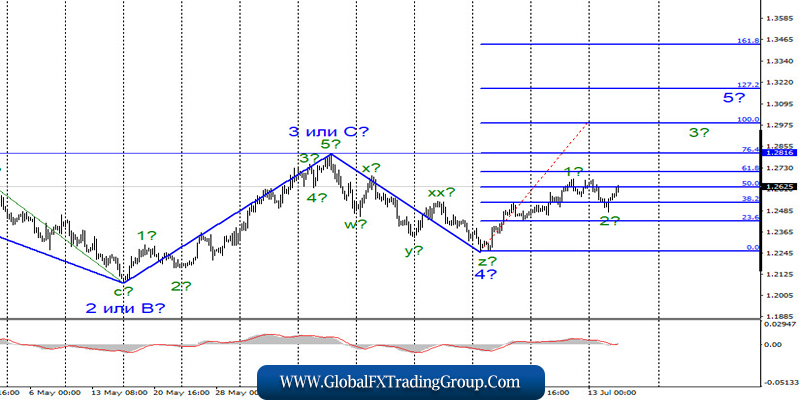

GBP/USD

The pound/dollar pair did not gain a single pip on July 14, but today, it climbed by 80 pips. Thus, the assumed waves 2 and 5 are completed. If this assumption is correct, an increase in quotes will continue with the target near the 76.4% and 100.0% Fibonacci levels. The entire wave 5 may take a fairly extended form and a complex internal wave structure.

Fundamental data:

In the UK, several important economic reports were released on Tuesday. Thus, in May, the UK’s GDP showed an increase of 1.8% on a monthly basis. Economists had expected an advance of 5%. At the same time, in May, the UK industrial production figures were in line with the forecast. Today, the inflation report was released in the UK. The indicator inched up in June from 0.5% to 0.6% on a yearly basis.

General conclusions and recommendations:

The pound/dollar pair has greatly complicated the current wave structure. Now, a building of a new upward wave should begin. Therefore, I recommend to buy an instrument with targets around 1.2816 and 1.2990, which act as a peak of wave 3 or C and the 100.0% Fibonacci retracement level respectively.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom