The pound/dollar instrument resumed the decline in quotes, which led to a dangerous complication of the downward trend, which I initially defined as a wave 4 in the composition of 5-5.

This wave takes on a longer and more complex form than the expected wave 2-5-5, so this suggests that the upward section of the trend, which originates a year ago, is either completed or will become very complicated once again.

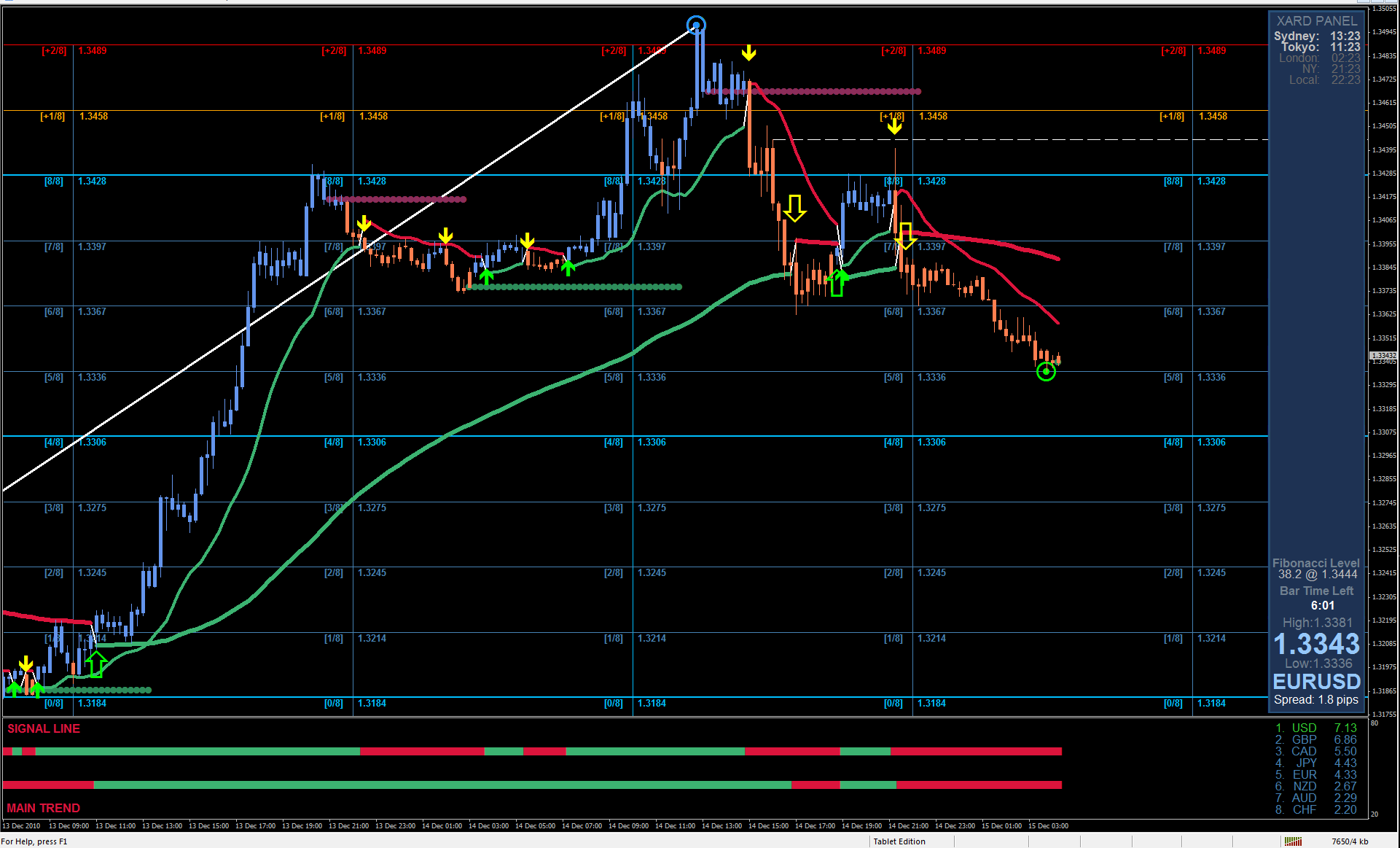

Unfortunately, the current wave marking is such that no special conclusions can be drawn from it. We can only consider the smallest scale, where we see five waves down, three up, respectively, now there should be five more waves down.

It is now impossible to understand what kind of wave it will be on the higher scale. I have already said that the entire assumed wave 3-5-5 and even the entire wave 5-5 look very complex, so their internal wave structures can be interpreted in completely different ways.

There is no unambiguity, so it is extremely inconvenient to trade the pound/dollar instrument now. We make wave markings to work it out later and make money on it. A wave counting that can be supplemented every day is useless. Friday’s reports from America were directly related to the current instrument.

However, although Nonfarm immediately increased by 379,000, and the unemployment rate decreased, the collapse of the instrument’s quotes did not occur. We can say that the markets reacted very cautiously to this data. On Friday, the pound almost did not lose positions.

Thus, it increasingly looks as if the markets have once again ignored the economic data. Thus, I believe that, as in the case of the euro/dollar instrument, wave marking now has a higher priority. Today, the Governor of the Bank of England, Andrew Bailey, made a speech.

However, there was nothing important in it, so the markets continued to trade calm today. Bailey warned the markets against excessive optimism, saying that there are positive developments in the issue of economic recovery, however, it is necessary to be realistic about all the problems that the UK has faced and that affect the country’s economy.

Bailey called the “light at the end of the tunnel” the decline in the number of new coronavirus cases, as well as the high rate of vaccination. The governor also expects that low rates and bond-buying programs will contribute to the economic recovery. However, these are all words and expectations.

You should look at the real numbers and reports, which are now stronger in the United States. Thus, after a long upward trend, most of the factors now really speak in favor of continuing to reduce the quotes of the instrument.

Based on the analysis, I would recommend selling the pound in the coming days with the expectation of building a new five waves down with targets located around the 36th figure.

The section of the trend, which originates on September 23, took a five-wave, fully equipped form. But the internal wave structure of the proposed wave 5-5 still does not look entirely convincing and may require additions and adjustments. The upward trend is nearing its end or has already been completed.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom