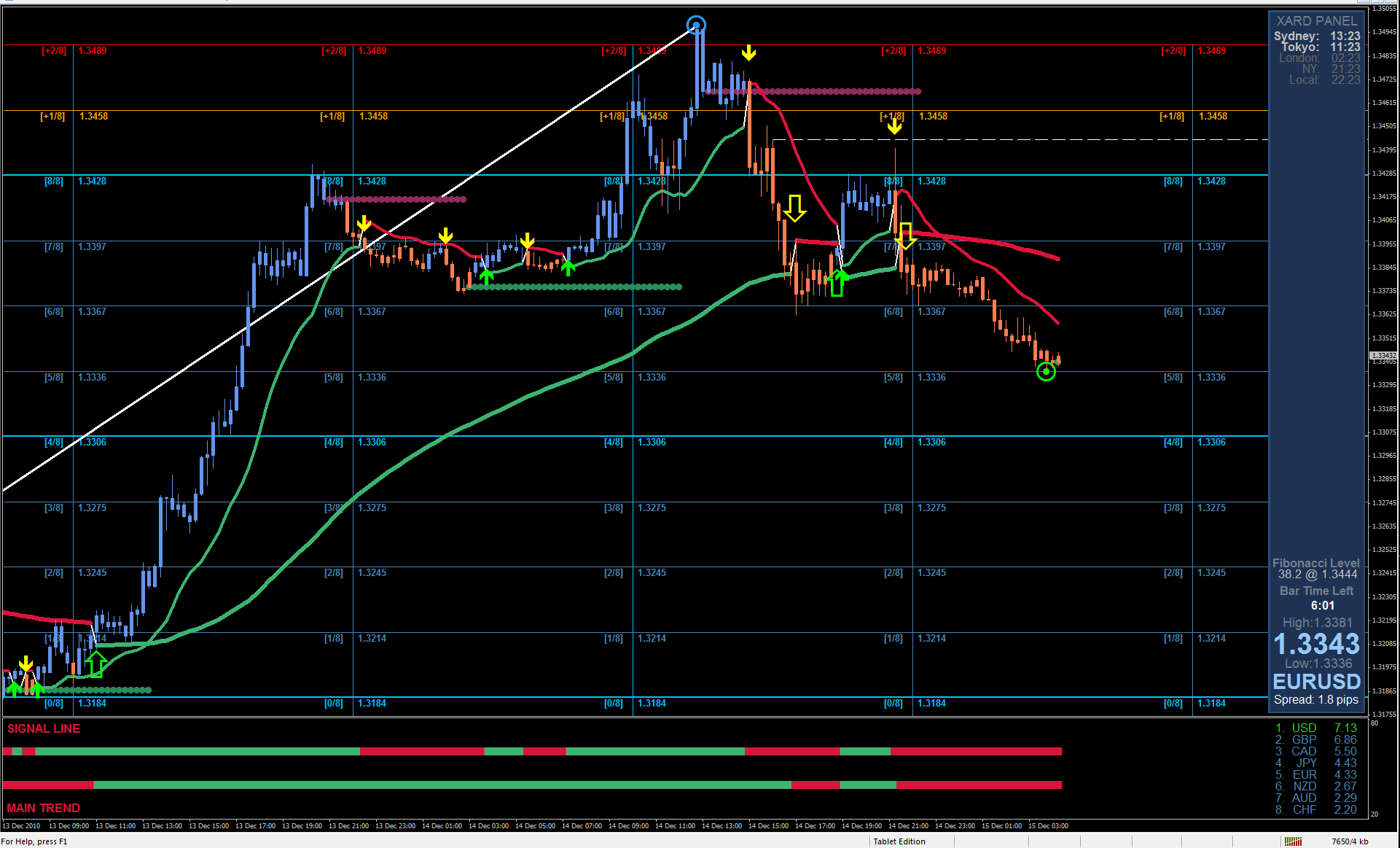

Analysis of transactions in the EUR / USD pair

Several trading signals emerged for the euro yesterday, however, all of them did not bring much result. Short positions at 1.2065 pushed the euro down by only 15 pips, since as soon as economic reports for the EU economy was published, the downward move of the currency halted. Then, at the US session, long positions at 1.2087 raised the quote by only 15 pips. Movement towards the target level 1.2127 could only be achieved today during the Asian session.

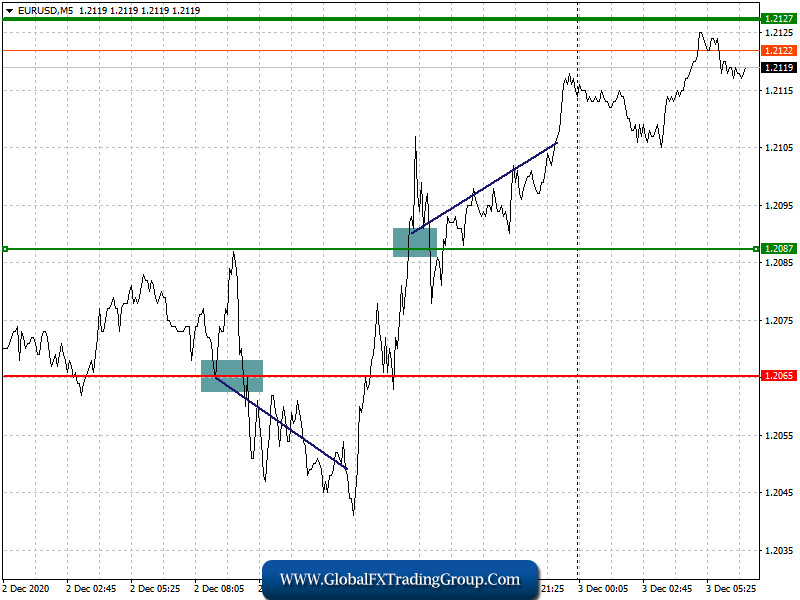

Trading recommendations for December 3

Quite a lot of economic reports are scheduled to come out today, one of which is data on activity in the services sector, which may come out weak and lead to a fall in the European currency. A decrease in the indices is expected because of the second pandemic wave. Meanwhile, data on EU retail sales is unlikely to affect the market, but the upcoming reports for the US services sector will strengthen the position of the US dollar. Nonetheless, it is best to trade along the trend, even though there are talks that the euro is overbought. Fed representatives are also said to deliver important speeches today, but only bad news on Brexit can harm the euro today.

Open a long position when the euro reaches a quote of 1.2130 (green line on the chart) and then take profit at the level of 1.2190. However, growth will only occur if economic data in the euro area comes out strong or better than the forecasts. Open a short position when the euro reaches a quote of 1.2102 (red line on the chart) and then take profit around the level of 1.2042. However, do this only if data on the euro area comes out worse than the forecast, and if the risk of not signing a post-Brexit trade deal increases.

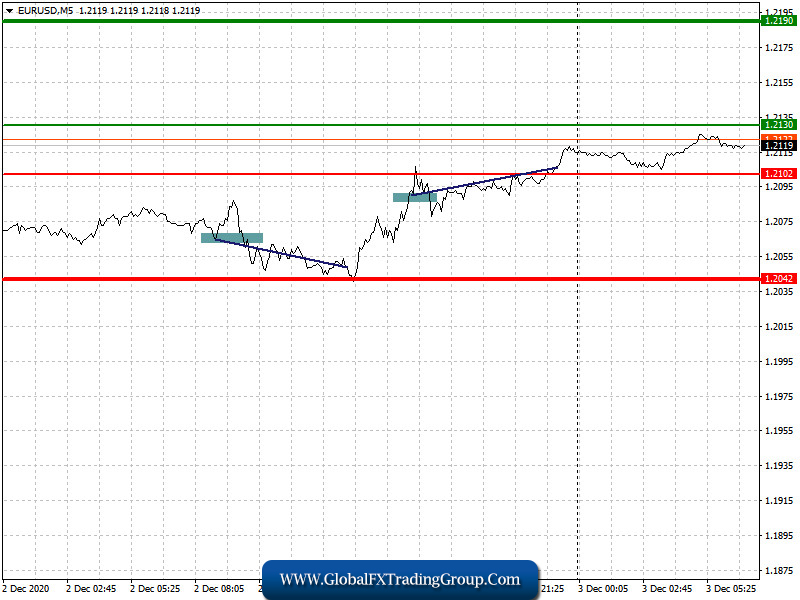

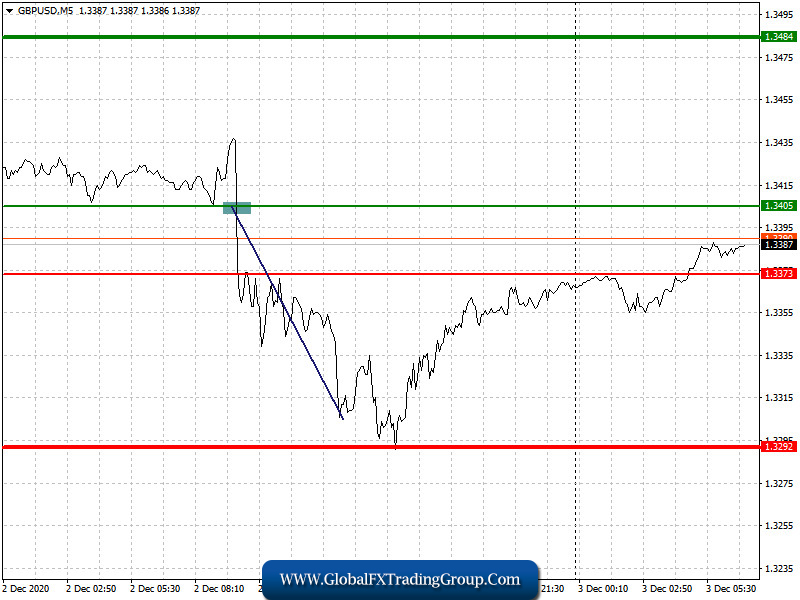

Analysis of transactions in the GBP / USD pair

Short positions from 1.3404 to 1.3305 got quite a lot of profit yesterday, as Michel Barnier’s statements that there is no progress on the Brexit negotiations led to a sharp collapse of the British pound. All in all, the downward move was more than 100 pips.

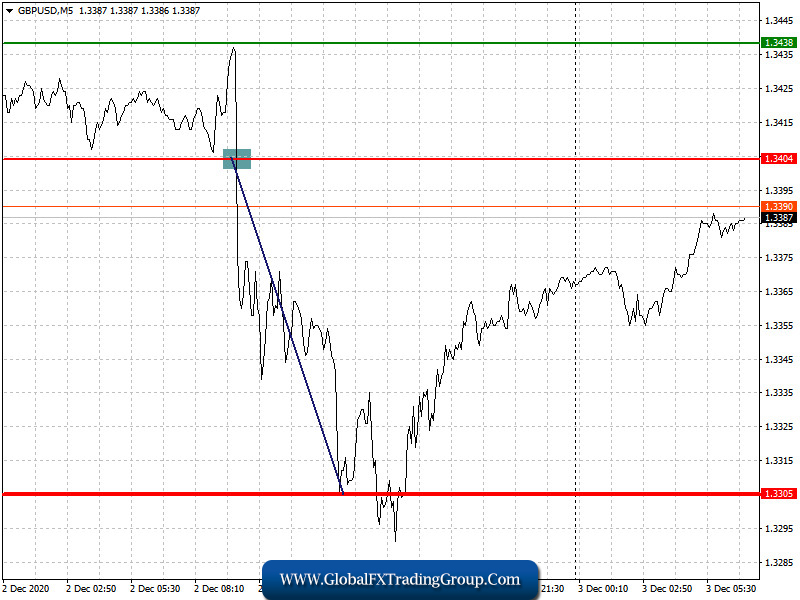

Trading recommendations for December 3

The pound will continue to move depending on the progress of Brexit negotiations. Yesterday, rumors circulated that there is some breakthrough in the issue on fisheries, which led to the sharp rise of the British pound. As we can see, traders are closely monitoring the situation, in which any positive news will lead to an immediate rally in the UK currency. Accordingly, if it is announced again that both parties failed to make any concessions, the pressure on the pound would increase. In another note, a very important report on the UK services sector is scheduled for release today, which may put additional pressure on the pound. However, many already expect weak figures in the index, therefore, the downward movement may not be large, even in case of weaker results.

Open a long position when the quote reaches the level of 1.3405 (green line on the chart) and then take profit around the level of 1.3484 (thicker green line on the chart). Good news on Brexit, as well as strong data on the UK services sector, may strengthen the position of the British pound. Open a short position when the quote reaches the level of 1.3373 (red line on the chart) and then take profit around the level of 1.3292. Bad news on Brexit will resume the downward trend in the GBP/USD pair.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom