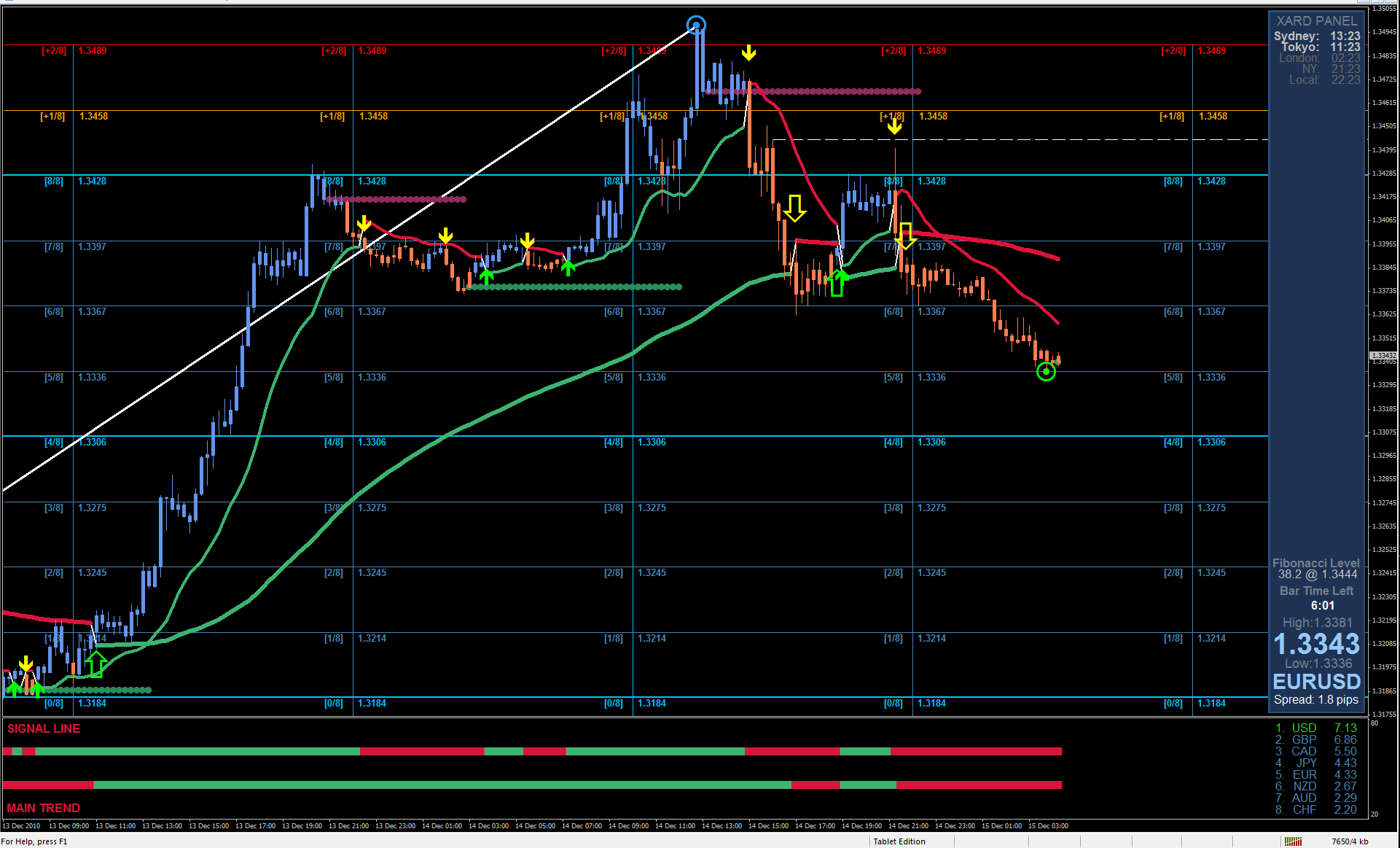

Analysis of transactions in the EUR / USD pair

The latest data on EU consumer confidence increased the demand for the euro yesterday, thereby allowing the bulls to offset any losses seen earlier. At first, the quote moved 10 pips down from 1.2180, but after that the market reversed. And although long positions from 1.2221 were not that profitable, the downward move from 1.2180 to 1.2129 pips to about 40 pips, which compensated the losses from earlier transactions.

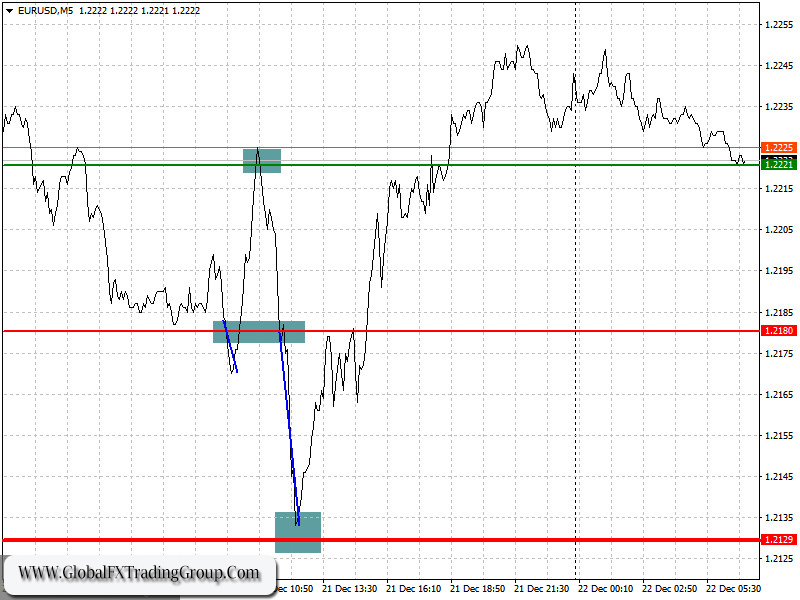

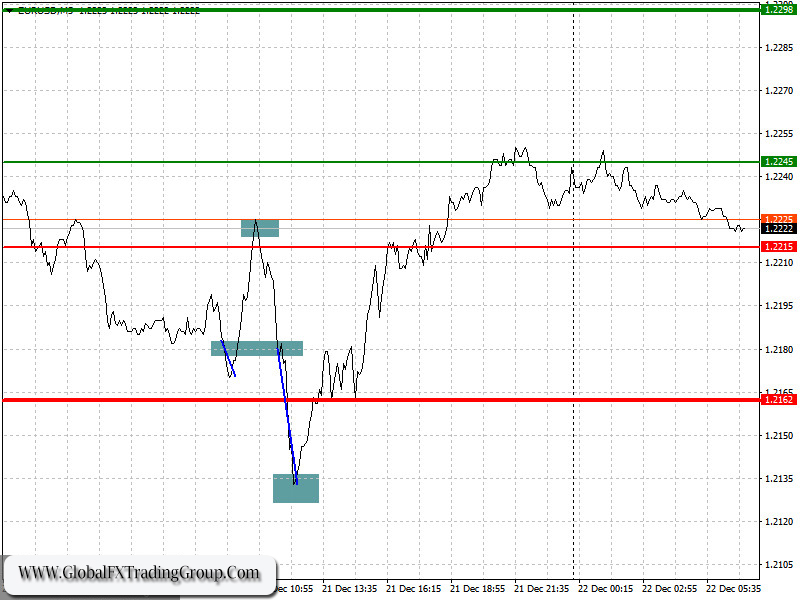

Trading recommendations for December 22

News that the US House of Representatives approved the $900 billion bailout bill led to the sharp collapse of the dollar, and accordingly, a rise in the European currency. But today, the euro could turn down if it is reported that the new strain of coronavirus first discovered in the UK is also found in other EU countries, and if the data on US consumer confidence, which is expected to come out in the afternoon, turns out to be better than expected. Meanwhile, data on EU GDP is unlikely to lead to strong changes in the market, as no major revision of this indicator is expected.

Open a long position when the euro reaches a quote of 1.2245 (green line on the chart) and then take profit at the level of 1.2298. However, growth can only happen if the economic report from the US comes out worse than the forecasts. At the same time, the euro could jump sharply if a Brexit trade agreement is reached. Open a short position when the euro reaches a quote of 1.2215 (red line on the chart) and then take profit around the level of 1.2162. Many are expecting a decline in EUR / USD especially since there is a new strain of coronavirus spreading in the UK.

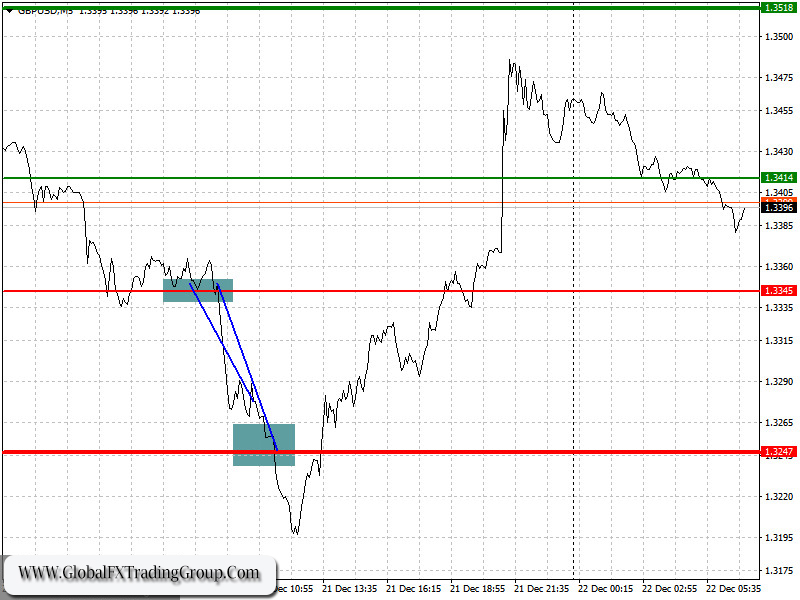

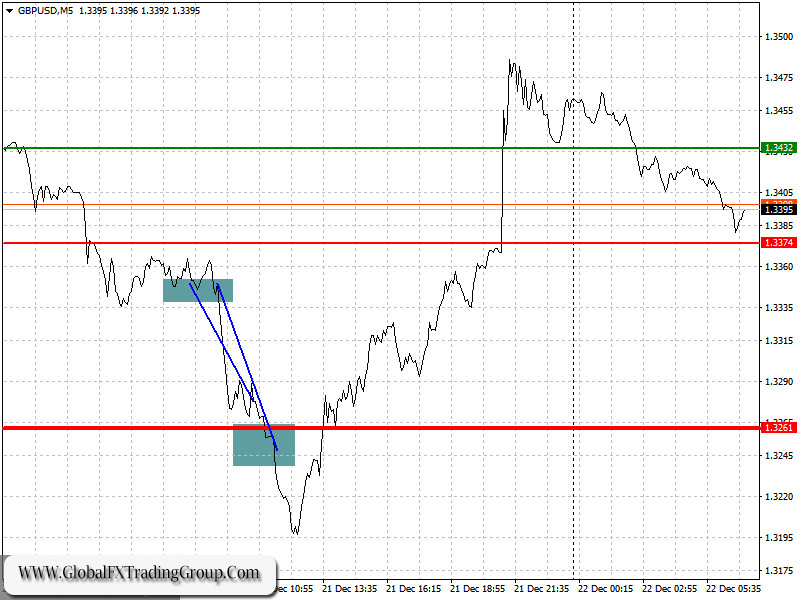

Analysis of transactions in the GBP / USD pair

Pound bears earned quite a lot of profit yesterday, when the quote moved 100 pips down from 1.3345 to 1.3247. The sharp decline was fueled by the concerns about the disruption to supply chains, as many European countries have tightened border controls due to the new coronavirus outbreak in the UK.

Trading recommendations for December 22

Although the UK implemented tougher quarantine restrictions, the pound still traded upwards yesterday, mainly due to the news that the US finally adopted a new package of stimulus. Then, today, data on UK GDP will be released. However, it may not affect the market much especially if they coincide with the forecasts of economists. In the afternoon though, there is a high chance that the dollar could gain back its positions, as soon as the data on US consumer confidence is released.

At the same time, news containing the rapid spread of the new strain of coronavirus in the UK will dampen demand for the pound, as will the likelihood of a Brexit breakdown. This week will be the last in which the parties will try to come to an agreement. Therefore, in this regard, it would be best to short the GBP / USD pair in the short term.

Open a long position when the quote reaches the level of 1.3432 (green line on the chart) and then take profit around the level of 1.3557 (thicker green line on the chart). Good news on Brexit, as well as strong data on UK GDP, may strengthen the position of the British pound. Open a short position when the quote reaches the level of 1.3374 (red line on the chart) and then take profit around the level of 1.3261. If there is bad news on Brexit or on the COVID-19 situation, the downward trend in the GBP / USD pair will resume.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom