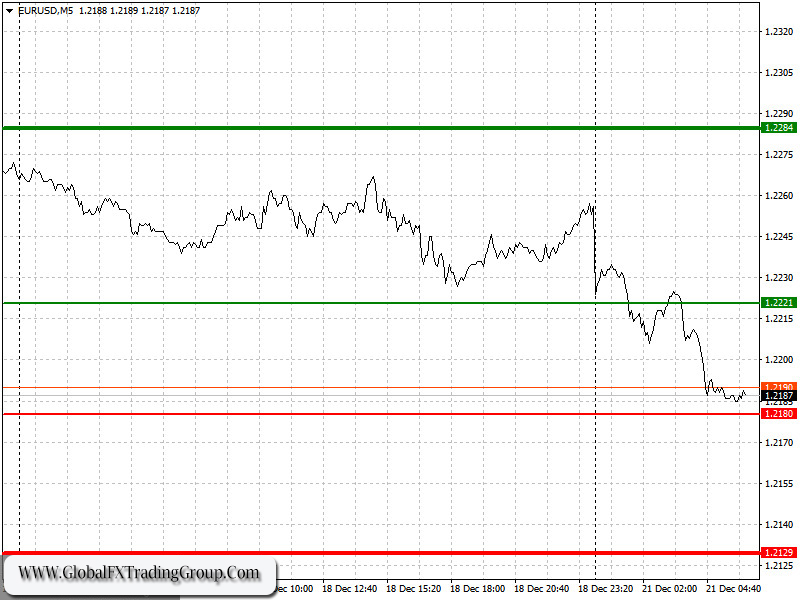

Analysis of transactions in the EUR / USD pair

Strong economic reports from Germany helped the euro keep its positions last Friday. In terms of volatility, it was quite low that day, and today seems to be the same.

Trading recommendations for December 21

EUR/USD will grow if the report on EU consumer confidence shows better-than-expected values. Accordingly, if the data comes out worse than the forecast, the euro will resume its decline in the market.

Aside from that, upcoming news on the COVID-19 vaccines will be very important, as favorable reports on it will help change economic indicators for the better. But for now, since there is a new strain of coronavirus discovered in the UK, authorities could tighten further its restrictions, that is, suspend flights in the country, which will negatively affect the economy.

Open a long position when the euro reaches a quote of 1.2221 (green line on the chart) and then take profit at the level of 1.2284. However, growth can only happen if the data from the euro area comes out better than expected. A stronger leap may also occur if a trade agreement is reached. Open a short position when the euro reaches a quote of 1.2180 (red line on the chart) and then take profit around the level of 1.2129. Many are expecting a decline in EUR / USD especially since news emerged that there is a new strain of coronavirus discovered in the UK.

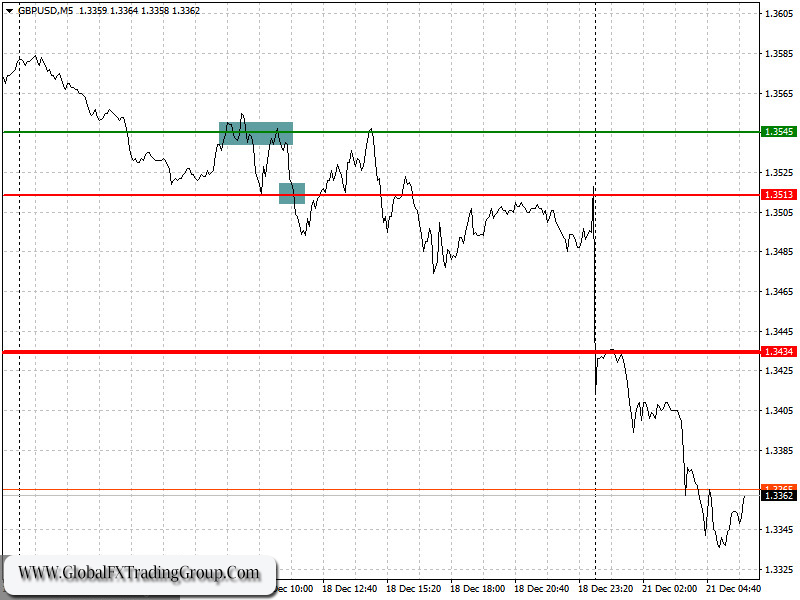

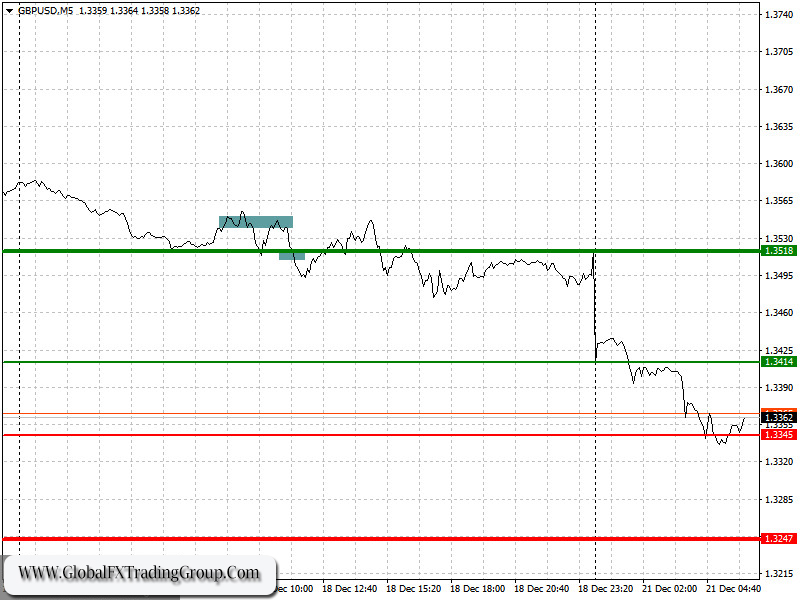

Analysis of transactions in the GBP / USD pair

Last Friday seems to be one of the worst trading days in GBP / USD. Long positions set at 1.2545 turned out to be unprofitable, as were the short positions opened at 1.3515. The pound remained trading in a sideways channel, especially amid the uncertainty that is now happening over the Brexit trade agreement.

Trading recommendations for December 21

News emerged that a new strain of coronavirus has spread in the UK, which led to a sharp collapse in the British pound. The currency dropped by nearly 200 pips from its opening level today. The introduction of strict quarantine measures, in which citizens of many areas and cities must remain isolated at home, clearly indicates the seriousness of the situation. Such news further decreased the demand in the pound, which is already one step away from falling due to the uncertainty over the Brexit trade agreement. This week will be the last in which the parties will try to come to a conclusion. In this regard, shorting GBP / USD is the best action.

Open a long position when the quote reaches the level of 1.3414 (green line on the chart) and then take profit around the level of 1.3518 (thicker green line on the chart). Good news on Brexit, as well as strong data on UK retail sales, may strengthen the position of the British pound. Open a short position when the quote reaches the level of 1.3345 (red line on the chart) and then take profit around the level of 1.3245. Bad news on Brexit will resume the downward trend in the GBP / USD pair.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom