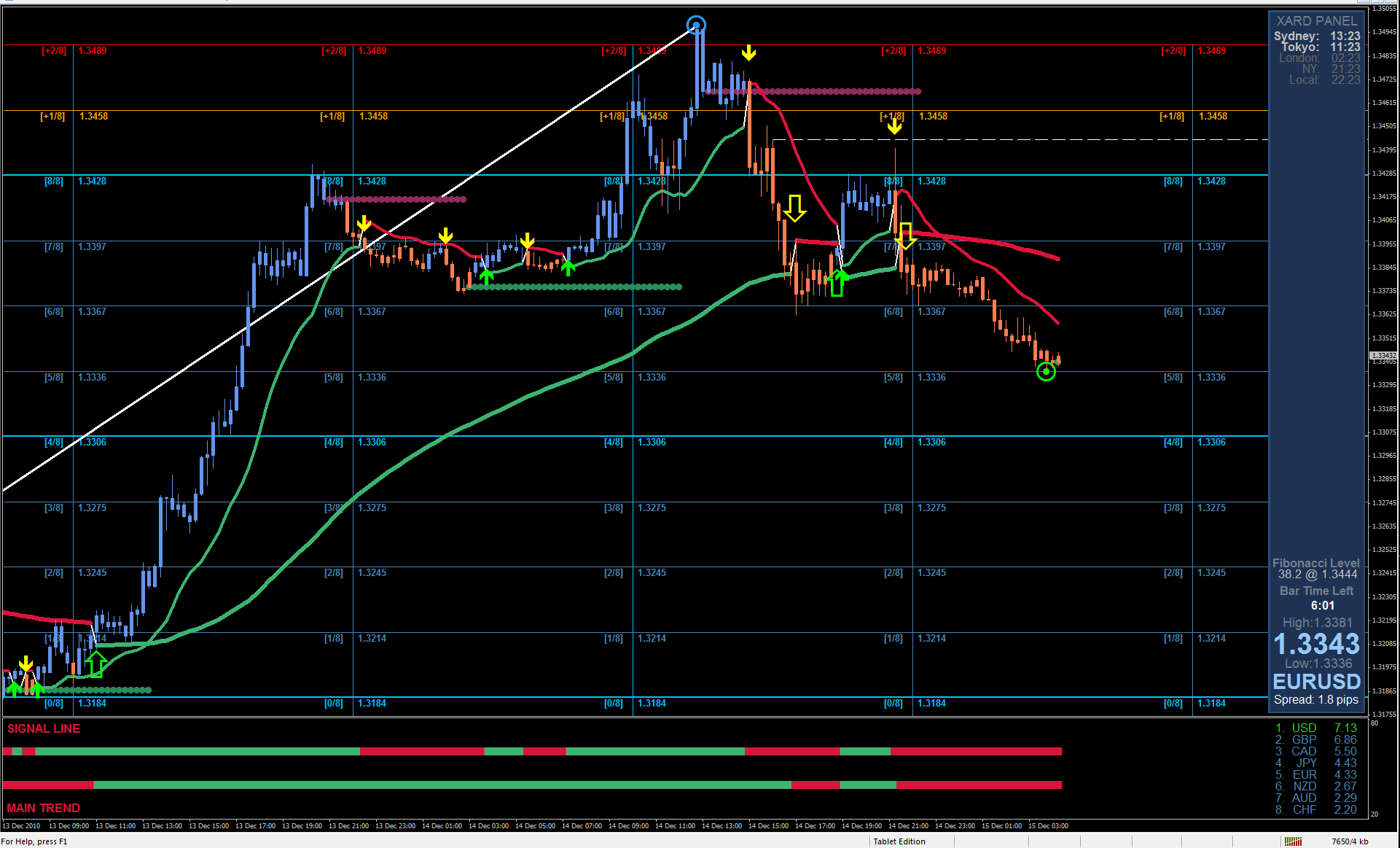

Analysis of transactions in the EUR / USD pair

Yesterday seems to be one of the worst trading days in the European currency. Volatility was quite low and the pair traded in a narrow sideways channel. A false sell signal also emerged, which led to a rather huge loss to euro bears. The quote only managed to move 10 pips down from 1.2142.

Even long positions from 1.2163 did not bring the desired result. There was no breakout nor a new bullish trend.

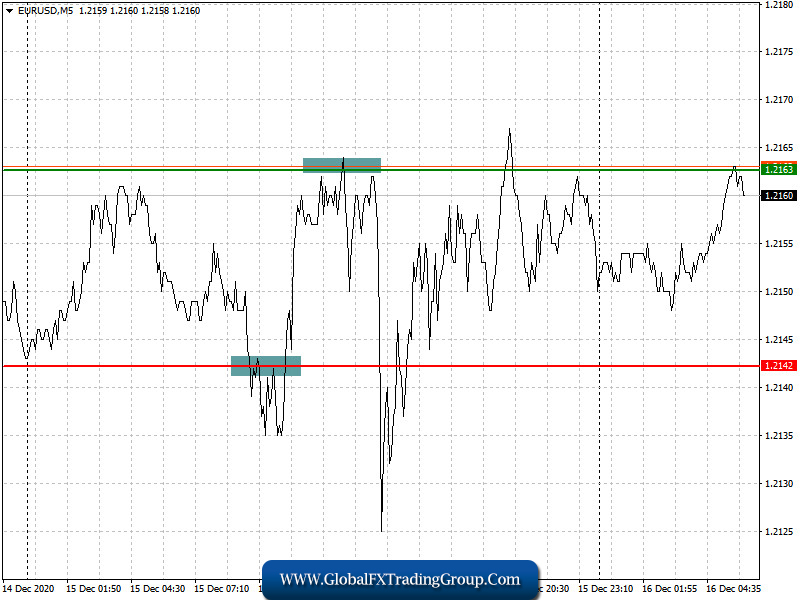

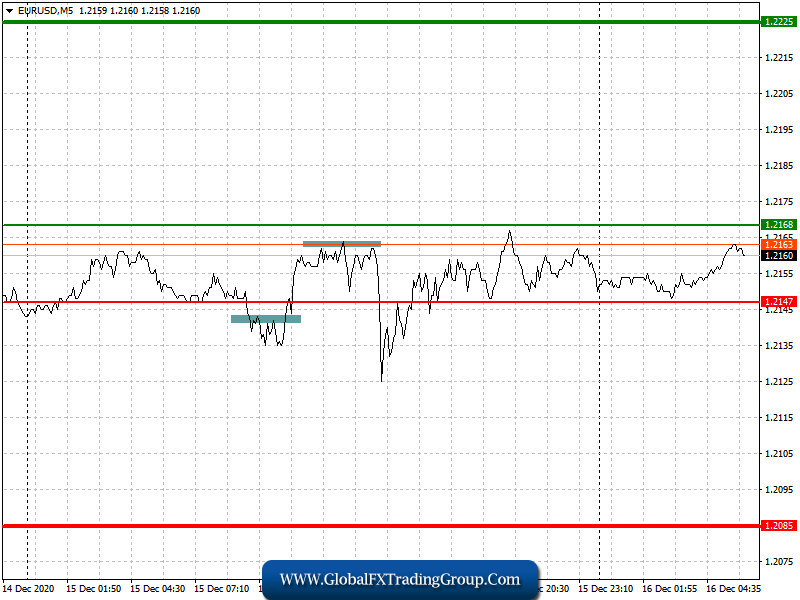

Trading recommendations for December 16

The movement of EUR / USD will depend today on the decision of the Federal Reserve regarding its monetary policy. If the bond purchase program is increased, the position of the dollar will weaken. But if the regulator takes a wait-and-see attitude, the dollar will rise against the euro.

Aside from that, a report on the eurozone’s services sector will also be published. If the preliminary figure for December comes out better than expected, the euro will grow (even before the Fed meeting).

Open a long position when the euro reaches a quote of 1.2168 (green line on the chart) and then take profit at the level of 1.2225. However, growth can only happen if there is good news on the EU services sector. A stronger leap may also occur after the meeting of the US Fed. Open a short position when the euro reaches a quote of 1.2147 (red line on the chart) and then take profit around the level of 1.2085. Do this if the data on the eurozone comes out worse than the forecasts, and if the statements delivered by the Fed indicate a tough position of the central bank.

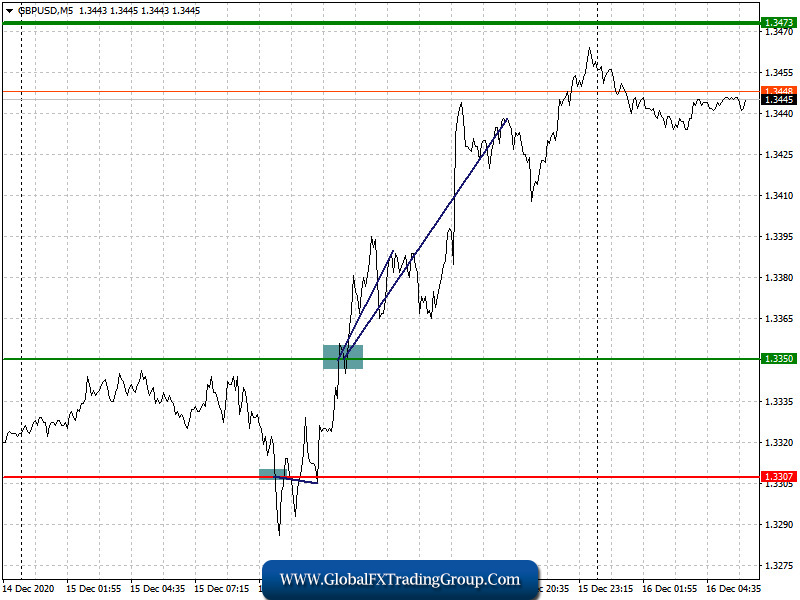

Analysis of transactions in the GBP / USD pair

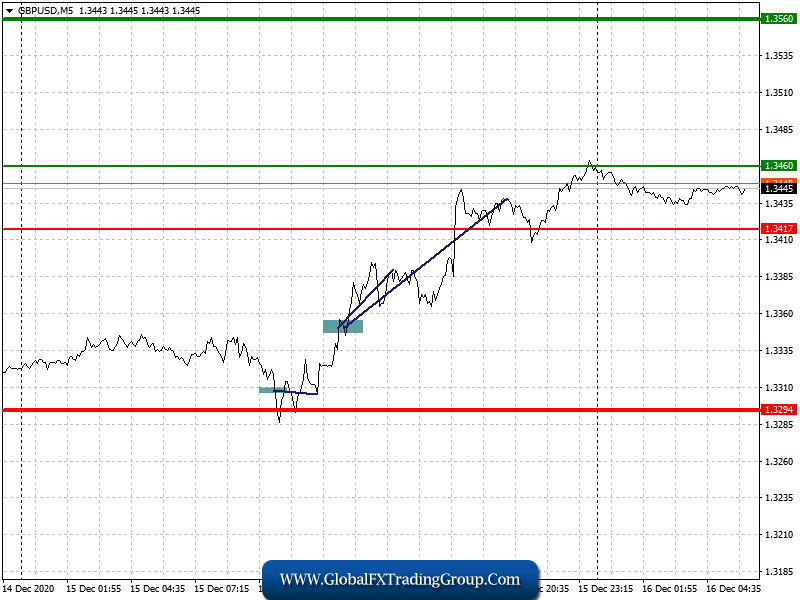

Sadly, short positions from 1.3307 did not bring the desired result, as the quote only moved 20 pips down in the market. Meanwhile, long positions from 1.3350 earned quite a lot of profit, with the pound climbing 45 pips up from the entry level. Those who were more persistent managed to get 90 pips, since the price almost reached the target level of 1.3437.

Trading recommendations for December 16

A report on the UK services sector will be released today, which is quite important for the economy. The indicator is expected to return to a level of 50 points, which will indicate the resumption of growth in activity. If it doesn’t, the pressure on the pound could return. At the same time, there will also be news on Brexit, which may lead to another explosion of volatility in the market.

After that, there will also be reports regarding the meeting of the US Federal Reserve, but they are unlikely to be of serious importance to the GBP / USD pair.

Open a long position when the quote reaches the level of 1.3460 (green line on the chart) and then take profit around the level of 1.3560 (thicker green line on the chart). Good news on Brexit, as well as strong reports on the UK services sector, may strengthen the position of the British pound.

Open a short position when the quote reaches the level of 1.3417 (red line on the chart) and then take profit around the level of 1.3294. Weak data on the UK services sector and bad news on Brexit will resume the downward trend in the GBP/USD pair.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom