Analysis of transactions in the EUR / USD pair

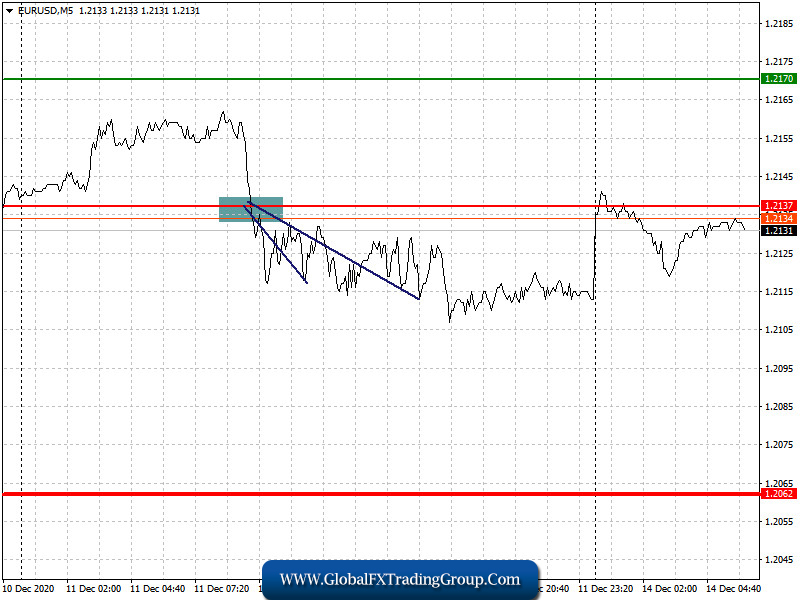

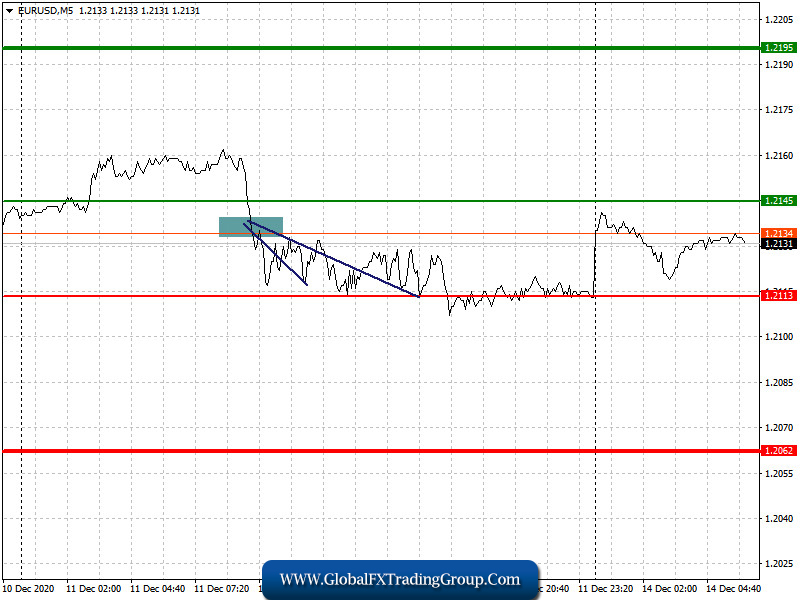

Euro bears tried everything they could to take control of the market, especially after the ECB’s decision to increase its bond purchase program last Thursday. However, they failed to trigger a massive sell-off in the euro, as many traders continue to believe in risks and a major recovery in the European economy next year. As a result, short positions from 1.2137 only brought 20 pips of profit, and despite the excellent data on US consumer sentiment, the euro did not go down further.

Trading recommendations for December 14

Today, traders’ attention will be focused on the data on Germany’s wholesale prices, as well as on the speeches of ECB representatives. Board Member Fabio Panetta will deliver a speech in the morning, followed by a series of statements from Isabel Schnabel. The Bundesbank will also release a report today. It seems that the current low market volatility will keep the chance for further growth in the European currency.

Open a long position when the euro reaches a quote of 1.2145 (green line on the chart) and then take profit at the level of 1.2195. However, growth can only happen if there is good news on the post-Brexit trade agreement. Open a short position when the euro reaches a quote of 1.2113 (red line on the chart) and then take profit around the level of 1.2062. Do this especially if the data on the eurozone comes out worse than the forecasts, and if the statements delivered by the ECB are negative.

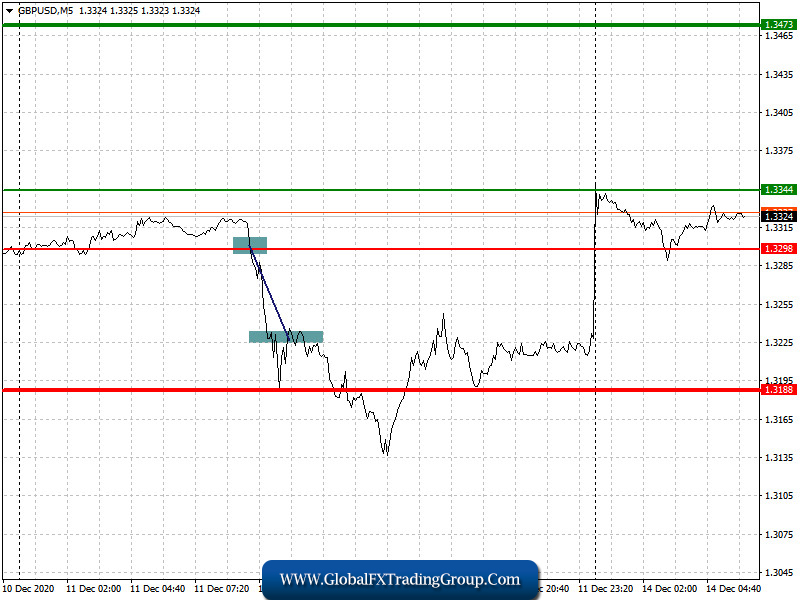

Analysis of transactions in the GBP / USD pair

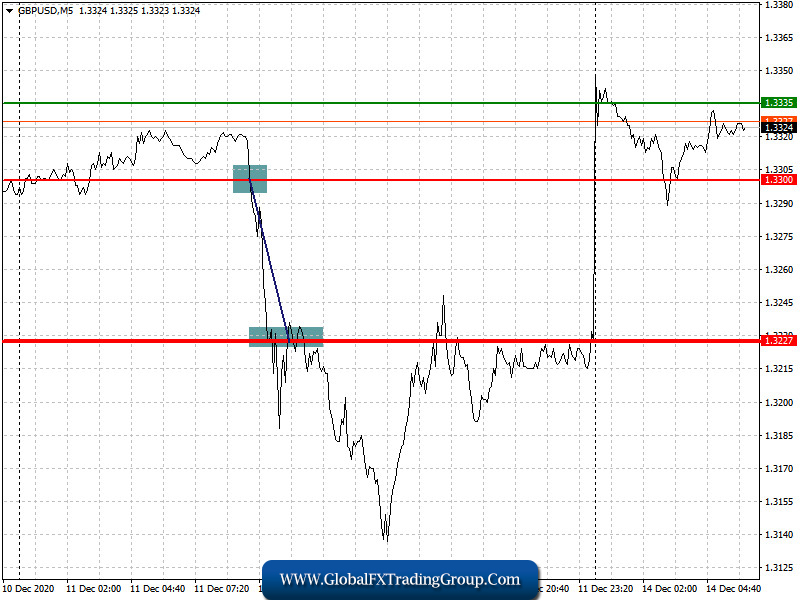

Short positions in the pound brought quite a lot of profit last Friday. The quote managed to move 70 pips down from 1.3300, reaching the level of 1.3227. It was the tense situation surrounding the post-Brexit trade agreement that kept the pound’s volatility high, as evidenced by the huge price gap during today’s Asian session.

Trading recommendations for December 14

Negotiations on Brexit will continue this week, which gives traders hope that a deal will be concluded at the last moment. But if there is no news on the trade agreement, volatility may decline sharply, especially since there are no important economic reports scheduled for release both in the UK and the US today.

Open a long position when the quote reaches the level of 1.3344 (green line on the chart) and then take profit around the level of 1.3473 (thicker green line on the chart). Good news on Brexit may strengthen the position of the British pound. Open a short position when the quote reaches the level of 1.3298 (red line on the chart) and then take profit around the level of 1.3188. Bad news on Brexit will resume the downward trend in the GBP / USD pair.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom