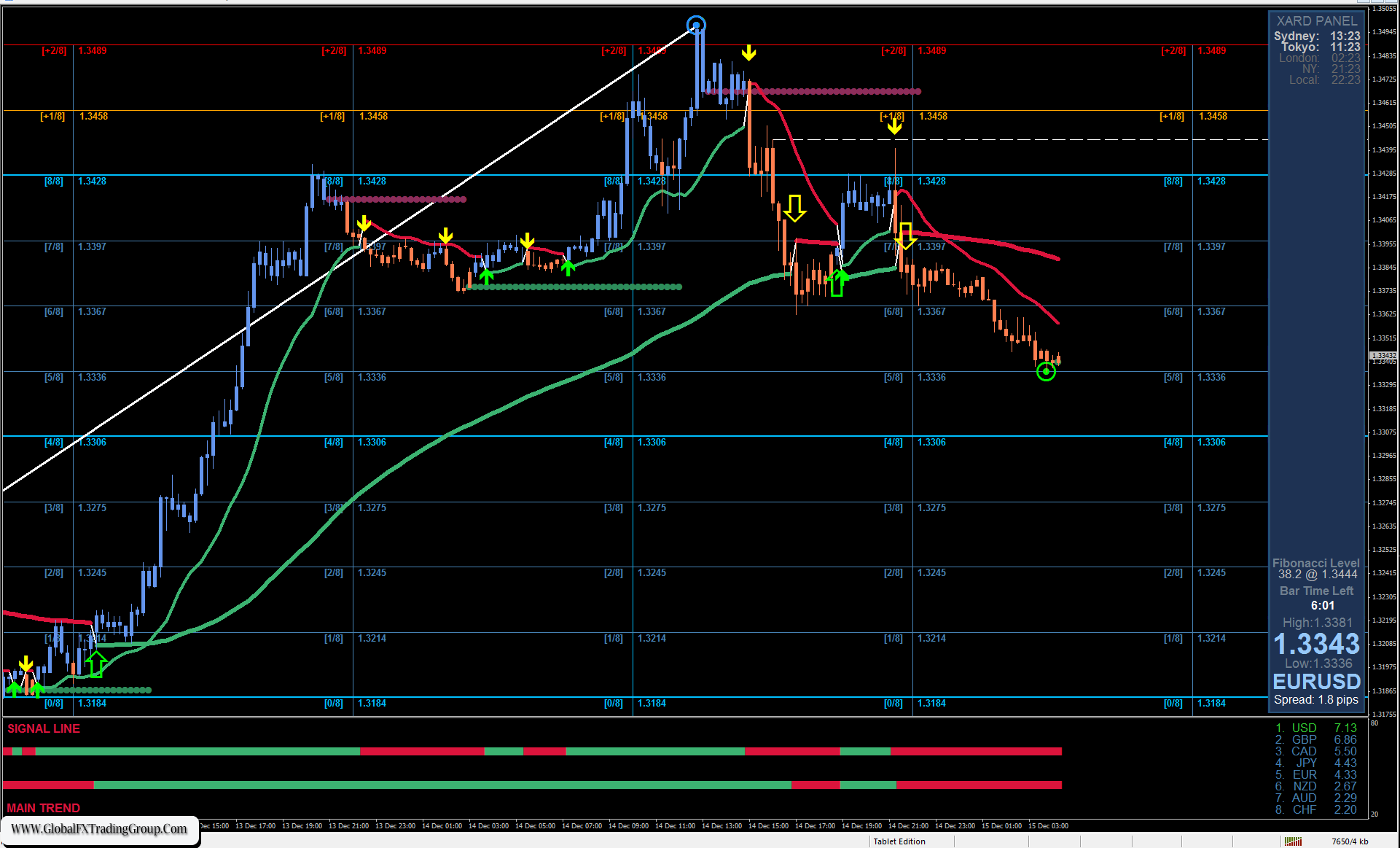

Yesterday, the euro pierced the upper shadow of the daily candle, breaching the upper boundary of the price channel dating back to December 2023. This channel is broken, and if the price doesn’t surpass yesterday’s high in just a few days, it will be restructured according to a new peak.

At the moment, today’s candle is within the body of Monday’s candle. There is a high chance that the market has finally turned downwards in the medium term. The Marlin oscillator suggests a reversal. The nearest target is 1.0796, but unless the euro accelerates its movement, and with the European Central Bank meeting scheduled for June 6th, the euro may continue to move sideways, albeit with a slight bearish bias.

Yesterday’s trading volume was high, indicating a connection between big players holding the euro back from rising during a period of very large auctions of US government bonds, as we already discussed. Today, there will be auctions of 7-year bonds worth $44 billion, 2-year notes worth $28 billion, and 17-week notes worth $60 billion. The volume remains significant, and 7-year bonds are strategically important. If the game has started, it will continue.

On the 4-hour chart, it’s now clear that the price made a false breakout above the MACD line, returned below it with a strong movement, managed to consolidate below it, and is now waiting for the Marlin oscillator to move into negative territory, in order to reach the target level of 1.0796 in a coordinated manner. Visually, the signal line of the Marlin oscillator will cross the zero line when the price overcomes Monday’s low (1.0841).

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom