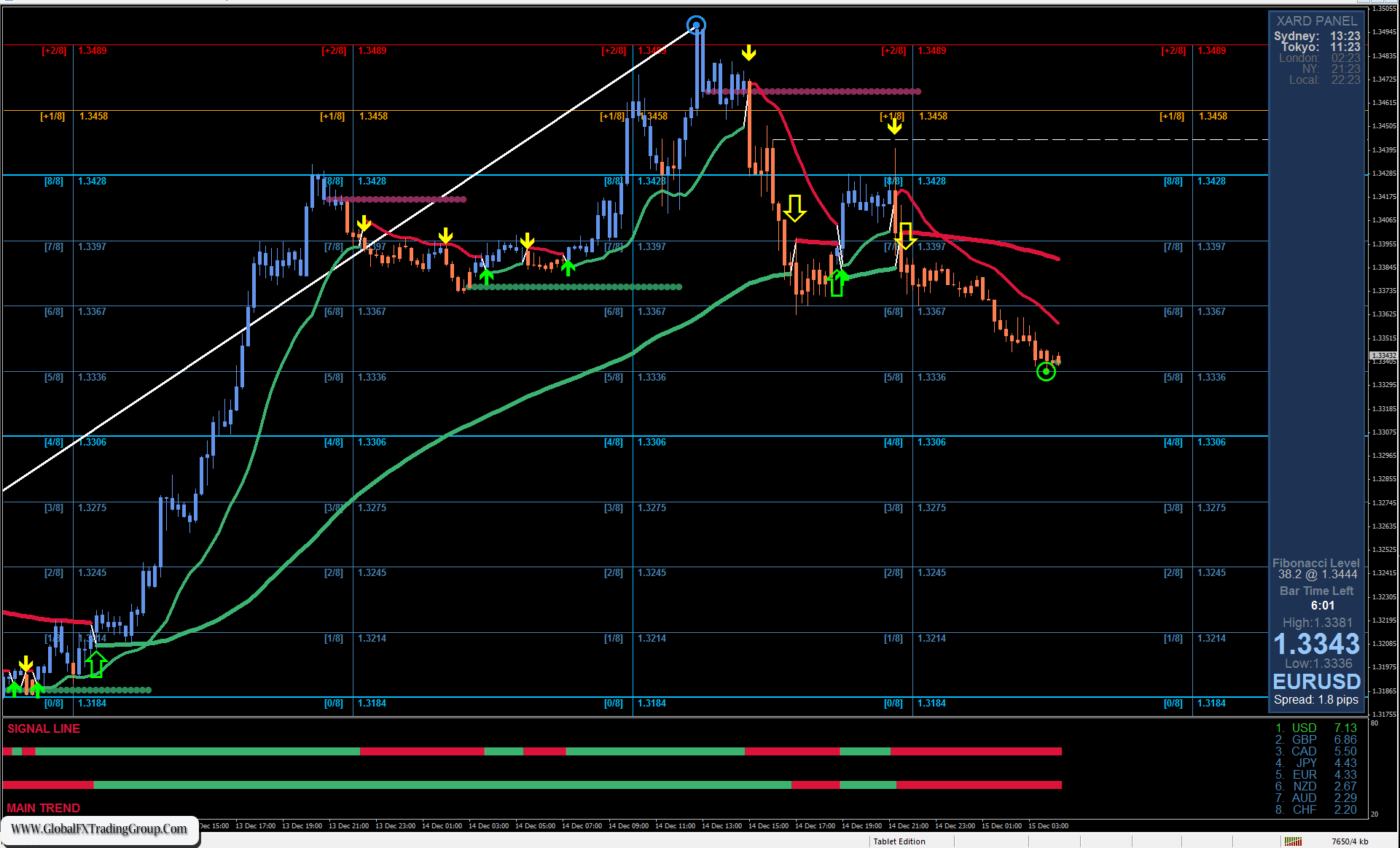

EUR/USD hit the lower line of the upward channel in the monthly chart. But a little earlier, it was below the 138.2% Fibonacci retracement level. This scenario suggests that the pair could dip to 0.9790-1.0030 (161.8% Fibonacci retracement level) this month.

The Marlin oscillator is slightly turned up in the daily chart, most probably because it is set to leave the oversold area before moving down. The consolidation could last for 1-2 days. And if the meeting goes without surprises, the Fed will raise rates by 0.25% next week. That will prompt the pair to rise to 1.0636/70, the lower limit of which is the March 2020 low. But if the pair dips instead, euro will decline for quite a long time.

The consolidation in 1.0825-1.0910 is very visible in the four-hour chart. The pair hit the borders in both directions, which indicates potential high volatility in the future. The Marlin oscillator is also growing strongly, so it is likely that it will leave the oversold area soon. But the end of the ongoing correction will provoke a further decline in EUR/USD.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom