The euro approached the Federal Reserve’s March meeting in a bearish position. However, there was also interest in risk yesterday: the S&P 500 rose by 0.56%, and oil prices by 0.35%. But at the same time, the federal funds rate has matched the Fed’s own projections for the pace of rate cuts – both the market and the Fed are assuming 3 rate cuts.

There are even opinions suggesting only two rate cuts. If we want to anticipate a rise in the euro, there is nothing to prevent it – all the weekly decline occurred above the balance indicator line on the daily chart, and the Marlin oscillator failed to enter the downtrend territory. In this situation, movement below the MACD line can be interpreted as preparation for upward movement from a low base.

The situation is neutral; it seems that the bears have done everything they can. If it weren’t for today’s Fed meeting, the price would have likely spent another 2-3 days moving sideways from purely technical positions, after which it would continue to decline below 1.0796. Perhaps the puzzle lies there? Because if the price doesn’t close the day above 1.0905, then Thursday and Friday could see black candles. For this, the Fed just needs to maintain 3 rate cuts for the current year in its “dot plots” and maintain a generally moderate-aggressive tone.

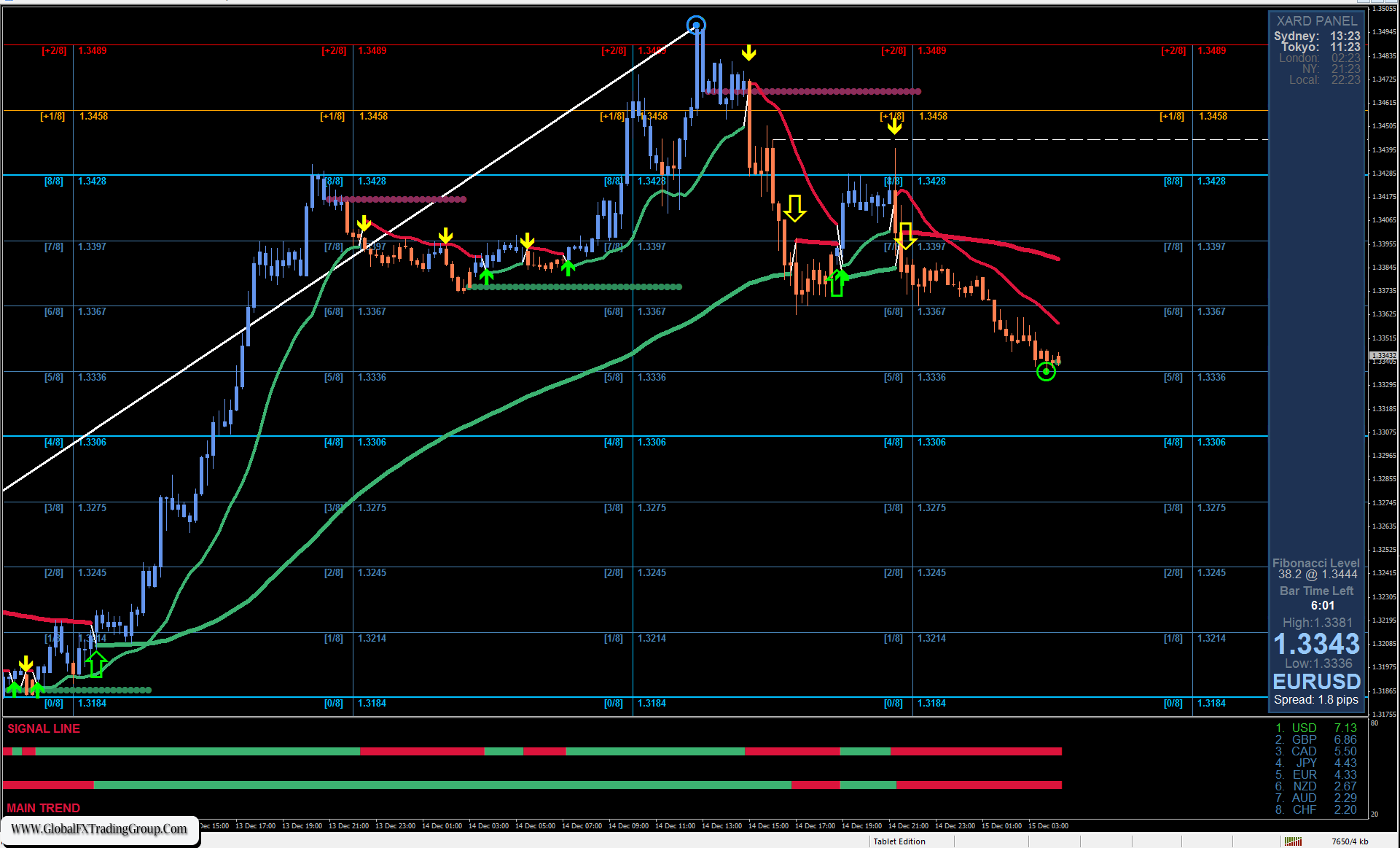

On the 4-hour chart, the price and oscillator have formed convergence, which, if the price progresses below the indicator lines on both scales, is a sign of sideways movement. We just have to wait for the outcome of the Fed meeting. Any of today’s trading actions are associated with particular risk.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom