On Thursday, the European Central Bank raised the rate by the expected 0.50%, which saved the market from panic. Then after the Swiss central bank granted Credit Suisse a loan of 54 billion francs, the European banking crisis can be considered reliably stopped. Much more problems may cause a debt crisis in Italy later, but that’s not the main topic for now. At the end of Thursday, the euro gained 36 points.

Such growth tells us that investors, like six months ago, a year ago, pay attention to the Federal Reserve policy. What the Fed will do on March 22 is a big question. If the Fed raises the rate by 0.50% as expected before the banking crisis in the US, it will also mean that the US is ignoring the problem and the dollar will strengthen in the medium term. If the rate is only raised by 0.25%, it would mean that the central bank recognizes the problem, and we don’t know if the dollar will rise further, not to mention, the Fed could also keep the rate unchanged.

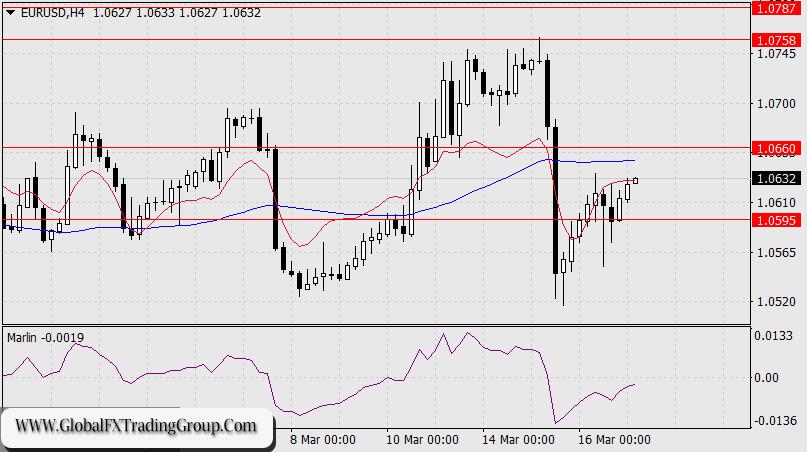

February CPI for the euro area will be released today, while the US will release a report on industrial production for the same period. Core CPI is forecast to rise to 5.6% y/y from the previous 5.3% y/y, overall CPI is expected to remain unchanged at 8.5% y/y. U.S. industrial production may show a monthly gain of 0.2% with capacity utilization rising from 78.3% to 78.4%. Thus, EUR can stay low before the Fed meeting, resistance level of 1.0660 is seen as the limit for short term growth. The Marlin oscillator has reached the zero line, from which a downward reversal is possible.

On the four-hour chart, there are two more resistances: indicator balance line, which already prevents the price from rising, and the MACD line, which is below the target resistance at 1.0660. The Marlin oscillator has not yet reached the growth area, it still has weak support. All in all, the price is more likely to consolidate under 1.0595, rather than reach 1.0660.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom