Weak economic data came out yesterday for the euro zone. Industrial production in the January estimate fell by 1.3% (forecast -0.5%), ZEW economic sentiment for the current month has fallen from 48.6 to -38.7 points. The main European stock indices closed the day in the red (Euro Stoxx 50 -0.08%), while the US indices decided to take risks ahead of the Federal Reserve meeting – the S&P 500 grew by 2.14%.

Probably, investors’ initial argument was in the recovery of the Chinese economy, where February industrial production showed an increase of 7.5%, and, which may seem more important, fixed investment increased from 4.9% y/y to 12.2% y/y. In China itself alone, the China A50 plunged 4.87% yesterday, which is associated with a new wave of lockdowns in Chinese cities due to the outbreak of covid.

Well, the euro ended up growing by 6 points yesterday, taking on some of the risky sentiment. Today, the Fed is almost 100% likely to raise the rate from 0.25% to 0.50%. The euro is now in the range of 1.0820-1.1060 – where it was in the second half of 2015, in January 2016, in the spring of 2020, and these are periods of political weakening in Europe.

History repeats itself once again, only the European crisis is far from over and is superimposed, as expected, by a long period of rate hikes in the United States. Under these circumstances, we do not believe that even the first increase of 0.25% is included in the price. As a result, we are waiting for the immediate support of 1.0820 to be overcome and the euro to fall further to the target range of 1.0636/70.

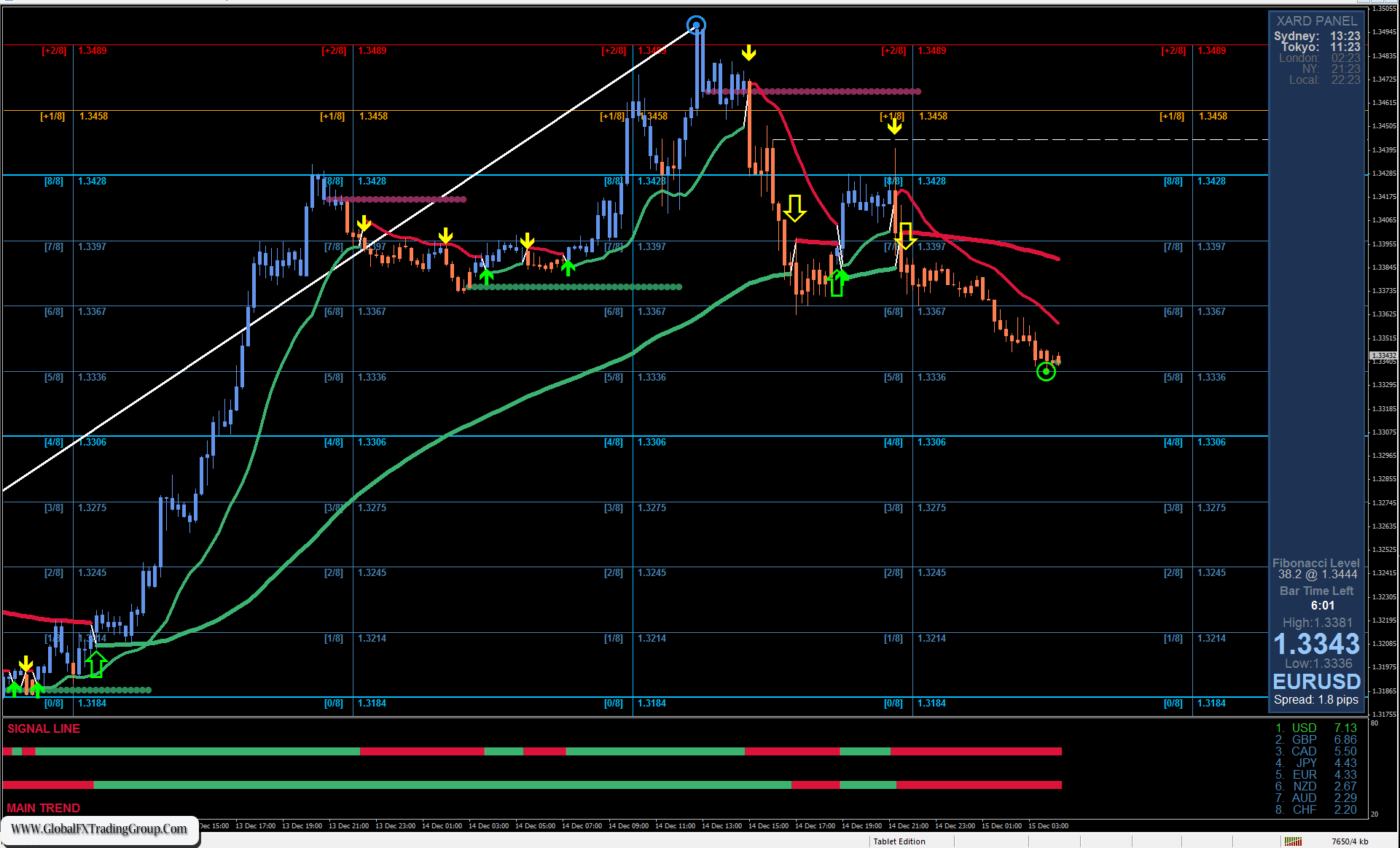

On the four-hour chart, the price is above the MACD indicator line, the Marlin Oscillator is consolidating on the zero neutral line. The market is waiting for the Federal Reserve’s decision on monetary policy. It is also important for market participants to find out how the FOMC members evaluate the prospects for the economy and determine the actual pace of the rate increase in the future.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom