The euro failed to develop an upward movement on Monday or Tuesday. Part of this is related to the U.S. Congress passing the budget for the current year, removing the threat of a shutdown. However, the stock market also showed some weakness yesterday, restraining the potential rise in risk currencies.

However, the stock market’s situation is more understandable – it is waiting for a flow of corporate reports for the 4th quarter, waiting for new data on inflation in the United States, and waiting for clarity on interest rates. The Consumer Price Index (CPI) for December is forecasted to increase from 3.1% YoY to 3.2% YoY, while the core CPI may show a decrease from 4.0% YoY to 3.8% YoY. For major financial institutions reporting on Friday, profits are expected to range from $0.92 per share to $8.75 per share.

For now, the outlook for the stock market is optimistic. We are waiting for the S&P 500 to surpass a historical high (4817), possibly within a week, and then it has three main targets: 4890, 5028, 5120. A reversal with a decline could occur from any of these levels in a few months, and divergences on longer timeframes (week, month) will be ready. From this perspective, the euro certainly has the potential to rise in the coming weeks – the direct correlation with the stock market remains intact, but there may be reversals within this upward movement.

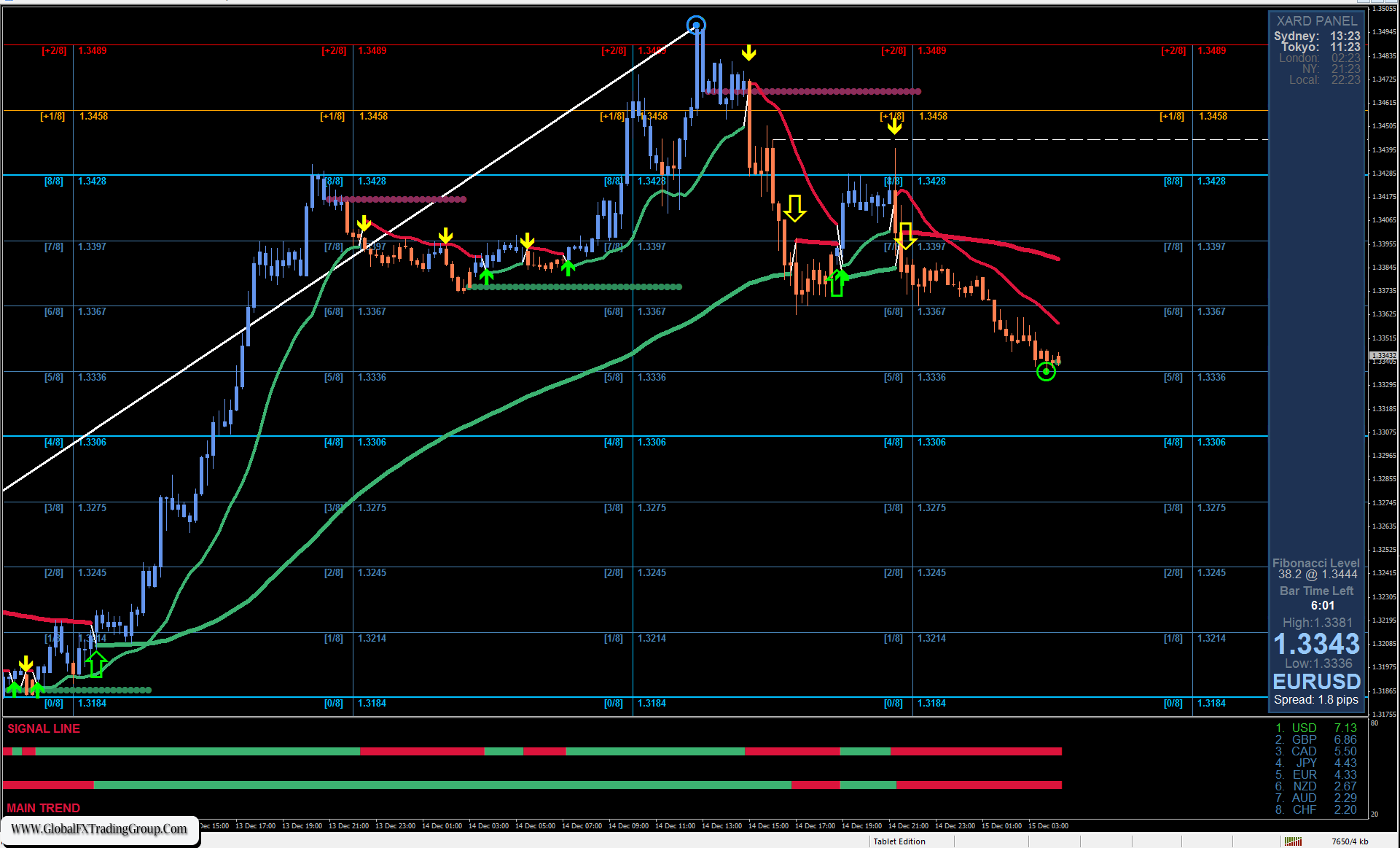

At the moment, the price is moving above the support at 1.0905 but is already pushing through the daily balance indicator line. If the price closes below this level, this would pave the way for the price to reach the target of 1.0825, and the MACD line is approaching this area, tempting the euro to test this support’s strength.

However, even if the price breaches the support, the uptrend is unlikely to push the price to surpass 1.0730, which is the target level near the embedded line of the global price channel. The optimistic scenario is growth within the range of 1.1033/76 from current levels. We are waiting for tomorrow’s US inflation data.

On the 4-hour chart, the price is falling below the balance indicator line, and the MACD line has turned downward. Therefore, the Marlin oscillator may not be able to withstand this pressure and will soon move into a downtrend territory. We have to wait for tomorrow’s data, and the market will reveal its choice. To reiterate, if the market’s choice is not in favor of the euro (risk), the move could largely be false.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom