The outcome of yesterday’s Federal Reserve meeting was far from dovish. The FOMC wants more evidence inflation is heading toward its 2% target. Markets raised the probability of a rate cut at the May meeting from 52% to 61%, slightly reducing this probability at the March meeting.

It seemed like nothing extraordinary happened, and the markets weren’t expecting a direct signal of an immediate rate cut in March. In order for the euro to rise, investors need to be confident that the European Central Bank is following the Fed’s lead.

But what worries us is the sharp decline in related markets: the S&P 500 -1.61%, the Russell 2000 -2.63%, oil -2.49%, copper -0.49%. More to the point, we are interested in the stock market. In a monthly review, we calculated the peak of the S&P 500 at 5028 (and that’s just the first target). In terms of time, the market still has a week to rise.

It hasn’t gotten there yet. Does it still have the opportunity? The US labor market is showing deterioration; according to yesterday’s ADP data, 107,000 jobs were created in the private sector in January, against a forecast of 145,000 and 158,000 in December. The forecast for unemployment, which will be released tomorrow, expects an increase from 3.7% to 3.8%. Let’s wait until tomorrow evening.

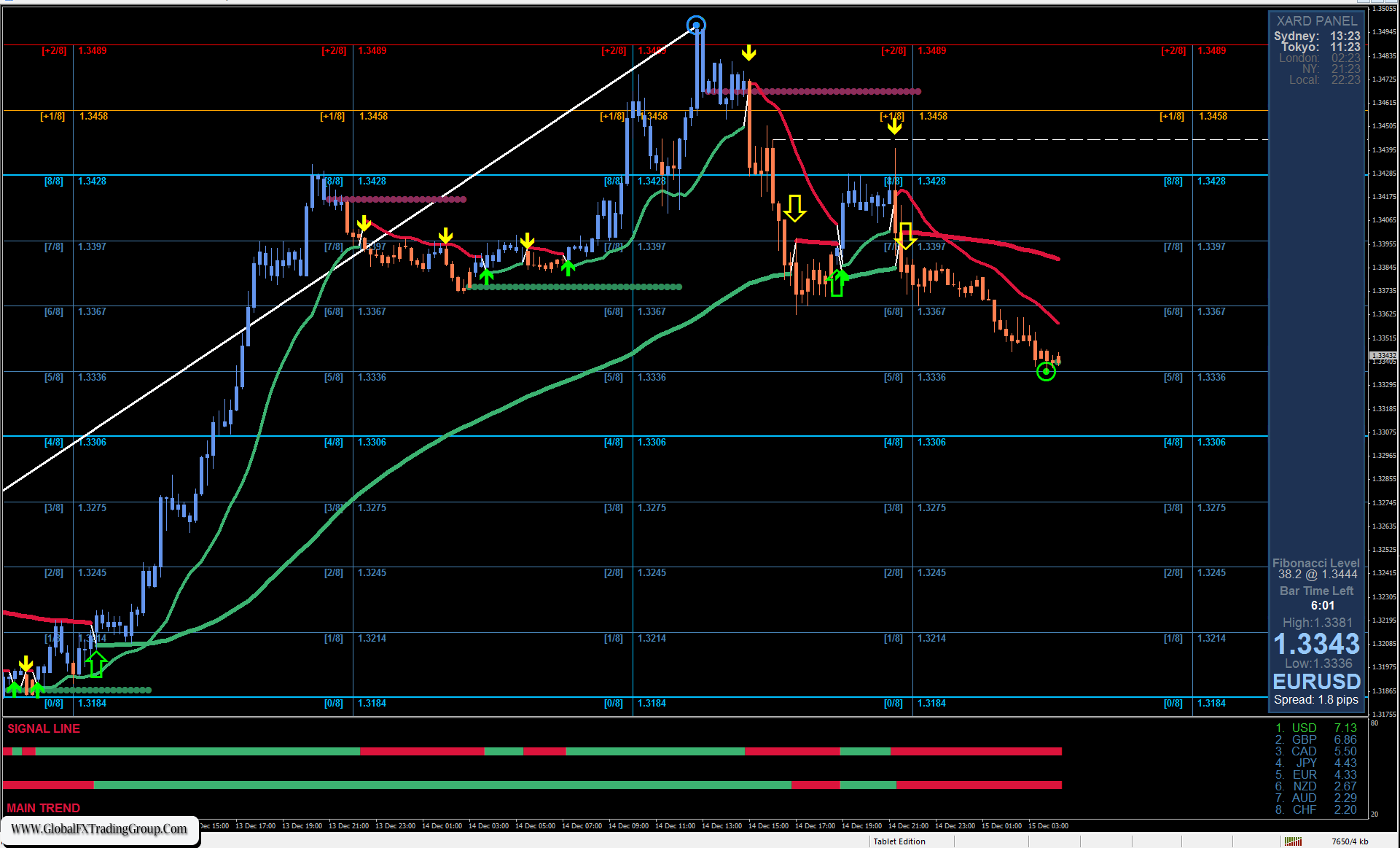

On the daily chart, the price is still within a descending wedge, but it is below the MACD line and the level of 1.0825. The probability of breaking out of the wedge and moving to the downside has significantly increased. If the market is pleasantly surprised with the employment data, we expect the euro to rise to 1.0905 and higher to 1.0966.

On the 4-hour chart, the situation is completely bearish: the price has managed to consolidate below the MACD line, and the Marlin oscillator is in the downtrend territory. We are waiting for tomorrow’s US employment data; perhaps many investors will not want to give up so quickly.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom