Friday’s U.S. employment data came out excellent, providing traders with a good reason for risk-taking, but then the enthusiasm quickly faded, and the euro and other counter-dollar currencies closed the day lower (the dollar index was down 0.17%). Today, Germany’s trade balance for February will be published, with forecasts suggesting a decrease from 27.5 to 25.1 billion euros.

No other significant data will be released for the day. Moving forward, the US CPI for March will be released on Wednesday – the forecast is 3.4% y/y compared to 3.2% y/y in February. This could influence investors’ views on a stronger European Central Bank rate cut compared to that of the Federal Reserve. The ECB’s next meeting is scheduled for Thursday, April 11th.

The market generally believes that the central bank will keep rates unchanged. However, the ECB has sent signals about potential imminent rate cuts. History shows us that the ECB has changed rates only after subtle hints, regardless of market sentiment, unlike the Fed, which initially prepares the markets for an upcoming rate change. But even if the rate remains unchanged on the 11th, the Bank will definitely show a dovish stance. It seems that there is little reason for the euro to rise this week.

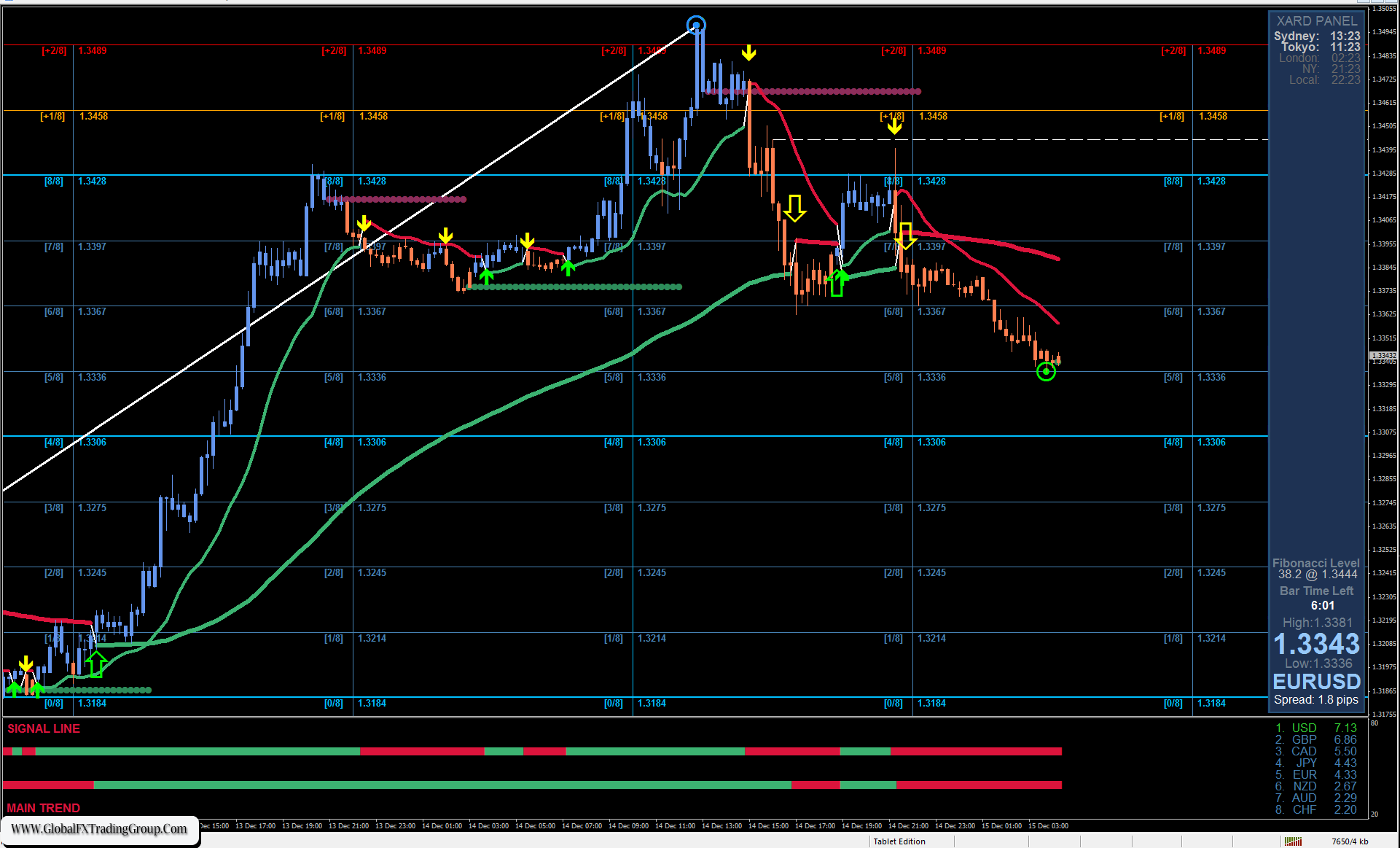

On the daily chart, the price is below the balance indicator line, and the Marlin oscillator has edged down after a short-term sideways movement. We expect the price to break below the support at 1.0796 and further decline towards 1.0724.

On the 4-hour chart, the price is moving above the indicator lines. Marlin is also in the uptrend territory. The pair needs good impetus in order for the price to attack the support at 1.0796, as well as the MACD line, which is below it. Until then, the price will likely move sideways.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom