Yesterday, the US retail sales data fueled the dollar’s strength. Retail sales rose a seasonally adjusted 0.7% in March against a forecast of 0.4%, and the February figure was revised upward to 0.9%. The Atlanta Federal Reserve upgraded its estimate for the annualized rate in first quarter GDP growth from 2.4% to 2.8%.

There is even talk that the Fed may not lower interest rates at all this year. The dollar rose by 0.24%, while the S&P 500, unable to withstand pressure, declined by 1.20%. In our opinion, this became the main event of the day, demonstrating a clear flight of investors from risk.

However, bond yields increased, but this is temporary – today, the Treasury is issuing $46 billion in annual bills, tomorrow $13 billion in 20-year bonds, and the day after tomorrow $23 billion in 5-year bonds, so institutional investors will become even more averse to risk.

Moreover, the US Treasury is launching Operation Twist, an operation that has not been announced directly – shifting short-term debt into long-term debt, as it was in the post-crisis period, since 2011. The problem is that such operations increase inflation, which means that there’s a serious basis for the assumption that the Fed will only lower the rate next year.

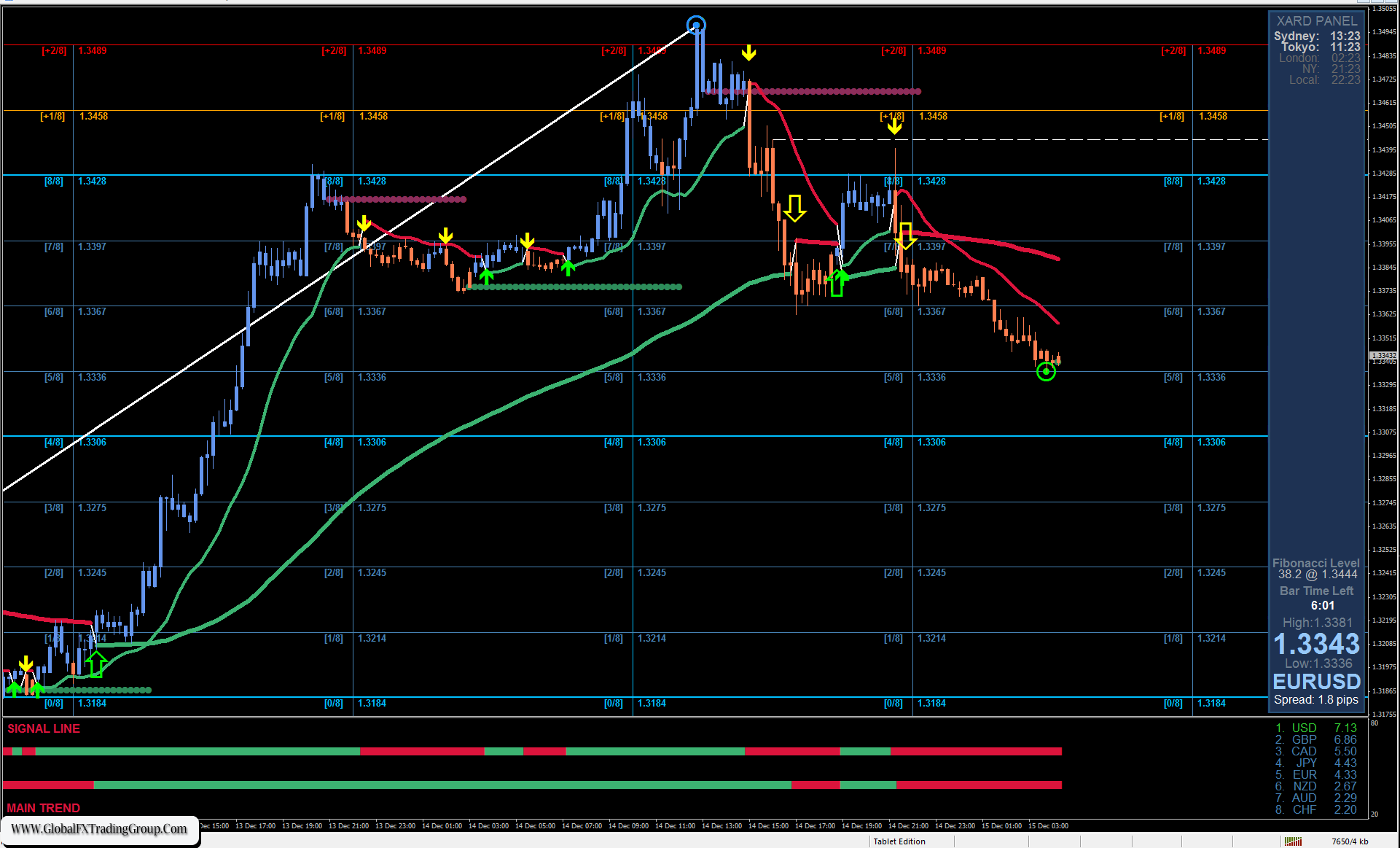

So, the EUR/USD pair has settled below the range of 1.0636/56 and is approaching the target level of 1.0567. Overcoming this level opens up the target of 1.0520. The signal line of the Marlin oscillator on the daily chart has left its own descending channel by moving downwards and is preparing to enter the oversold zone. Perhaps a correction will start from the level of 1.0520.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom