Yesterday, the euro made an impressive jump upward by 105 pips, reaching the upper boundary of the price channel precisely at 1.1879.

Economic data out of Europe and the US were solid: in Europe, the key figures were the ZEW Economic Sentiment Index, while in the US, industrial production, retail sales, and Q3 GDP forecast (3.4% vs. 3.1% previous estimate). If it weren’t for market nervousness about the expectation of three Fed rate cuts, the dollar would have definitely strengthened.

This time, however, even a slight increase in European data (sentiment for September 26.1 vs. 25.1 in August; July industrial production +0.3% vs. -0.6% in June) was met with extra enthusiasm—even against a declining stock market (S&P 500 -0.13%) and slightly declining US bond yields. Possibly, euro strength was also supported by oil jumping 2.12% and currency contract expiries.

All of this is a sign of a looming collapse. In our opinion, the market has overestimated the influence of employment figures on Fed policy. This can be traced to Trump’s discontent and the resignation of Bureau of Labor Statistics head E. McEntarfer. However, Jerome Powell remarked at Jackson Hole that, in tackling weak employment and high inflation, the Fed would primarily focus on inflation. And inflation has been rising for four straight months.

Its current level, 2.9%, is surpassed only by Japan (3.1%), the UK (3.8%), and Mexico (3.57%). Therefore, the market’s expectation of three cuts by year-end seems even more inflated than in January, when investors had priced in six cuts for the year. Today, the Fed will cut its rate by 0.25%—if only not to disappoint a bond market that has fully priced in such a move—but will give a very firm signal: no more cuts this year. After all, Trump’s tariffs have only just started to drive this inflation higher (in four months).

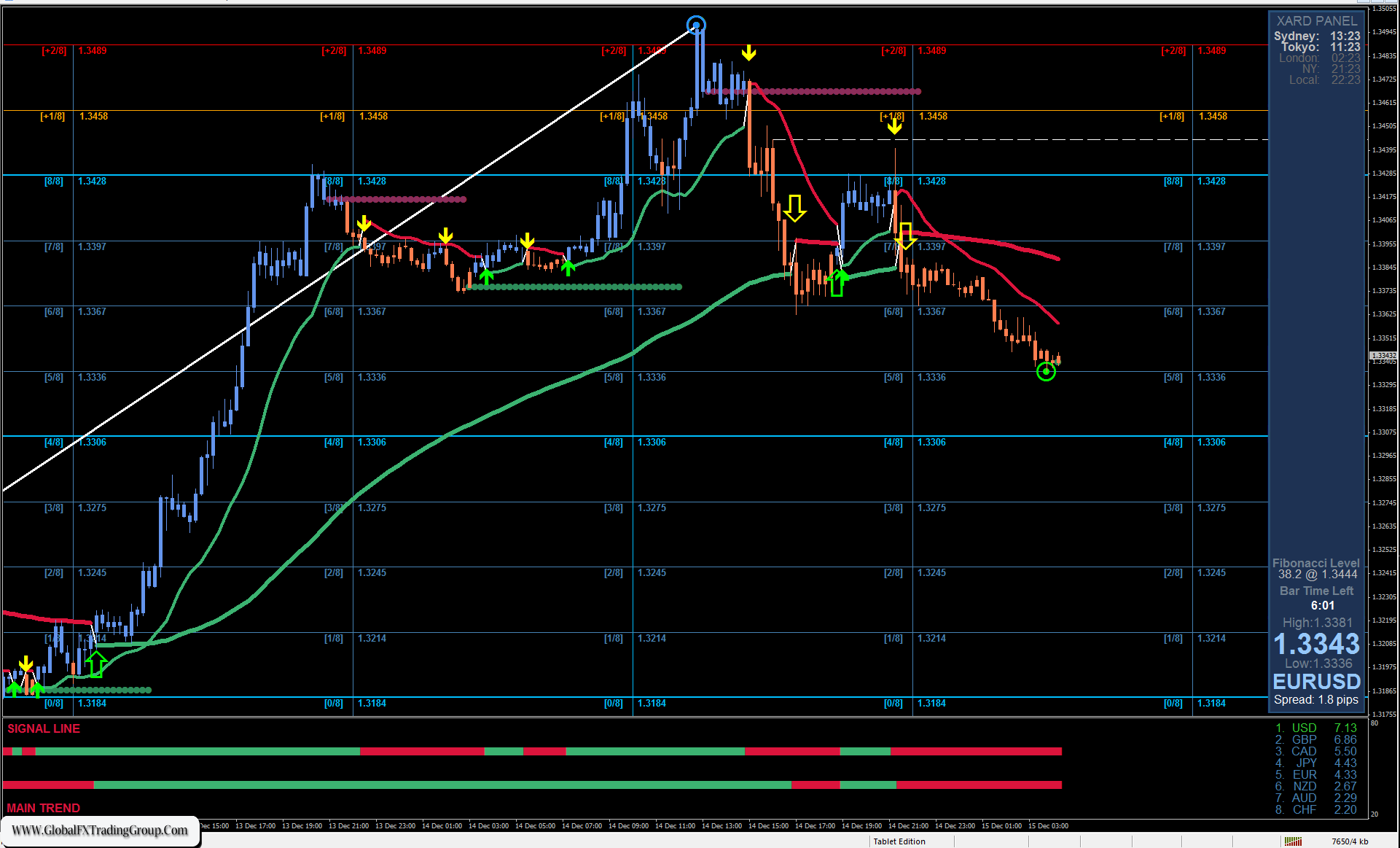

On the four-hour chart, the Marlin oscillator has shown accelerated growth and has entered the overbought zone—a sign of an impending pullback. In the coming days, we expect EUR/USD to head toward 1.1392 (the August low). Supports at 1.1632 and 1.1495 are now seen as interim levels.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom