At midnight Washington time, the U.S. government will “shut down” due to a failure in Congress to reach an agreement on the continuation of enhanced COVID-era benefits. Employees of 21 federal agencies will be placed on unpaid leave. We believe this shutdown will likely be short-lived, as President Trump has threatened to close down additional Democrat-controlled agencies if “Democratic sabotage of government operations” and “reckless Medicare spending” continue.

Over the past week, 154,000 federal employees have left their jobs. If we don’t receive the September jobs report on Friday due to the shutdown, that alone may lead investors to view the U.S. labor situation more pessimistically.

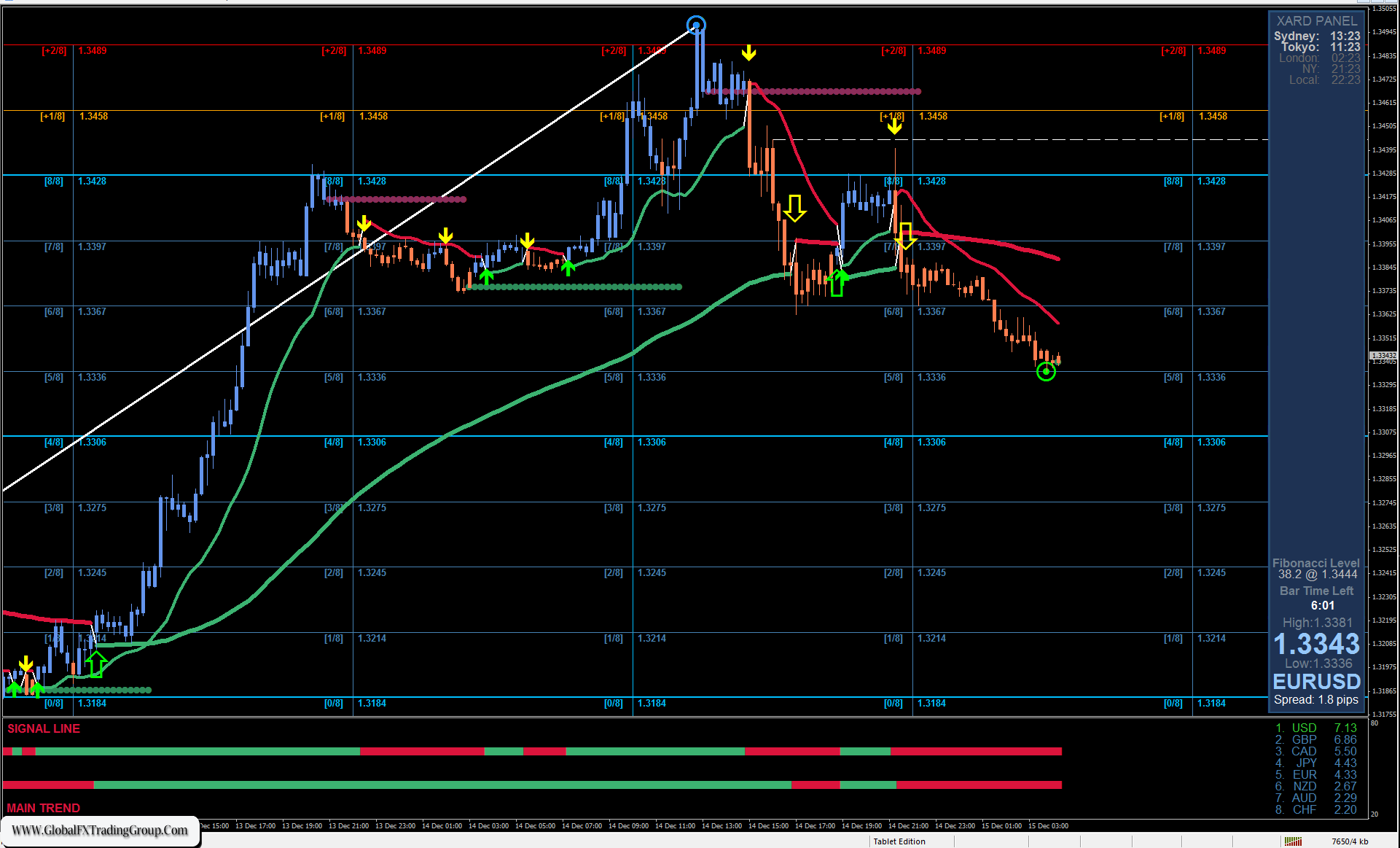

How high could the euro rise? If the government shutdown lasts for two weeks, EUR/USD may climb to the upper boundary of the price channel near the 1.1910 mark. If it ends sooner, the pair is unlikely to reach that level. A limiting factor here is investor risk aversion.

Simultaneously, a reverse mechanism could also kick in: increased buying of government bonds (yields have been falling for three straight days), driving demand for dollars and an investor pullback from equity markets. This mechanism could quickly push EUR/USD below the MACD line (1.1703), opening the path toward the first bearish target at 1.1605.

Thus, the euro market remains in a state of uncertainty — and its potential decline could occur faster than its potential rise. On the H4 (four-hour) timeframe, the price remains within the range of the MACD indicator lines from both timeframes: 1.1703/68. A breakout above the upper line (1.1768) would allow bulls to push the euro toward 1.1914. Conversely, a firm move below 1.1703 would give bears control over the market.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom