On Thursday, the euro rose by 45 pips. Formally, this rise can be seen as a continued risk-on move (S&P 500 +0.32%), but we are more inclined to interpret the euro’s behavior over the past two weeks as consolidation in anticipation of a Federal Reserve rate cut on September 17. Before that event, today will see the release of the Personal Consumption Expenditures Price Index, followed by employment data on September 5 and the CPI on September 11.

Despite the importance of these releases, the September rate cut is a done deal and already priced in by the market. The only question that remains is from which level the market will be dumped on the day of the Fed meeting. Perhaps it will be around 1.1878 from the upper boundary of the price channel, or from the MACD line (1.1752), or even from the range of 1.1495–1.1632, where there will likely be heavy euro buying ahead of the rate cut.

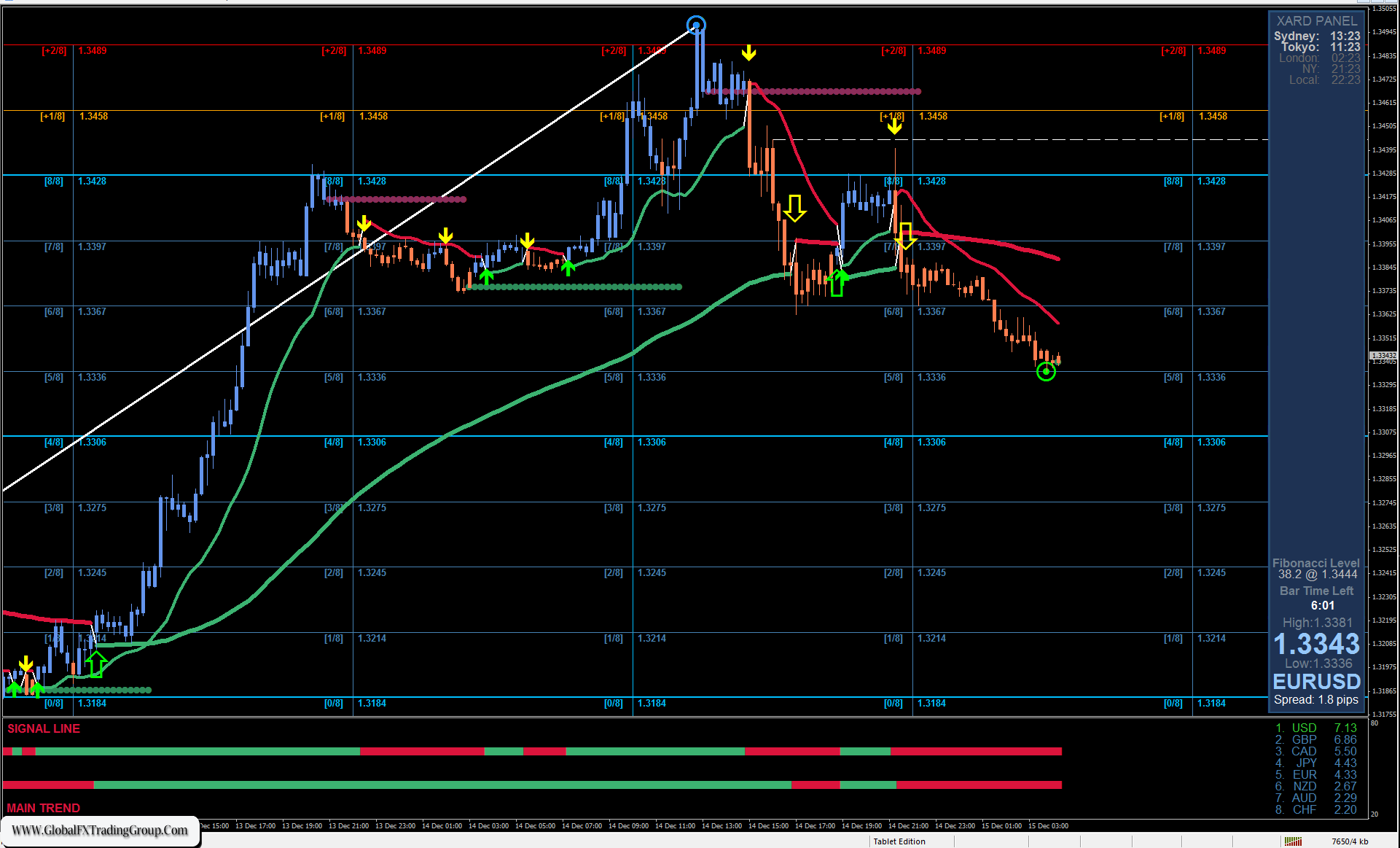

In other words, the euro remains in a period of free roaming. Incoming data is unlikely to significantly influence speculators’ positioning within a range above or below current prices. For now, the sentiment is bullish, since the price is above the balance line, which serves as a guide to market participants’ inclination towards buying or selling, and the Marlin oscillator has settled in positive territory. Nothing is stopping the price from testing the MACD line at 1.1752.

On the H4 chart, the price consolidated below the MACD line after previously making a false breakout above it. Marlin remains on the bullish side. In general, this is a convenient position for the price to break down below the 1.1632 mark if today’s inflation data matches or comes in below forecasts. The core PCE is expected to rise from 2.8% y/y to 2.9% y/y, while the headline PCE is expected to remain unchanged at 2.6% y/y.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom