With support from the stock market decline (S&P 500 –0.25%), the euro fell by 25 pips yesterday, breaking below the 1.1632 support level. If today closes below this level, it will confirm the breakout and open the way toward the 1.1495 target. We expect this decline to be gradual, as Fibonacci time line No. 8 has not yet been passed. The Marlin oscillator is also declining slowly.

Economic forecasts for the euro area and the US favor a slow decline in the euro; the eurozone ZEW Economic Sentiment Index for August is expected at 28.1 versus 36.1 in July, while the US CPI for July may rise from 2.7% y/y to 2.8% y/y.

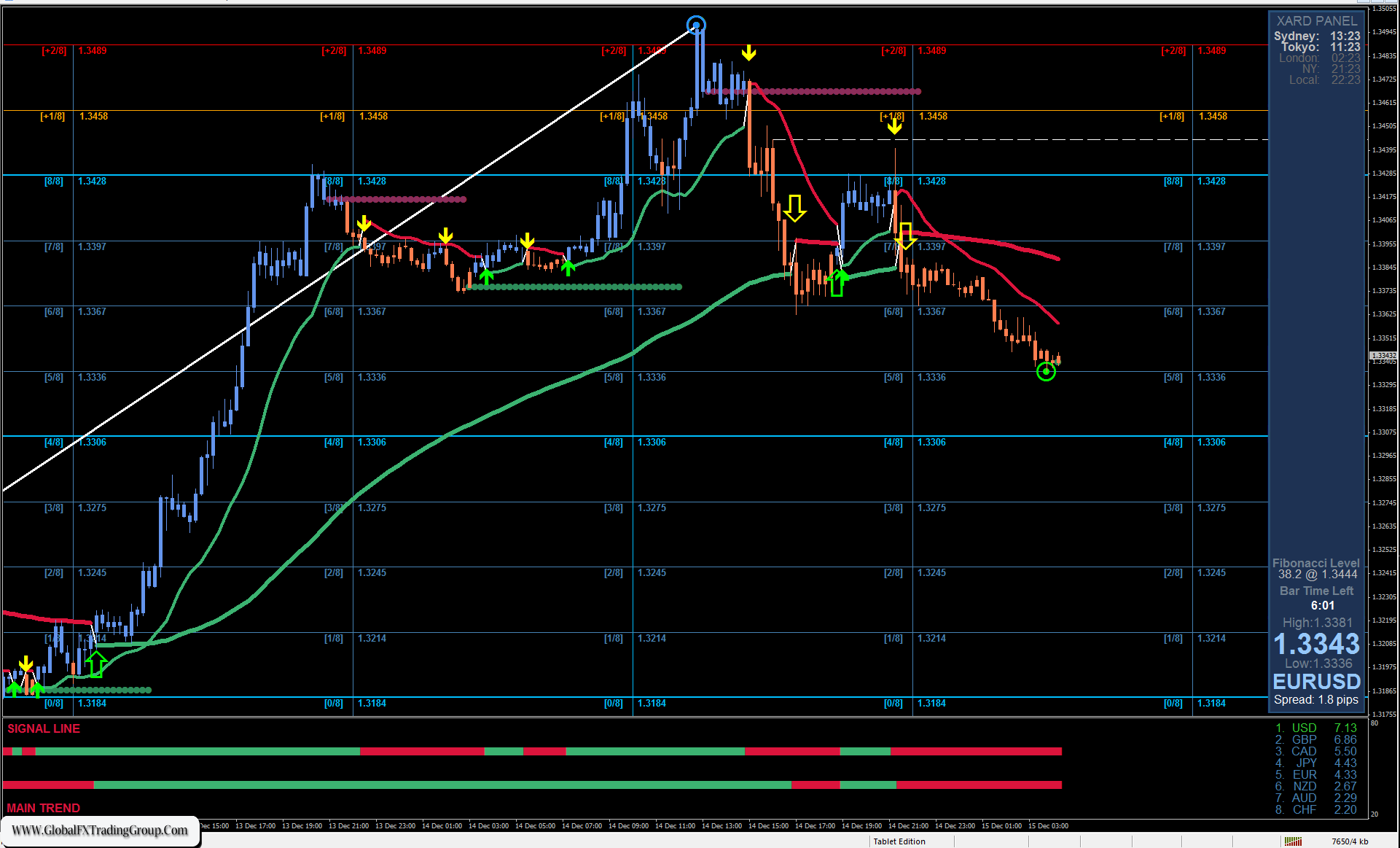

On the four-hour chart, yesterday’s price drop corresponded to a downside breakout from a triangle. The price has settled below 1.1632. The MACD line now acts as support at 1.1578. Price consolidation is likely between the MACD line and the 1.1632 level. A firm move below the MACD line will open the way toward the 1.1495 target.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom