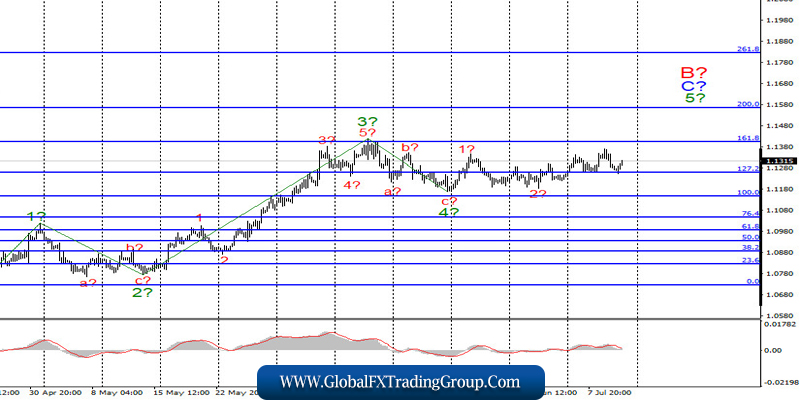

EUR/USD

On July 9, the EUR/USD pair lost about 45 basis points and made an unsuccessful attempt to break through the 127.2% Fibonacci level. Thus, the current wave marking remains unchanged and is still set to form an upward wave 5 in C and B. If this scenario is true, then the price will rise further to the targets located at 161.8% and 200.0% Fibonacci. So, the wave 5 in C and B is likely to take a very complex and extended form.

Fundamental factors:

No important economic reports were expected today and yesterday both in Europe and the US. I did not pay any attention to the data on jobless claims in the US since it does not seem to influence the markets any longer. Investors were terrified by its huge numbers only at the beginning of the COVID-19 outbreak. However, today the reaction is rather calm. Other news was not of big importance as well.

Yesterday, during the video conference, the Eurogroup elected its new president Paschal Donohoe, the Irish minister of finance.Yet, the markets are more willing to know when the EU will approve the EU Economic Recovery Fund of 750 billion euros. This is especially important now after US Treasury Secretary Steven Mnuchin said that the next stimulus package could be approved and implemented by the Congress as soon as in late July.

Amid this news, the EUR/USD pair was trading mixed showing that neither bulls nor bears have gained momentum. It turns out that the coronavirus spread in the US remains the most worrisome factor for the markets. The virus is rapidly spreading across the country, and the White House seems unable to do anything about it. So far, the US president has not made any statements regarding the measures to combat the second wave of the pandemic.

I think that this may lead to Donald Trump’s lower rating ahead of the election. What is more, his opponent Joe Biden has now more reasons to criticize him. And there is a real reason for criticism since the US has almost completely lost its fight against the pandemic. Those countries that managed to control the virus are now lifting the lockdowns and returning back to normal life. In the US, however, the quarantine lockdown has been removed too early, and the virus continues to infect nearly 50-60 thousand Americans every day.

Conclusion and recommendations:

The euro/dollar pair is expected to continue the formation of the upward wave C in B. Thus, I recommend opening long deals on the pair with the targets at 1.1406 and 1.1570. These levels correspond to 161.8% and 200.0% Fibonacci for every MACD signal for the uptrend calculated on the formation of wave 5 in C and B.

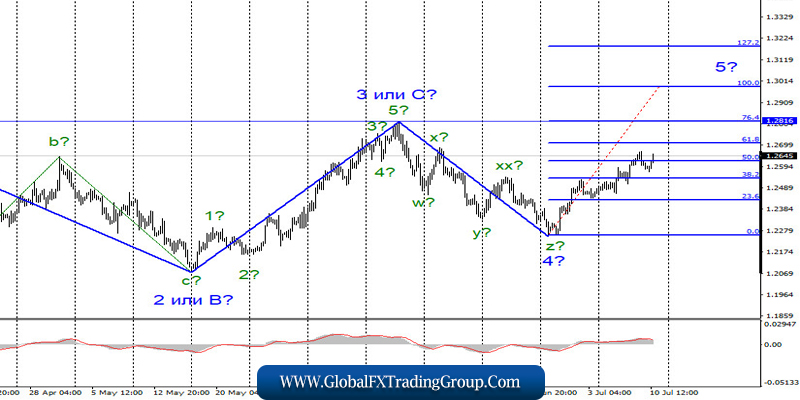

GBP/USD

On July 9, the GBP/USD pair advanced by only several basis points. So, the current wave marking remained almost unchanged. I still expect the formation of an upward wave 5 as part of the uptrend. For this wave, the closest target is located near the peak of wave 3 or C. A successful attempt to break through the 1.2816 mark will indicate more long deals on the pound.

Fundamental factors:

No significant news was released in the UK on Thursday. UK Chancellor Rishi Sunak unveiled the government’s plan to adopt a stimulus package worth £30 billion. The rescue program is aimed at those employers who kept their employees during the pandemic and the lockdown. It was also speculated this week that the EU is ready to find a compromise with the UK regarding the future Brexit trade agreement. However, this information is not confirmed.

Conclusion and recommendations:

The changes in the pound/dollar pair trajectory have made the current wave marking more complex. This is sure to lead to the formation of a new upward wave. Therefore, I recommend placing long positions on the pair with the targets at 1.2816 and 1.2990, which corresponds to the peak of the wave 3 or C and 100.0% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom