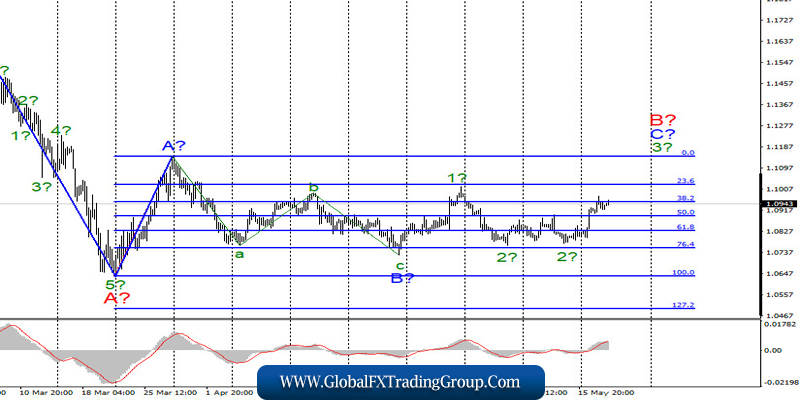

EUR/USD

On May 19, the EUR/USD pair gained only 10 basis points and continued to build the estimated wave 3 in C to B. If the current wave indication is correct, then the quotes will continue to rise to the targets at the mark of 11 and 12. The proposed wave 2 turned out to be more complex than expected, but at the moment it is considered to be completed. If the price breaks through the high of the wave 1, this will mean that the markets are ready for opening more buy positions on the pair.

Fundamental factors:

The entire news background of Tuesday was focused on US Treasury Secretary Steven Mnuchin and Fed Chairman Jerome Powell giving speech to the US Congress. However, markets did not get any new information this time. It was already known that the US economy could contract by 20% in the second quarter, and unemployment could reach 25%. Both Steven Mnuchin and Jerome Powell share this opinion. So they pledged to use all the available arsenal to help the economy overcome the crisis.

Jerome Powell also called on Congress to approve several more fiscal rescue packages for the US economy. At the same time, the European Union has presented its plan to save the economies most affected by the pandemic. France and Germany proposed the creation of a special Recovery Fund which will provide money to all those in need on an irrevocable basis. However, this plan proposed by Merkel and Macron immediately faced severe criticism since not all EU countries can afford such measures.

Today, the European Union has already released the consumer price index for April which dropped to 0.3% year-on-year. Thus, major economic indicators in the EU continue to fall. Likewise, the situation in the US is not less pessimistic. Judging by the current wave marking, the demand for the euro is quite high in recent days. Nevertheless, markets may need additional drivers to buy more of the European currency.

General conclusion and recommendations:

The euro/dollar pair is likely to continue forming the upward C wave in B. Thus, I recommend opening buy positions on the instrument with the targets located near the level of 1.1148 which corresponds to Fibonacci 0.0%. Another option is to place long positions near the high of the A wave every time the new MACD signal shows “up”. The low of the wave B has not been tested yet, so the current wave marking remains relevant.

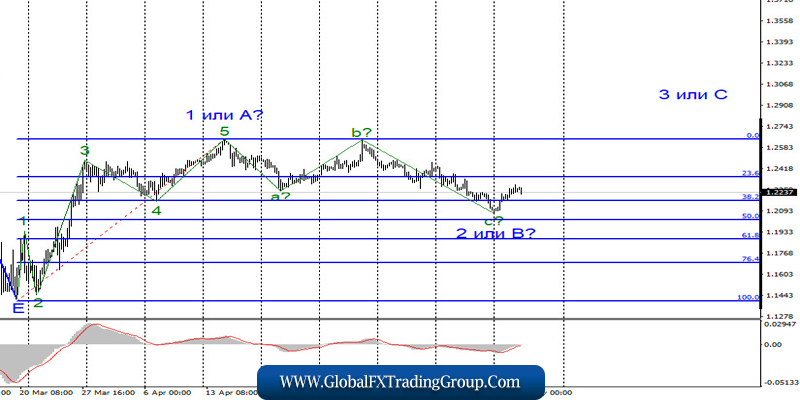

GBP/USD

On May 19, the GBP/USD pair gained another 55 basis points. Today, it continues to build the proposed wave 3 or C. Thus, the quotes may continue to rise to the targets located near the high of the wave 1 or A and above. At the same time, an alternative option involves a significant complication of wave 2 or B which can take a 5-wave form. In this case, I also expect the quotes to move up to the targets located near the mark of 26.

Fundamental factors:

The news coming from the UK is still pessimistic. Last Friday, both parties of the negotiation process between Brussels and London announced that no progress had been made in the second round of negotiations. Both the UK and the EU insist on getting concessions and stress that the agreement is impossible without them. However, at the beginning of the week, the demand for the British currency remains rather high. Today, the UK also released a report on inflation in April. This indicator dropped to 0.8% year-on-year and to -0.2% on a monthly basis. Despite the downbeat economic data, the pound remains in high demand and it is unlikely to decrease.

General conclusion and recommendations:

The pound/dollar pair seems to have completed the formation of the second wave in a new uptrend. Thus, now I recommend buying the pound with the targets located at 26 and 27 mark, keeping in mind the construction of the wave 3 or C, or the wave D in 2 or B in case it becomes more complex. The breakthrough of the 1.2645 mark will confirm that the buy positions on the pound are more preferable.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom