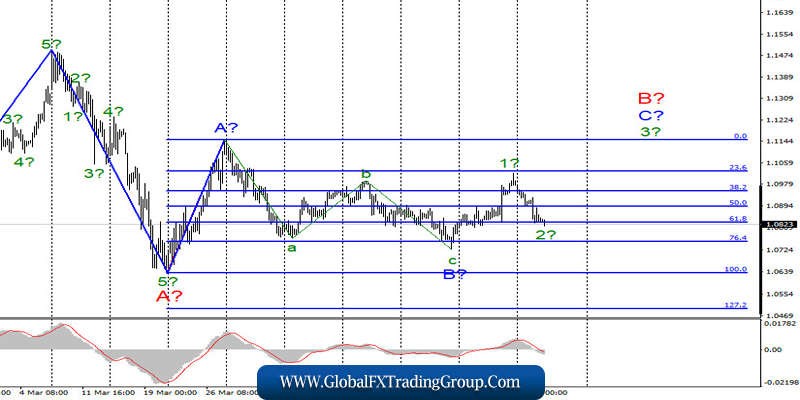

EUR / USD

On Tuesday, May 5, the EUR / USD pair lost about 75 bps and thus continued to build the expected wave 2 to C in B. If the current wave marking is correct, then the increase in the quotes of the instrument will resume with targets at about 11 figures in the near future. At the same time, instability in the foreign exchange market may lead to a further decrease, which will require the introduction of new adjustments and additions to the wave marking. Until the breakthrough of the B wave low, the upward mood of the markets remains.

Fundamental component:

The news background for the EUR / USD pair on Tuesday boiled down to just a few business activity reports. However, the markets did not pay any attention to these figures, and this was understandable from the very beginning. The whole world has been distracted by the coronavirus and is now anticipating the new brewing confrontation between America and China. Unfortunately, as in the case of the trade war, which lasted two years, no one will be able to simply be outside observers.

If the two largest economies in the world decide to move from words to deeds, then everyone will get it. The global economy will fall under a new powerful blow if a new conflict arises between Beijing and Washington. And it can arise extremely easily. According to many political scientists, Donald Trump is decided into finding those responsible for spreading the epidemic across the USA as soon as possible, and, unsurprisingly, the first in his list is China.

Although, quite frankly this may not be unreasonable since the virus began in China and has now escalated and has infected more than 180 countries on the planet. On the other hand, we do not know whether the virus was created artificially, whether it was an oversight by Chinese scientists, and if the virus emerged by chance. And it is on these factors that Trump can play. Yesterday, the US president said that he would soon present the results of an investigation on the origin of coronavirus and the reasons for its spread from China around the world.

Donald Trump didn’t say anything about the specific dates, but the White House is unlikely to back down now and not say anything. At the same time, according to other information, there is no evidence of China’s intentional creation of the virus and its deliberate spread. However, the truth is not too important right now.

General conclusions and recommendations:

The EUR / USD pair presumably continues to build the upward wave C in B. Thus, I recommend buying the instrument with targets located, as before, around 1.1148, which equates to 0.0% Fibonacci, or the peak of wave A according to MACD signal “up”. A successful attempt to break through the low of wave B will indicate that markets are not ready for new purchases of the euro.

GBP / USD

On May 5, the GBP / USD pair lost only a few base points and, therefore, continues to build the expected wave c in 2 or B as part of the upward trend. Lower quotes may continue with targets located near the minimum of wave a at 2 or B or slightly lower. After which I expect the resumption of the increase in quotes within the framework of wave 3 or C with targets above the 26th figure. At the same time, all wave marking can take a more complex form.

Fundamental component:

The news background for the GBP / USD pair on May 5 was extremely weak. Business activity in the service sector decreased to a minimum value of 13.4. The situation in America in the service sector is slightly better, where two business activity indices showed a decrease to 26.7 and 41.8. Today in Britain there will be an index of business activity for the construction sector, and no one expects anything positive from this report either. Meanwhile, in the US, the ADP report was released which showed a decrease in the number of employees in the private sector by 20.5 million, as well as the lowered demand for the US dollar in instruments with the euro and pound sterling.

General conclusions and recommendations:

The GBP/USD pair seemingly completed the construction of the first wave of a new upward trend section. Thus, now I recommend selling the pound with targets located around 22 and 21 figures per 2 or B correction wave. After this wave is completed, I recommend buying an instrument with targets above 26th figure per wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom