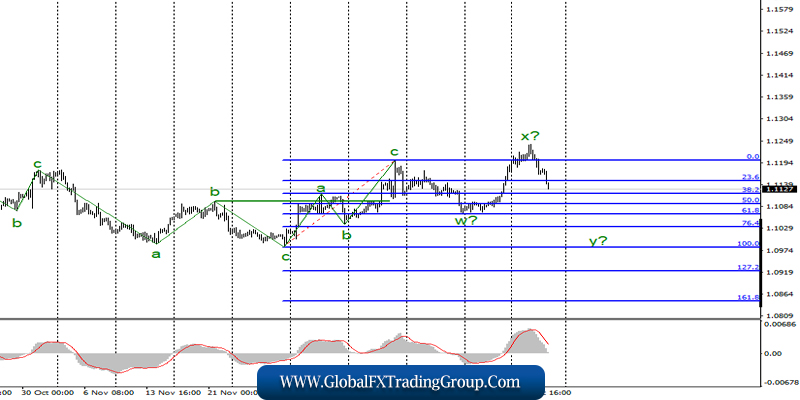

EUR/USD

On January 2, the EUR/USD pair lost about 50 basis points, and another 45 on Friday, January 3. This will consequently move the trading instrument to the construction of the expected downward wave y. If that happens, the quotes will continue to decline to the goals located below the minimum of the wave w which is below the 61.8% Fibonacci.

In recent months, the instrument has been predominantly building three-wave structures, so the current wave structure can be completed in about 10 figures.

Fundamental component:

The news background for the EUR/USD pair was unfavorable yesterday, as most of the indices of business activity in the production areas of the Eurozone countries, although showed positive dynamics, still remained at fairly low values.

Today, it will be interesting to look at the ISM index of the gradual acceleration of inflation, the index of business activity in the ISM services sector, and the publication of Fed’s report regarding open markets. The ISM index for the manufacturing sector will be of the greatest interest. Let me remind you that yesterday, the Markit index was at 52.4, allowing us to judge the positive dynamics of business activity in the US.

However, the ISM index in November was at 48.1, so today, the markets expect to see a value of about 49.0, making a value of not lower than 49.0 to lead a further increase in the US currency and a decrease in the EUR/USD instrument.

The event with a louder sign “Fed report”, however, is unlikely to affect the market and its behavior today. It will be published late in the evening a few hours before closing for the weekend. It is more statistical in nature, so all the information from the last meeting has long been known, and it only emphasizes the results.

Let me remind you that the Fed took a pause in the cycle of lowering the key rates, which in some ways, is a bullish factor for the US currency.

General conclusions and recommendations:

The EUR/USD pair has presumably completed the construction of an upward trend section. Therefore, I would recommend continuing to sell the instrument with targets located near the 1.1034 and 1.0982 marks, which corresponds to 76.4% and 100.0% for Fibonacci.

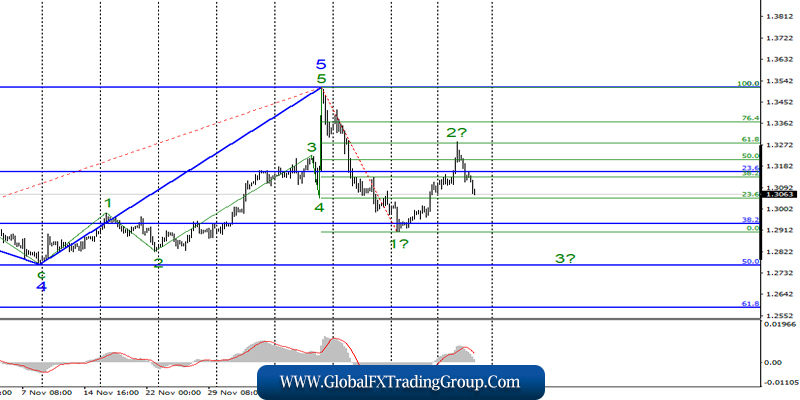

GBP / USD

The GBP / USD pair fell by 110 basis points on January 2 and thus moved to the active construction of wave 3 as part of a new downward trend section. Given the size of the expected wave 1, wave 3 may be very long, which leads to the idea of a potential rise in the US currency in the coming months.

The minimum targets of the current wave structure are currently seen around 29 and 28 figures. Everything will then depend on the news background and events related to Brexit.

Fundamental component:

The news background for the GBP/USD instrument on Friday can be said to be exactly the same as that of the EUR/USD instrument, since economic reports are coming from America today. Thus, a strong ISM business activity index can help the pair.

For the GBP, “Brexit” remains the number one topic, and no new information is received, as it is the holidays after all. However, the situation may change next week.

Let me remind you that Brexit will enter its final phase on January 31, 2020, after which a transition period will begin, where the parties will need to agree on all aspects of further relations between the EU and Britain.

British Prime Minister Boris Johnson is already taking a very hard line in these negotiations even though it has not started yet. Johnson wants to get an agreement that will suit him, and at the same time, to negotiate as soon as possible, as December 31, 2020 will be the final break between Brussels and London.

According to most experts, it is impossible to reach an agreement of this size in 1 year. This factor is what will dominate the pound throughout 2020.

General conclusions and recommendations:

The GBP/USD pair continues to build a new downward trend. I recommend selling the instrument now with targets located near the 1.2764 mark, which corresponds to the 50.0% Fibonacci level, since wave 2 or b is presumably completed, as indicated by the unsuccessful attempt to break the 61.8% Fibonacci level.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom