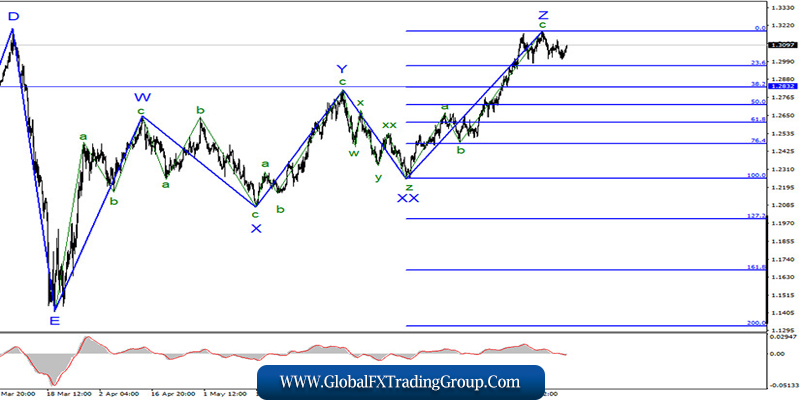

The wave structure of the upward trend section, which began on March 20, has taken the form of a triple zigzag and looks quite convincing. The last wave Z may complicate its internal structure, however, until a successful attempt to break through the 0.0% Fibonacci level, I would not recommend considering this option as a working one. If the news background from the US continues to remain weak, then the whole Z wave may take on a more complex and extended form. At the same time, all the waves look quite harmonious relative to each other at present. Thus, I still believe that the increase in the instrument quotes is complete.

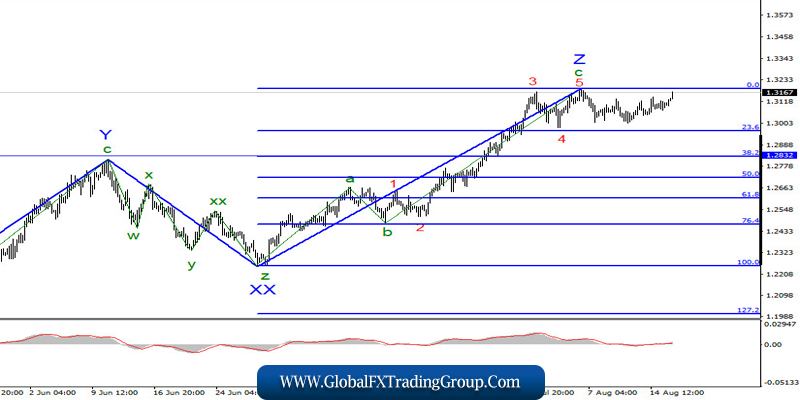

The current wave pattern shows that wave structure a – b – c can be seen inside wave Z , and waves 1-2-3-4-5 are seen inside wave c . Thus, at the moment, I believe that the upward trend has completed its construction. If this is true, then the decline in quotes will resume within at least a three-wave downward structure, which, in turn, may continue to build from a month to one and a half. Another option involves the complication of the Z wave .

There was no news background for the Pound / Dollar instrument on Monday. However, on Tuesday it was reported that a new round of negotiations between the EU and British delegations had started in Brussels. According to 10 Downing Street statements, London still believes in the possibility of a trade agreement. It is noted that the parties are still “on opposite sides of the barricades” in matters of fishing and competition. It is also reported that the seventh round of negotiations, which began today, will be the last summer, although earlier the parties announced that they would resume negotiations no earlier than September.

After the previous round of negotiations, Michel Barnier accused his colleague David Frost of the fact that London is not making any effort to break the “deadlock” in which the negotiations found themselves. Barnier also stated that the deal needs to be agreed by the end of October at the latest so that it can be ratified by the end of December, when the transition period between Britain and the EU will be officially completed.

The UK CPI for July is due tomorrow. Just a reminder that the latest inflation report came out much more positive than the markets expected. True enough, the demand for the US dollar did not grow. Inflation in Britain is planned at 0.6% y / y, which is certainly very low. No other economic reports are scheduled for Tuesday. I believe that more attention should be paid to wave counting tomorrow, and especially the level of 1.3183. An unsuccessful attempt to break through it should throw the instrument down.

General conclusions and recommendations:

The Pound-Dollar instrument is expected to have completed the upward wave Z around 1.3183. Therefore, I recommend at this time to close all purchases at least until a successful attempt of breaking through the 0.0% Fibonacci level. Also, observe potential decline in quotes within a new downward trend section with the first targets located around 1.2832 and 1.2719, which equates to to 38.2% and 50.0% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom