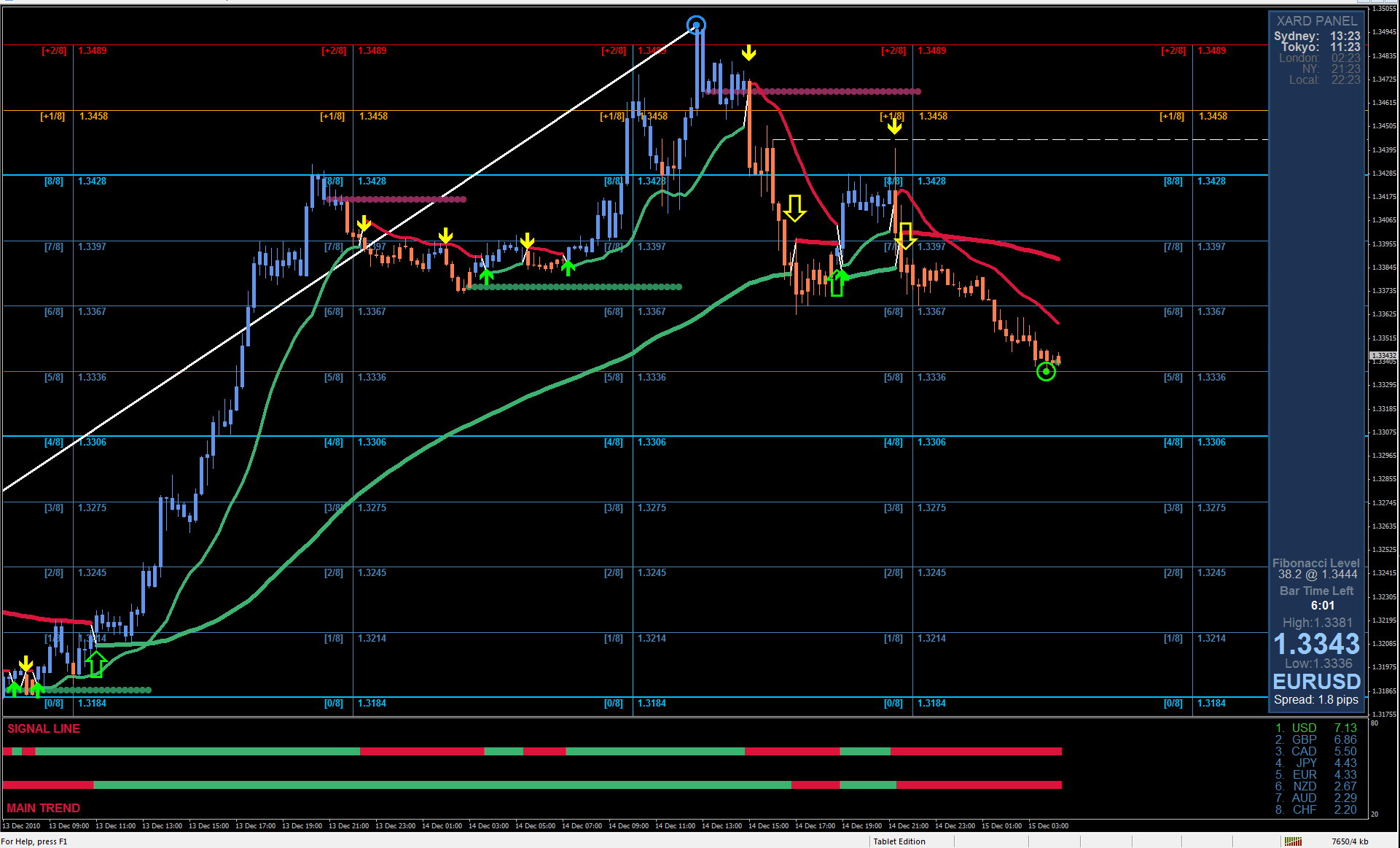

The wave pattern of the EUR/USD pair has remained unchanged in recent days, which signals that the upward part of the trend is already completed. Thus, wave 4 or the first wave of a new downward trend section should begin to form sooner or later, or maybe it has already started forming in the chart. Meanwhile, a successful breakout of wave 4 will confirm that the markets are ready for a downturn, but until this happens, the formation of the upward trend section can resume at any time, which will then take on the form of wave 5.

At the same time, the wave pattern on the lower chart shows that wave 3 or C is supposedly completed. However, it is impossible to make a clear conclusion until a successful breakout of the low of wave 4 at 5 at 3 or C. The upward part of the trend, in turn, may well take a 5-wave structure, but then markets need to make a successful attempt to break the high of wave 5.

On another note, there were very few economic reports and news on Tuesday, which explains why trading of the pair was slow. The trading week started with a report that the representatives of China and America had negotiated a trade deal between the countries. However, it turned out that there were no trade negotiations. The parties only discussed the current implementation of the agreements signed in January this year, but there was no discussion regarding the second phase of the deal.

Consequently, the tension between Washington and Beijing remains. Moreover, Donald Trump almost openly declared that if he is re-elected in November, he will continue his anti-Chinese activities, since he sees China not only as a competitor in the international market, but also as the main enemy for the coming years and decades. He does not want it to profit from America, instead he wants China to be punished for the spreading of COVID-19, which led to a record drop in the US economy and to the highest unemployment.

Due to this news as well as other reports of new protests and riots in the United States, the dollar may already lose the low demand in the currency market. Today, I recommend looking at the US durable goods orders report for July.

General conclusions and recommendations:

Since the euro/dollar pair resumed building the assumed global wave 3 or C, I recommend buying the pair with targets located near the calculated level of 1.2089, or 323.6% Fibonacci. Moreover, wave 5 in 5 in 3 or C could already be done forming, so if the low of wave 4 is passed, it will be possible to open sales, after the construction of corrective wave 2 or b.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom