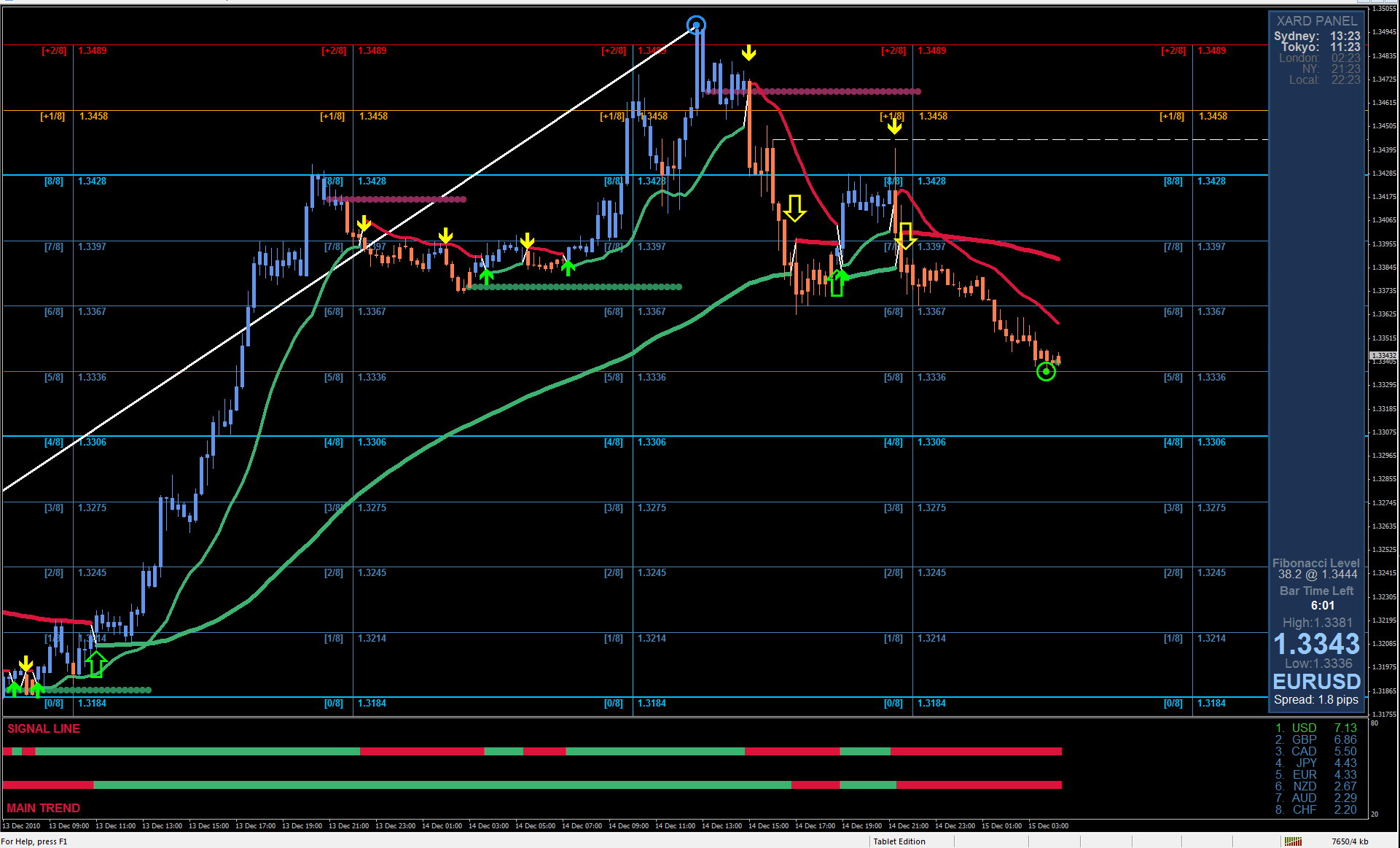

In the most global terms, the wave marking of the EUR/USD instrument has undergone certain changes this week, however, at this time, it looks coherent and convincing. The upward section of the trend is presumably nearing its end or has already been completed.

Thus, in the near future, wave 4 should begin its construction (or has already begun). Or the first wave of a new downward trend section. A successful attempt to break through the low wave 4 will confirm the readiness of the markets to reduce the instrument.

A smaller-scale wave markup refines data obtained from a higher timeframe. The attempt to break the peak of the supposed wave 3 was successful, but, as mentioned above, wave 5 can now end at any moment. At the same time, the quotes of the instrument can continue to increase if the wave 5, 5, 3 or C takes a complex and extended form. At the moment, everything looks as if the upward section of the trend or its wave 3 or C is completed. Thus, I expect to build at least one global wave, possibly 4 upward trend sections, possibly the first of a new downward trend section.

On Thursday, August 20, the day after the release of the minutes, the FOMC presented its minutes of the last meeting and the European Central Bank. Thus, it turned out that the ECB Monetary Committee believes that the economy will need additional stimulus measures in the near future. Representatives of the ECB note new downward risks for the economy, as, first, many EU states have eased quarantine measures to a minimum, and secondly, they began to curtail programs to help the population and small businesses in times of a pandemic.

Members of the ECB Monetary Committee did not agree at the July meeting on the possible expansion of the program to counter the economic crisis caused by the COVID pandemic. Some ECB members support its expansion from the current 1.35 trillion euros, while some do not support this proposal. Also in the second half of yesterday, data on applications for unemployment benefits in America was released. The report showed a new increase in the number of initial applications compared to the previous week. The total number of secondary applications fell to 14.844 million.

On Friday morning, the European Union released reports on business activity in the manufacturing sector (51.7), the service sector (50.1). As well as similar indices in Germany and France. All indices were significantly below market expectations, which indicates that the services and manufacturing sectors, if not started to decline again, are on the verge of starting this process. If the business activity indices go below 50.0 again, it will mean that the EU economy will start to slow down again.

General conclusions and recommendations:

The euro/dollar pair resumed the construction of the expected global wave 3 or C. Thus, at this time, I recommend new purchases of the instrument with targets located near the calculated mark of 1.2089, which corresponds to 323.6% of the Fibonacci, for each MACD signal up. At the same time, the wave 5, 5, 3 or C could have already ended. If the low of wave 4 is passed, then after building a corrective wave 2 or b, it will be possible to open sales of the instrument.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom