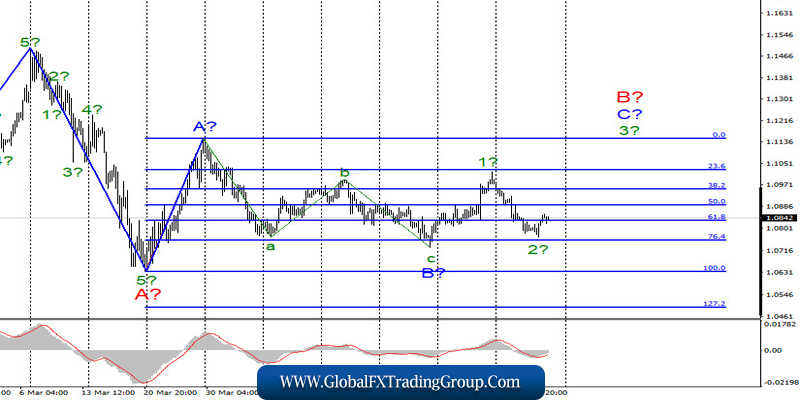

EUR / USD

On May 7, the EUR/USD pair gained about 40 basis points and presumably completed the construction of the expected wave 2 in C in B. If this assumption is correct, then the increase in prices will continue with the targets located about 11th figures and higher within the framework of the construction of the wave 3 in C in B. The entire wave C can be very long and complex in its internal structure. A successful attempt to break through the minimum of wave B will indicate that the markets are not ready for further purchases of the Euro currency.

Fundamental component:

The news background for the EUR/USD pair on Thursday was reduced to just a report on applications for unemployment benefits in the US. It turned out that in the reporting week, the total number of primary applications increased by another 3.2 million, and the total number of secondary applications – was 22.7 million, which was much higher than market expectations. Thus, statistics from America was extremely weak once again, so it is not surprising that demand for the US dollar fell in the afternoon. Another question is that in Europe the statistics remain just as sad. There were simply no important reports yesterday.

For today, there are also no important reports planned in the European Union. Thus, markets will focus solely on US reports on Nonfarm Payrolls and unemployment. No surprises are expected here, and even more pleasant surprises. The unemployment rate in April may rise to 14%, and the number of jobs outside agriculture will be reduced by 22 million. Real numbers may be even worse, but even these should be enough for US currency to continue to decline.

Another salary report for April will be released, which may brighten up the negative from the first two. However, it is unlikely that he will be able to block unemployment data. In addition, it is reported that China and the United States agreed yesterday to work to create favorable conditions for the implementation of the first phase of the trade transaction, which was signed in January.

Chinese Deputy Prime Minister Liu He and US Trade Representative Robert Lighthizer also agreed to develop cooperation in macroeconomics and health. However, the opinion of Donald Trump, who is the main critic of China and even intends to introduce new trade duties, remains unclear if China is proved guilty of deliberate misinformation regarding the coronavirus.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the rising wave C to B. Thus, I recommend buying the instrument with targets located, as before, around 1.1148, which is equal to 0.0% for Fibonacci, or the peak of wave A. Now, a successful attempt to break the minimum of wave B will require making adjustments and additions to the current wave markup.

GBP / USD

On May 7, the GBP/USD pair added only 15 basis points and presumably completed the construction of the expected wave C in 2 or B. If this is true, then the current positions will resume increasing quotes with goals located above the peak of wave 1 or A. At the same time, wave 2 or b can take on a more complex and extended form. Thus, only after a successful attempt to break through the peak of wave 1 or A, it will be possible to conclude that the markets are ready for new purchases of the British currency. Fundamental component: The news background for the GBP/USD pair on May 7 was quite strong. Almost all the news and messages are concerning the Bank of England, which left the key rate unchanged. The volume of asset repurchases from the open market, but at the same time declared a strong “economic shock” for the British economy, which will shrink by the end of 2020 by at least 14%. However, this information did not impress the markets too much, as demand for the British pound was quite high yesterday. Today, it can continue to remain so, as the American statistics do not bode well. General conclusions and recommendations: The pound/dollar instrument supposedly completed the construction of the second wave of a new upward trend section. Thus, I now recommend buying the pound with goals located around the 26th figure, calculated on the construction of wave 3 or C or d in 2 or B. Now, a successful attempt to break through the level of 1.2645 will allow you to buy the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom