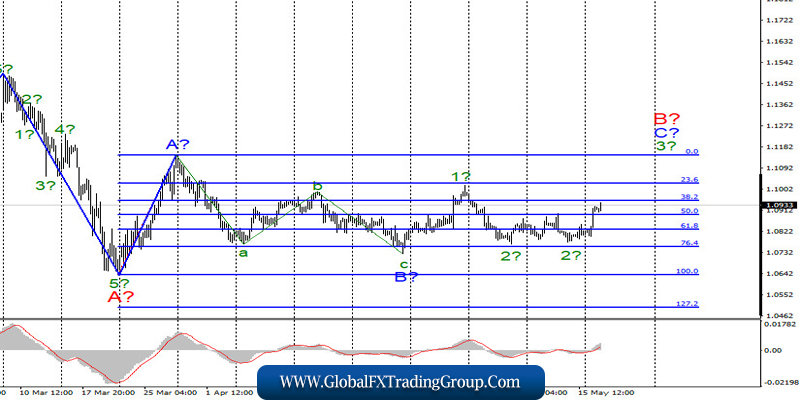

EUR / USD

On May 18, the EUR/USD pair gained almost 100 basis points and thus completed the construction of the supposed wave 2 to C in B. There is already a doubt that the markets are currently able to begin building a new rising wave. The positions of the American currency in recent weeks have looked too good. However, everything unexpectedly changed at the beginning of this week. The markets turned away from the dollar and now the instrument got the chance to resume building the upward trend section again.

Fundamental component:

Monday’s entire media background had no economic context. According to the latest information, Germany and France proposed the creation of a fund for economic recovery, from which funds will be allocated to countries most affected by the coronavirus epidemic. It is planned to create a fund of 500 billion euros. However, is there enough money to help everyone in need? And how long will it take to create this fund?

Countries such as Italy or Spain need help right now, but a package of 2 trillion in aid to the eurozone economy has not been agreed by the European Council. The longer aid is delayed in these countries, the more aid may be needed to restore their economies. There was also information that the American company Moderna has successfully tested human coronavirus vaccines. Thus, by fall of this year, a vaccine that turned out to be safe for people can go into mass production.

In America, the discussion of a new package of stimulus measures for 3 trillion dollars continues, with the adoption of which there are also problems, as in the European Union with the adoption of a package for 2 trillion euros. Jerome Powell calls on Congress to provide more assistance to the American economy and predicts an increase in unemployment to 25% and a drop in GDP in the second quarter by 20%. Jerome Powell will address the Congressional Banking Committee today.

General conclusions and recommendations:

The euro/dollar pair, presumably continues to build the upward wave C from B. Thus, I recommend buying the instrument with targets located, as before, around 1.1148, which equates to Fibonacci 0.0%, or near the peak Wave A for each new MACD signal “up”. The low of wave B has not been updated, so the current wave markup retains its integrity.

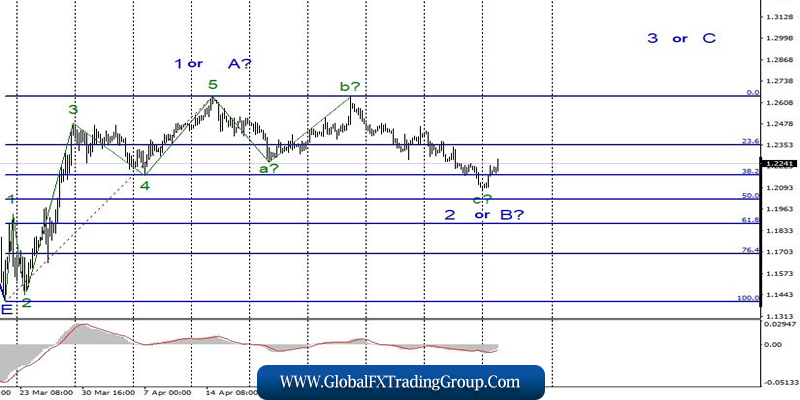

GBP / USD

On May 18, the GBP/USD pair also gained about 100 basis points, and also presumably completed the construction of a downward wave, 2 or B. If this is true, then the increase in quotes will continue within the framework of building a wave 3 or C with targets located near the 27 figure and above. It is not known whether the Brit has the potential for such a strong increase, given the far from best economic and epidemiological situation in the UK. But the current wave markup assumes this scenario.

Fundamental component:

The news feed from the UK still contains only negative news. Last Friday, both sides of the negotiation process (Brussels and London) announced that no progress had been made following the results of the second round of negotiations. Both sides, although making concessions, state that an agreement is impossible without them.

However, demand for the British currency still increased at the beginning of the week, and it is difficult to clearly name the reasons that caused this. Rather, it is not even an increase in demand for the pound, but a fall in demand for the dollar. Today, the report on applications for unemployment benefits in the UK showed 856.5 thousand in April. This is a huge figure for a country whose population is only 67 million.

General conclusions and recommendations:

The pound/dollar pair supposedly completed the construction of the second wave of a new upward trend section. Thus, I now recommend buying the pound with goals located around 26th and 27th figures, based on the construction of wave 3 or C or d in 2 or B. On the other hand, a successful attempt to break the level of 1.2645 will allow you to buy the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom