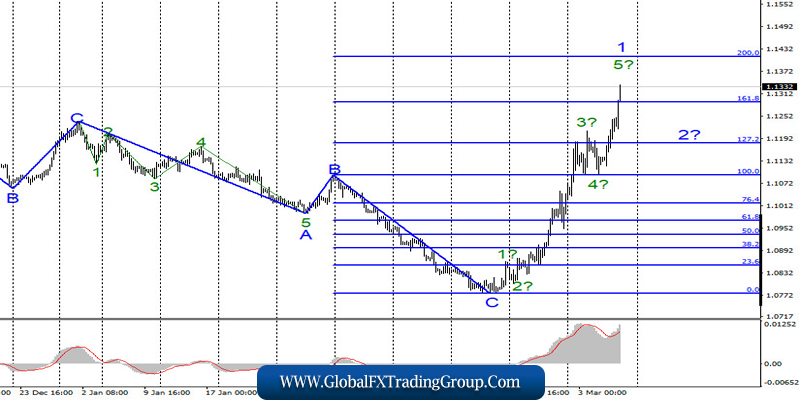

EUR/USD

On March 5, the EUR/USD pair gained about 100 base points and continues to build an upward wave as part of a new upward trend section. Presumably, wave 1. The current wave layout is complicated, as wave 1 becomes too extended. It is difficult to see 5 waves inside it, but even with this layout, wave 1 should end soon. However, along with the completion of its construction, I see a continued increase in the instrument’s quotes. Today, the markets did not even need to wait for news to continue buying the euro.

Fundamental component:

There was no news background for the EUR/USD instrument on March 5. No particularly important news, no economic reports, no important speeches or comments. Thus, the market took a pause and a corrective wave 4 was built inside wave 1. However, today, on Friday, when several economic publications were scheduled in America, the markets did not even wait for them and again rushed up.

At the moment, the tool has added another 90 points. I don’t even think that this is the reaction of the markets to the expectations of the US reports. Most likely, the reports have nothing to do with it. Just a panic mood continues to remain in the markets, which leads to such movements. Nevertheless, the unemployment rate, Nonfarm Payrolls, and US payroll data will be released in a few hours.

Given the amplitude of trading in the first half of the day, it is unlikely that the American news will be able to affect anything. However, the Nonfarm report is very important for the US government, the Fed, and currency markets. Thus, the dollar’s chance in the second half of the day is a strong Nonfarm.

If the report turns out to be weak, then the markets will have another reason to continue making purchases of the euro. Although without reason, the euro has already added more than 550 basis points since February 20. The absolutely unprecedented growth of the euro.

General conclusions and recommendations:

The euro/dollar pair is presumably continuing to build a new ascending section. Based on the current wave layout, wave 1 continues its construction. Thus, I still recommend waiting for wave 2 to be completed and buying the tool only after wave 3 starts building.

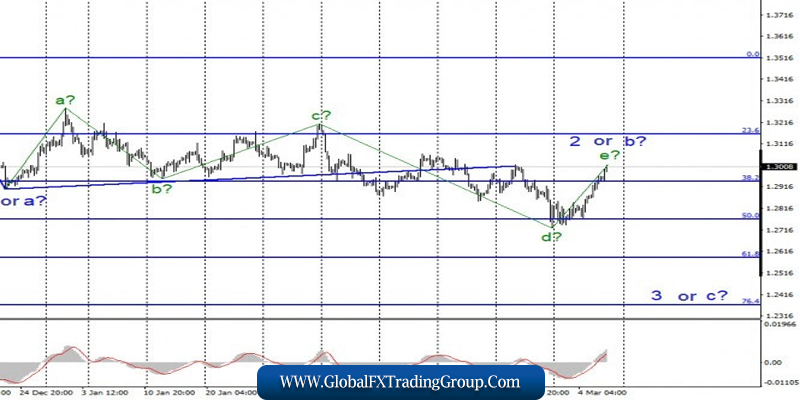

GBP/USD

The GBP/USD pair gained about 85 basis points on March 5. Thus, the current wave markup once again required adjustments and additions. Now the wave d is very complicated, and the instrument is presumably within the wave 2 or b. However, the wave pattern may become more complicated. If the current wave markup is correct, then after the completion of wave e, the decline will resume within the long-awaited wave 3 or C. However, given the news background, the wave markup may become more complex.

Fundamental component:

The news background for the GBP/USD instrument on Thursday was only in the speech of Bank of England Chairman Mark Carney, who will leave his post in 10 days. However, for now, it is Carney who runs the British Central Bank, so his comments would be extremely important and could affect the markets.

However, Carney did not tell the markets anything interesting, although he was expected to comment on the Central Bank’s plans for the next meeting. After all, everyone is interested in the answer to the question: will the Bank of England follow the example of the Fed? The UK economy has long felt weak due to Brexit. Now the raging coronavirus has had a strong impact on supply chains, tourism, and some other industries. The IMF lowered its forecasts for global economic growth.

Thus, the economy needs help, and the Bank of England can lower the rate to give it this help. But the markets did not wait for any comments yesterday. And today we can’t wait for American statistics and continued to buy the British after the euro.

General conclusions and recommendations:

The pound/dollar tool has complicated the current wave markup, which has now become even more extended. Thus, I recommend selling the instrument with targets located near the marks of 1.2584 and 1.2369, which corresponds to 61.8% and 76.4% for Fibonacci, using the new MACD signal “down” in the calculation of building a wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom