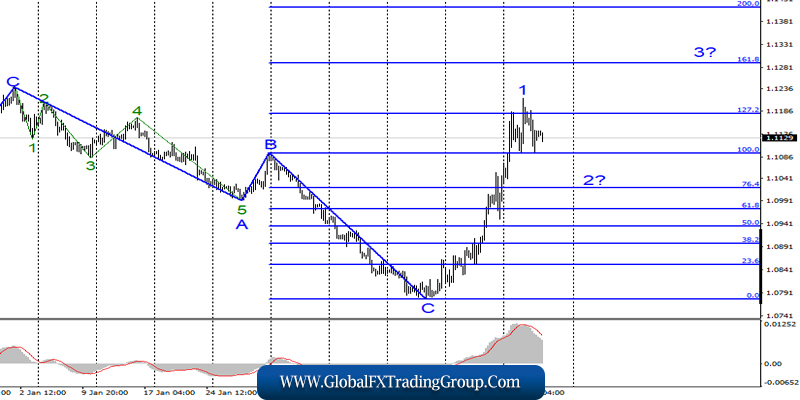

EUR / USD

On March 4, the EUR/USD pair lost about 35 basis points and, thus, presumably, proceeded to build a bearish wave 2 as part of the upward trend section, which, most likely, will also take a three-wave form. If this assumption is correct, then the instrument can begin to decline with targets located near the level of 76.4% Fibonacci. The news background has been very strong in recent weeks, but markets do not always follow it since oftentimes, the direction of movement does not coincide with the nature of the news.

Fundamental component:

The news background for the EUR / USD instrument on March 4 was extensive. There were several indices of business activity in the countries of the European Union, the European Union and America. The most important index, perhaps was the ISM for the US services sector, which significantly exceeded the expectations of the market. However, the indices of business activity in Germany and the EU were quite weak, although they did not decline below the level of of 50.0.

In addition, the ADP report was quite strong, which is considered very important for the US economy, along with Nonfarm Payrolls and other indicators of unemployment and the labor market. It showed new 183,000 workers in the private sector with market expectations of 170-175K. Thus, an increase in demand for the American currency was quite expected yesterday.

However, I also cannot say that the US dollar went on the offensive, and the markets refused further purchases of the euro. All because that coronavirus is spreading in the world, and panic in the markets is also rampant due to the negative impact of this virus on global economic growth. Many countries, including the United States and the European Union, have already decided to support the economy in any way possible.

In America, the key rate has already been lowered by 0.5%, and in the eurozone, a decision has been made to expand fiscal measures. One way or another, assistance to the economy will be provided, because no one knows when it will be possible to defeat the virus and what damage it can do before it is completely defeated. In the past two weeks, when the topic of coronavirus has become particularly acute, the US dollar is paired with the euro. Thus, it is possible that it is coronavirus that causes a slight decrease in the quotes of the pair, when the wave marking implies the construction of a downward wave.

General conclusions and recommendations:

The euro-dollar pair is supposedly continuing the construction of a new ascending section. Based on the current wave counting, wave 1 is supposedly completed. Thus, I recommend waiting for the completion of the construction of wave 2 and buying an instrument with targets located near the levels of 1.1180 and 1.1289, which corresponds to 127.2% and 161.8% Fibonacci.

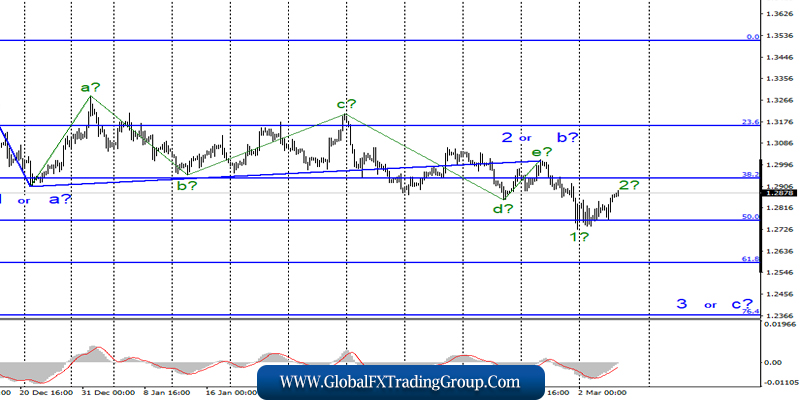

GBP / USD

On March 4, GBP/USD pair won about 65 basis points, and continues to build presumably wave 2 as part of 3 or C. If the current wave markup is correct, then the decline of the Pound/Dollar instrument will resume in the near future within wave 3 in 3 or C with targets located near the 61.8% and 76.4% Fibonacci levels. At the same time, a further increase in instrument’s quotes may lead to changes in the current wave marking.

Fundamental component:

The news background for the GBP / USD instrument on Wednesday only consisted of the index of business activity in the services sector and composite. Both showed a slight decrease. Meanwhile, the markets are waiting for more important information about the Bank of England’s efforts to fight the coronavirus, as well as about the course of negotiations between Britain and the European Union on a trade deal.

Without this information, the pound is unlikely to continue to increase. Today, Bank of England Chairman Mark Carney will make a statement, which may just tell the markets what measures will be taken to reduce the negative impact of the epidemic. Other than that, no other economic events are planned for today in the UK and the USA.

General conclusions and recommendations:

The pound / dollar instrument has complicated the current wave marking, which has now taken on a much more extended form. Thus, I recommend selling the instrument with targets located around the levels of 1.2584 and 1.2369, which corresponds to 61.8% and 76.4% Fibonacci, after a successful attempt to break through the 50.0% level or a new MACD signal ” way down”.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom