EUR / USD

On March 3, the EUR/USD pair added 40 more basis points and, therefore, continued to build wave 1 as part of a new upward trend section. Yesterday, another unsuccessful attempt was made to break through the 127.2% Fibonacci level, so the probability that wave 1 is completed increases. At the same time, a strong news background may lead to the fact that this wave will get a much more extended form, although it is believed that the time has come to build a correctional wave with targets located near the 76.4% Fibonacci level.

Fundamental component:

The news background for the EUR/USD instrument on March 3 was not initially too strong. Yesterday, inflation was planned to exit in the European Union, and that’s all. Moreover, the consumer price index did not please the markets (decrease to 1.2% y / y) once again; however, all attention was paid to the decision of the Federal Reserve System at an emergency meeting to lower the key rate immediately by 0.50%.

The Fed hasn’t made such a decision for a very long time, and it was unexpected for the markets in some way. A softening of monetary policy was expected, however, as part of the Central Bank meeting scheduled for March. At the same time, the spread of coronavirus, several deaths in America and quarantine in Washington state forced Jerome Powell to take such a serious step. Oddly enough, the instrument showed very inadequate growth after this event. In total, the euro only gained 40 points over the past day.

Although, given the importance and scale of the Fed decision, one could expect a much stronger increase in quotes. However, the increase did not stop for almost two weeks until yesterday. Buyers ran out of power, and the market reaction turned out to be more than restrained. Thus, I am more and more inclined towards the option of building a correctional wave.2.

Today, the index of business activity in the service sector (a decrease of 0.7) and the composite index (a decrease of 0.4) have already been released in Germany. Meanwhile, the picture is approximately the same in the EU. Business activity decreased by 0.2 in the service sector, while the composite index remained unchanged.

General conclusions and recommendations:

The euro-dollar pair is supposedly continuing the construction of a new ascending section. Based on the current wave counting, wave 1 is supposedly completed. Thus, I recommend waiting for the completion of the construction of wave 2 and buying an instrument with targets located near the levels of 1.1180 and 1.1289, which corresponds to 127.2% and 161.8% Fibonacci.

GBP / USD

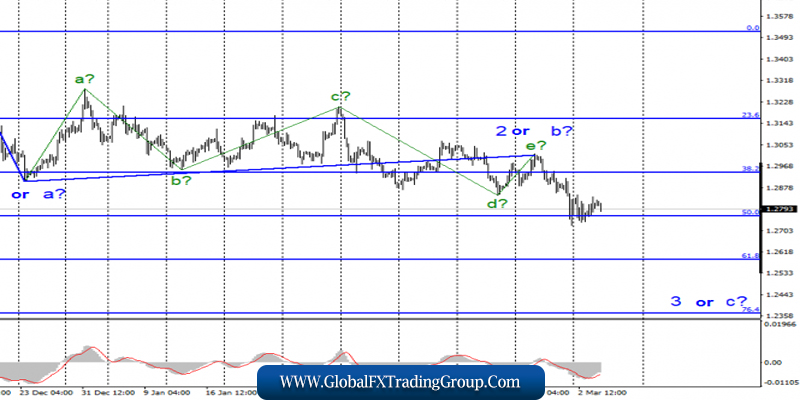

On March 3, the GBP/USD pair gained about 60 basis points and made an unsuccessful attempt to break through the 50.0% Fibonacci level. Thus, the alleged wave 3 or has already begun to complicate its internal wave structure and may resemble wave 2 or b in its complexity. One way or another, the quote of the instrument will not continue until the breakdown of the level of 50.0%. Thus, the markets need to gather strength and make a breakthrough, otherwise, the whole wave pattern may require additions and corrections.

Fundamental component:

There was no news background for the GBP / USD instrument on Tuesday, since no economic data was received from the UK and the USA. There was only the notorious Fed decision to lower rates. This event caused a slight increase in the quotes of the instrument, but no strong market reaction followed, which is very strange. If the continuation of the increase in the euro was logical because of the strong growth before this.

That British pound was in the construction of a downward set of waves in recent months and could very well have demonstrated a stronger increase. However, the markets also expect that the Bank of England will also go on easing monetary policy in the near future. This was already stated by Mark Carney, so this decision has almost been made. Now, all countries of the world need economic support against the backdrop of the raging coronavirus.

General conclusions and recommendations:

The pound / dollar instrument has complicated the current wave marking, which has now taken on a much more extended form. Thus, I recommend selling the instrument with targets located around the levels of 1.2584 and 1.2369, which corresponds to 61.8% and 76.4% Fibonacci, after a successful attempt to break through the level of 50.0%.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom