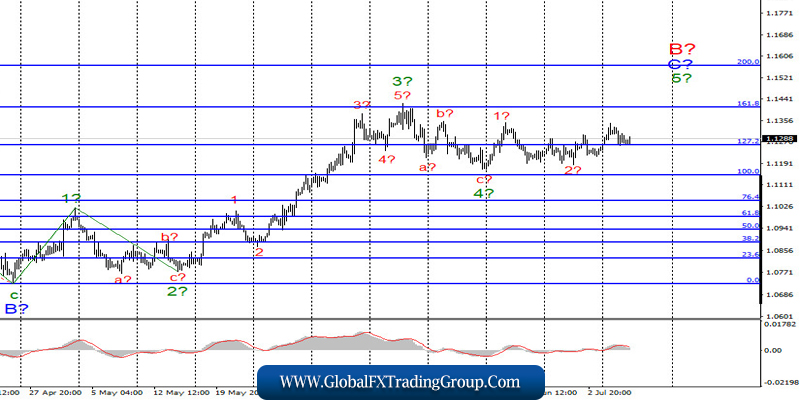

EUR / USD

On July 7, the EUR / USD pair lost about 40 basis points, but the current wave markings still include the upward set of waves as parts of wave 5 in C and B. Thus, another increase in quotes will occur, targeting the levels near the 161.8% and 200.0% Fibonacci. Until a breakout from the lower limit of wave 4 in C and B succeeds, the current wave marking will hold.

Fundamental component:

On Tuesday, quite few macroeconomic reports in the US and EU were published, so the markets did not find reasons and grounds to continue buying positions in the European currency. It resulted to a downward reversal near the highs of waves b and 1, which is quite unusual if we look at it closely in the market.

On the one hand, there is a clear wave marking, according to which the upward trend should continue to occur, but on the other hand, many factors influence the mood of the market, one of which is the belief of many analysts that the US dollar will decline due to the growing number of COVID-19 infections in the United States.

I, myself, partially agree with this conclusion, but I want to note that the economic factors in America and Europe are now approximately the same. Just the other day, the European Commission published new forecasts for GDP for 2020 and 2021, which have been revised downward due to the deteriorating situations.

Moreover, both Christine Lagarde and representatives of the European Commission have repeatedly stated that the restoration of the EU economy will be long and difficult, and the current problems with regards to reaching an agreement between the UK and EU on Brexit adds pressure to it. The aim of the supposed agreement is that the parties will continue to trade with each other in free trade mode, but if it does not happen, the British and European economy will not reach several percent of GDP in 2021 and the subsequent years.

This will result to a much slower economic recovery. Thus, the current growth of the European currency is not confident, and at any moment, the US dollar may again take the lead in the markets. Nevertheless, any deterioration / improvement in the economies of the European Union and the United States will seriously influence the markets.

General conclusions and recommendations:

The EUR / USD pair may continue to form the rising wave in C to B, so buy positions with targets located near the calculated marks 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci.

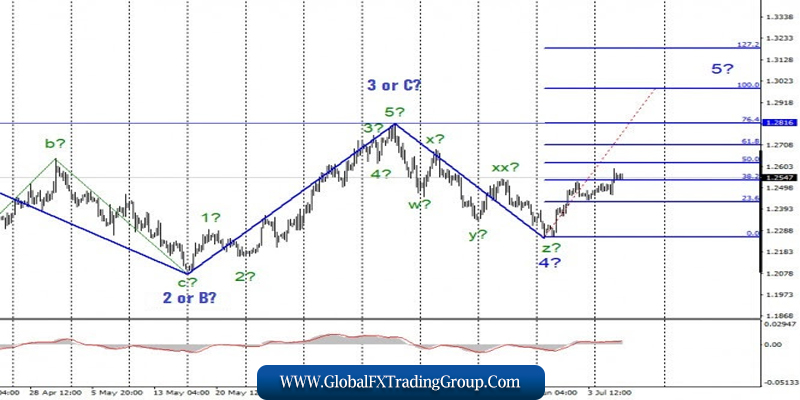

GBP / USD

The GBP / USD pair gained about 50 base points on July 7, so the formation of the alleged wave 5 of the upward trend continued, taking a form of a “zigzag” pattern. If this assumption materializes, then the increase in quotes will continue, targeting the areas near the peak of wave 3 or C. Wave 5 itself can take a rather complex and extended form, the same as the pattern of the previous rising waves.

Fundamental component:

The British pound was in demand on Tuesday, despite the fact that there are no positive news for it. The negotiations on Brexit once again failed to reach a consensus, even though the press regularly receives statements that the parties are going to carry out new stages and ultimately intend to sign an agreement. Fortunately, the markets currently do not take into account this news when trading.

General conclusions and recommendations:

The GBP / USD pair has greatly complicated the current wave marking, which now involves the construction of a new upward wave. Hence, buy positions in the market, targeting the levels 1.2816 and 1.2990, which are the peak of wave 3 or C and 100.0% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom