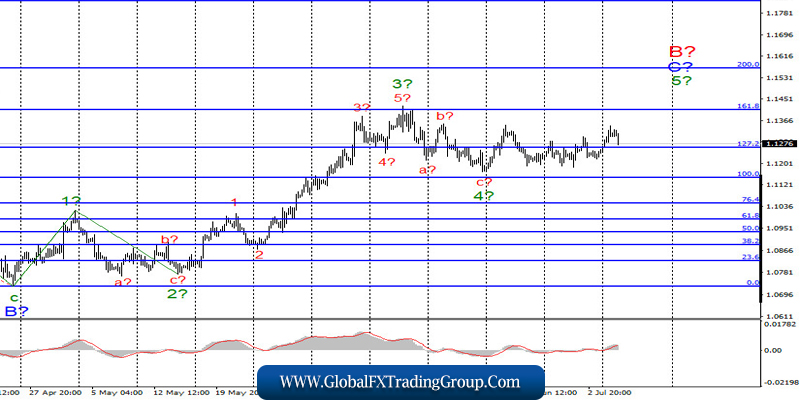

EUR/USD

On July 6, the euro/dollar pair gained 65 basis points but lost most of it on Tuesday night and in the morning. Thus, the current wave markup remains unchanged, however, it becomes very complicated. I still expect to build a wave 5, C, or B. Until a successful attempt to break through the minimum of wave 4, the priority will be to build wave 5 with targets located near the Fibonacci levels of 161.8% and 200.0%.

Fundamental component:

There were no large numbers of economic reports on Monday. However, a lot of interesting things are happening in the world and, in particular, in the EU and the UK. For example, another escalation of the conflict between the US and China. Beijing still adopted the law “on national security in Hong Kong”, so Washington has already started preparing sanctions against China. Also, the White House sent two nuclear-powered aircraft carriers with 90 aircraft on board each to the South China Sea for exercises.

China, in turn, called these actions of the White House “a show of force” and believes that Washington is destabilizing the situation in the region. Also, a new record for the number of cases of coronavirus has been set in the United States. This time, the counter stopped for almost 60,000 infected people in one day. In total, almost 3 million cases and 130,000 deaths have already been recorded in America.

The White House continues to insist that the increase in infections is due to increased testing, and also says that the death rate from the virus in the United States is decreasing. On Monday, the US also released two business activity indices for the services sector, each of which significantly exceeded the expectations of traders. Thus, the service sector in America has begun to recover, which can not but please.

However, markets are now paying more attention to more global topics, rather than to ordinary statistics. The same applies to statistics from Europe. According to the current wave markup, the instrument should continue to increase, but in recent weeks it has been openly marking time in one place, showing the disinterest of the markets in new purchases of the euro currency.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build an upward wave C or B. Thus, I recommend buying a tool with targets located near the calculated levels of 1.1406 and 1.1570, which is equal to 161.8% and 200.0% for Fibonacci for each “up” signal of the MACD in the calculation of building a wave 5, C, or B.

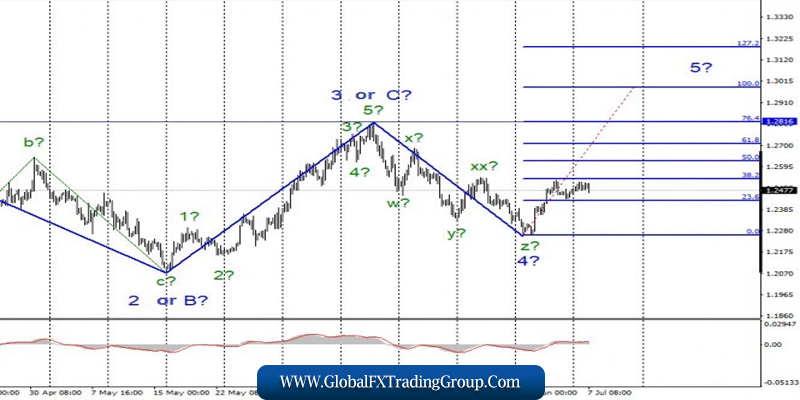

GBP/USD

The pound/dollar pair gained about 20 basis points on July 6. Now I assume that the entire section of the trend, which originates on March 19, takes a 5-wave form, but not a pulse one. Most likely, five waves of the “zigzag” format will be built. The same applies to wave 4, which took a similar waveform “triple zigzag”. So now I expect to build wave 5 with targets located near the maximum of wave 3 or C.

Fundamental component:

There were no noteworthy economic reports in the UK on Monday. But there is constant information about failures in the negotiations between Brussels and London regarding Brexit and the relationship between the country and the bloc after 2020. The EU recently outlined its position again: it wants to conclude a comprehensive agreement with Britain, however, it is not ready to go along with London. Thus, the hope now remains for face-to-face talks between Boris Johnson and top EU officials, which are rumored to take place this month. If they end in nothing, then in 2021, Britain may feel a new blow to the economy.

General conclusions and recommendations:

The pound/dollar tool has greatly complicated the current wave markup, which now involves building a new upward wave. If this is true, then I recommend buying an instrument with targets around 1.2816 and 1.2990, which equates to the peak of wave 3 or C and 100.0% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom