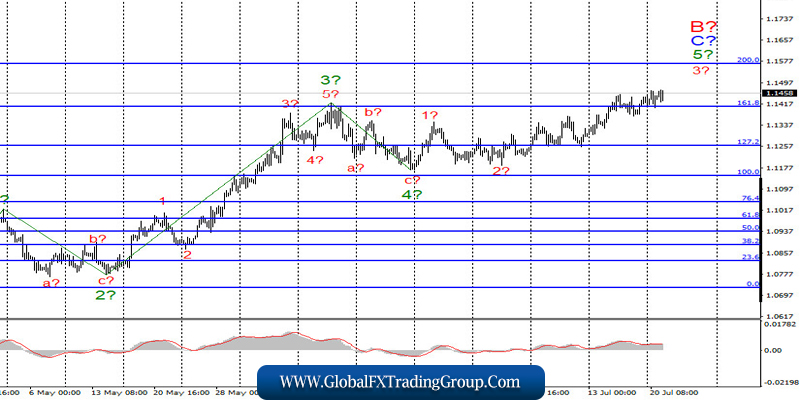

EUR / USD

On July 20, the EUR/USD pair gained about 30 pips. Thus, the instrument remains within the framework of the construction of the assumed wave 3 in 5 in C in B, which takes on a very extended form. If the current wave counting is correct, then the rise in quotes will continue in the near future with targets located near the 200.0% Fibonacci level, as the attempt to break the 161.8% Fibonacci mark was successful.

Fundamental component:

Although there was a huge excitement around the European Union summit, which eventually lasted four days, the markets reacted relatively calmly to its results. The European currency just continued to rally at the same rate as before. The current wave counting has not changed at all either. Thus, either the markets were ready for the leaders of the EU member states to agree in the end, or, in principle, they do not see anything supernatural in the results, believing that it is normal when, in times of the most severe crisis, countries cooperate to help their common economy. One way or another, nothing has changed for this instrument.

I still believe that the markets attach great importance to the dire situation with the coronavirus in the United States, which can have a very negative impact on the American economy. Moreover, the United States is now also preparing a new aid package, which could range from 1 to 3 trillion dollars. However, given how the markets reacted to the adoption of the 750 billion EU aid package, it seems that this is not the most interesting development. That is, there is no news now, except for the coronavirus in the United States, that would affect the movement of the instrument.

On the other hand, China and America exchanged “pleasantries” after Beijing passed the Hong Kong National Security Act, which made the city a regular part of China. Washington responded by stripping Hong Kong of all trade preferences. The confrontation between China and the United States has not yet developed, which is very good for the world economy, which has just begun to recover from the crisis.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build an upward wave C in B. Thus, I recommend buying the instrument with targets located near the calculated level of 1.1570, which equates to 200.0% Fibonacci, for each MACD up signal in the calculation to continue building wave 5 in C in B.

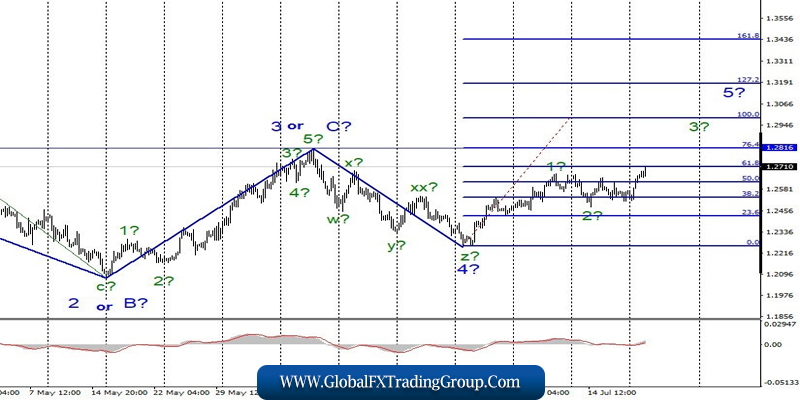

GBP / USD

On July 20, the GBP/USD pair gained about 100 pips. Wave 2 in 5 is still considered completed, so the instrument is currently continuing to build the intended wave 3 in 5. Based on this, I believe that the increase in quotes will continue with the goals located around the 76.4% and 100.0 Fibonacci levels. The entire wave 5 can take a very extended form.

Fundamental component:

There is very little news in the UK at the start of a new week. However, the data that comes from the US is quite enough for the markets to continue to reduce the demand for the US currency. As a result, the pound continues to grow. There will be very little news from the UK this week. Several indexes of business activity and data on retail trade will be released on Friday only. However, markets are also expecting the development of negotiations on a Brexit agreement. Let me remind you that Boris Johnson intended to personally visit Brussels for negotiations, which have been at an impasse from the very beginning.

General conclusions and recommendations:

The pound/dollar pair has made the current wave counting very complicated, which now suggests building an upward wave. Therefore, I recommend buying the instrument for each MACD signal “up” with targets located near the levels of 1.2816 and 1.2990, which equates to the peak of wave 3 or C and 100.0% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom