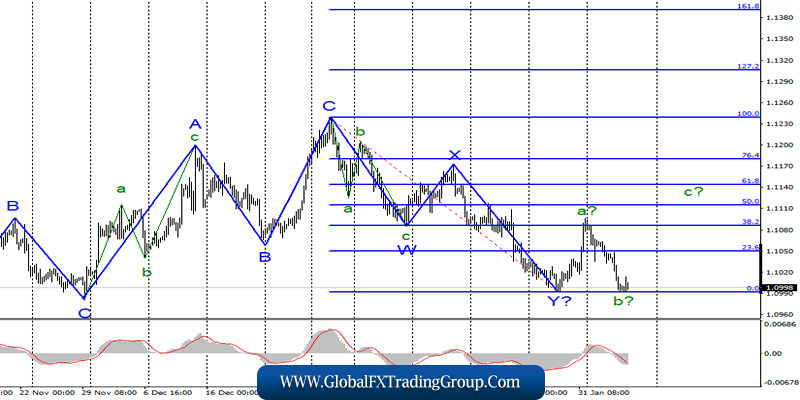

EUR/USD

On February 5, the EUR/USD pair lost another 45 basis points and thus continued building the expected wave b as part of a new upward trend. Due to yesterday’s decline, this wave b has acquired a very deep form and even called into question the further construction of the ascending set of waves. However, an unsuccessful attempt to break the 0.0% Fibonacci level indicates that the markets are ready for new purchases of the European currency. A break of the mark of 1.0993 is highly likely to complicate the entire wave layout.

Fundamental component:

The news background on Wednesday was very extensive. I spoke about the European economic reports of the day before. It remains only to deal with American data. They were very impressive. The Markit services PMI was 53.4 (above market expectations), the composite PMI was 53.3 (above market expectations), and the ISM PMI was 55.5 (above market expectations). Thus, all three reports exceeded forecasts and caused additional demand for the US currency.

This partly explains the complexity and lengthening of the proposed wave b, which even calls into question all further construction of the ascending section. Today, a single report was released in Germany on production orders for December, which fell by 8.7% y/y and 2.1% at once, with much higher expectations of the foreign exchange market.

Thus, all European statistics were either quite weak or showed minimal improvements. Economic data from America showed a major improvement over the previous month. ECB President Christine Lagarde’s speech may have caused additional demand for the euro currency, but she did not touch on the topic of monetary policy, so the markets were left with only economic data.

As of Thursday, the news calendar no longer contains any entries. The amplitude of the euro/dollar instrument may be low until the end of today. Tomorrow we are waiting for important news again from America, which can put a bullet in the positive week for the American currency.

General conclusions and recommendations:

The euro-dollar pair is presumably continuing to build an upward set of waves. Thus, before a successful attempt to break the minimum of the wave y, I recommend buying euros using the MACD “up” signals with targets located near the calculated marks of 1.1115 and 1.1144, which is equal to 50.0% and 61.8% for Fibonacci.

GBP/USD

The GBP/USD pair lost about 35 basis points on February 5 and made another unsuccessful attempt to break the 38.2% Fibonacci level. A new departure of quotes from the reached lows has not yet begun, which gives some hope for a breakthrough of the 38.2% level. Until this point, there are still chances of further complication of the proposed wave 2 or b, although everything now speaks in favor of continuing the construction of the proposed wave 3 or C.

Fundamental component:

The news background for the GBP/USD instrument on Wednesday was more optimistic than for the EUR/USD instrument. After all, the index of business activity in the UK services sector has significantly exceeded market expectations. However, the Briton remains an outsider, and with very vague prospects. I have already mentioned that Boris Johnson seems to be playing against the pound.

Of course, not on purpose, but his statements and his position in negotiations with the European Union make all markets worry and fear. On the one hand, to sound the alarm too early, negotiations with Brussels has not even begun. On the other hand, many analysts doubt that London will be able to agree with the EU, without which Brexit will again be “no deal”.

This is exactly the scenario that the politicians of the opposition forces in the UK Parliament tried to avoid, and this is the outcome that Boris Johnson’s policy may lead to at the end of 2020. The Briton will continue to lose demand if the probability of successful negotiations between London and Brussels decreases.

General conclusions and recommendations:

The pound-dollar instrument has presumably moved to build a downward wave 3 or C. Thus, I now recommend selling the British with targets located near the mark of 1.2764, which is equal to 50.0% for Fibonacci, and below. At the moment, I recommend selling the instrument after a successful attempt to break the mark of 1.2939, which corresponds to 38.2% for Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom