EUR/USD

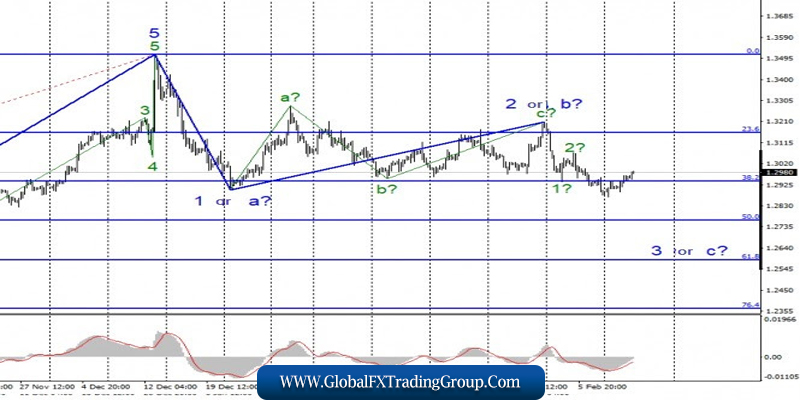

On February 11, the EUR/USD pair gained about 5 basis points and made an unsuccessful attempt to break the 76.4% Fibonacci level. Thus, there are certain reasons to assume the beginning of building an internal correction wave 3 or C. If this is true, then the current values of the instrument’s quotes will begin to increase, which can be maintained up to 10%. At the same time, wave 3 or C does not look complete, so in the future, I expect a further decline in quotes.

Fundamental component:

The news background on Tuesday was mixed. There were no economic reports released in America or the eurozone that day. But there were speeches by two heads of the Central Banks at once – Christine Lagarde and Jerome Powell.

Their rhetoric differed markedly from each other and corresponded to the current state of the economy of the country they represent. If Jerome Powell mainly talked about the good condition of the economy in the US Congress, as well as a strong labor market, weak unemployment and lower risks, then Christine Lagarde spoke only on general topics and did not touch upon any issues of monetary policy at all. Powell in his speech noted the spread of the Chinese pneumonia virus and reported possible threats to the world economy due to this infection.

Lagarde did not touch on the topic of the pandemic. Since Powell did not report anything new, and Lagarde did not report anything at all to the markets, the amplitude of the movement of the euro/dollar instrument did not change or increase. Trading on Tuesday was held in the usual manner and even did without a new decline in the European currency.

It seems that the instrument is preparing to build a corrective wave since the report on industrial production in the European Union released today was extremely weak and could cause a new drop in demand for the European currency.

But it didn’t, although production in December decreased by 4.1% y/y against market expectations of -2.3% y/y. Compared to November 2019, production lost 2.1% against expectations of -1.6% m / m.

General conclusions and recommendations:

The euro/dollar pair continues to build a downward set of waves. Thus, I recommend waiting for the correction wave to be built as part of 3 or C (since wave 1 is nearing its completion) and then selling the instrument with targets located near 1.0908 and 1.0850, which is equal to 76.4% and 100.0% for Fibonacci.

GBP/USD

The GBP/USD pair added about 35 basis points on February 11 and thus began building a new corrective wave as part of the future 3 or C. Given the length and size of the first and second waves of the current downward trend, the third wave can also turn out to be very long and complex.

Therefore, the new upward wave may not be 4 in 3 or C. In any case, I am waiting for the resumption of the decline of the instrument’s quotes with targets located near the levels of 50.0% and 61.8% for Fibonacci.

Fundamental component:

The news background for the GBP/USD instrument on Tuesday was very strong and interesting. And even caused an increase in demand for the pound, although the markets were waiting for the exact opposite. By and large, only one economic report allowed the pound to continue to increase – this is GDP for the fourth quarter in Britain.

Markets were expecting GDP to drop from the previous value to less than 1.1%. The forecasts predicted a reduction of up to 0.8-0.9%. However, unexpectedly for many, GDP did not decrease and amounted to the same 1.1% y/y. On a quarterly basis, the value was 0%, as expected by the markets. Thus, the absence of a decrease in the indicator helped the British to continue the weak increase.

Although, for example, the report on industrial production showed significant deterioration in the situation in the industry -1.8% in December y/y and +0.1% m/m. The markets were waiting for stronger values but still allowed for a general reduction in volumes.

It turns out that the second report was not taken into account, and the first one remained without positive changes. Based on this, I expect further construction of the downward trend section in accordance with the current wave markup.

General conclusions and recommendations:

The pound/dollar instrument continues to build a downward wave 3 or C. Thus, I recommend new sales of the instrument after the end of the current corrective wave, that is, on the MACD signal “down” with targets located near the mark of 1.2767, which corresponds to 50.0% for Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom