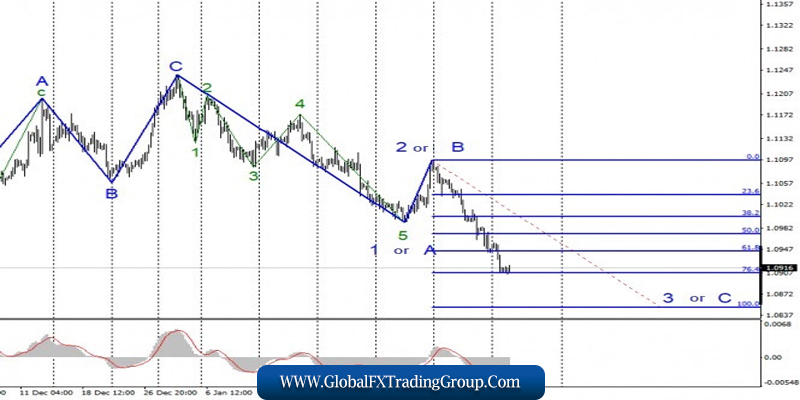

EUR/USD

On February 10, the EUR/USD pair lost another 35 basis points and thus continues to build the expected downward wave 3 or C. The first wave inside 3 or C turns out to be very long. If waves 3 and 5 are proportional to it, then the entire wave 3 or C will also turn out to be very long. An unsuccessful attempt to break through the 76.4% Fibonacci level can lead to an internal correction of wave 3 or C. The same effect can be achieved if an unsuccessful attempt to break through the 100.0% Fibonacci level.

Fundamental component:

The news background on Monday was almost absent, which did not prevent the markets from continuing to sell the euro currency. The decline of the euro/dollar instrument is gaining momentum and today may either strengthen or end. The second option is even preferable, based on the current wave markup, which involves building a correction wave.

On February 11, the news calendar contains statements by two presidents of the Central Banks, Christine Lagarde and Jerome Powell. Both events are extremely important for the Forex market, and even more so for the euro/dollar instrument.

However, for the markets, Lagarde or Powell must report something important, otherwise, the demand will not grow for either the US dollar or the euro currency, and the amplitude will remain the same. You can only expect a “dovish” performance from Christine Lagarde. Inflation, industrial production, GDP, retail sales – all these indicators remain at low values, eloquently showing that the EU economy needs a new stimulus.

There are no signs of an acceleration in the European economy, so the ECB should either continue to simply monitor the situation from the outside (which may lead to an even greater drop in the economy) or again intervene with the help of monetary policy instruments. In the case of Jerome Powell, everything is much more optimistic, since the American economy is just showing signs of acceleration, which is undoubtedly good for the dollar.

Thus, Powell’s speech to Congress can just point out the strength of the US economy, the excellent state of the labor market, wages and employment levels.

General conclusions and recommendations:

The euro/dollar pair continues to build a downward set of waves. Thus, I recommend waiting for the correction wave to be built as part of 3 or C (since wave 1 is nearing its completion) and then selling the instrument with targets located near 1.0908 and 1.0850, which is equal to 76.4% and 100.0% for Fibonacci.

GBP/USD

The GBP/USD pair gained about 30 basis points on February 7, but such a small increase in the instrument’s quotes did not affect the current wave markup in any way, which still involves building a wave 3 or C as part of a downward trend section. If the current wave markup is correct, then the decline in quotes will resume soon with targets located near the levels of 50.0% and 61.8% for Fibonacci.

Fundamental component:

The news background for the GBP/USD instrument on Monday was also absent for the “Briton”. However, the overall trading amplitude of the instrument does not contradict the news background. The most interesting events for the pound occurred today. Quite unexpectedly for the markets, the GDP figure for the fourth quarter in Britain was + 1.1% y/y, although forecasts indicated a decline to 0.8%.

In relation to the previous third quarter, there is no GDP growth – 0.0%. On the one hand, the pessimistic forecasts were not justified, and on the other hand, there is no improvement in the indicator. But there is a deterioration in the report on industrial production for December, which fell by 1.8% y/y instead of the 0.8% reduction that the markets expected to see.

Every month, production increased by 0.1%, which is also worse than forecasts. There will also be a speech by Bank of England President Mark Carney in Parliament today, and everything will also depend on what the chairman will say, who will leave his post in March.

General conclusions and recommendations:

The pound/dollar tool continues to build a downward wave 3 or C. Thus, I recommend staying in the sales of the pound with targets located around the mark of 1.2764, which is equal to 50.0% for Fibonacci. A successful attempt to break this mark will lead to a further drop in quotes. The news background from the UK today is very strong, so I recommend that you carefully follow all the news and reports that may well lead to a strong increase in the instrument, contradicting the wave markup.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom