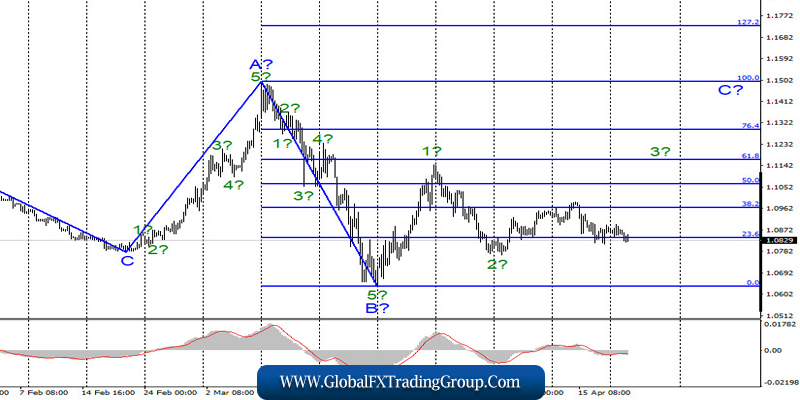

EUR/USD

On April 20, the EUR/USD pair lost just about 10 basis points, and later on Tuesday it eased by additional 30 points. Thus, we can see another attempt of the price to break through the 23.6% Fibonacci level. The previous two attempts were not successful. However, the current wave marking does not imply a further downward trend of the pair. Even if the pattern, which started to form on March 23, evolves into three waves, the quotes should still rise at least to a high of wave 1 in C. Otherwise, the entire wave pattern may require drastic changes.

Fundamental factors:

The foreign exchange market cannot boast any positive news these days. Yesterday, WTI oil futures tumbled to the negative territory which is now viewed as an unprecedented drop in US oil prices. However, I would like to note that another collapse in the oil market has had no significant effect on the foreign exchange market. For example, the euro continues to trade steadily high.

Moreover, the drop in oil demand has overall global impact. It also means that the world simply does not need the amount of oil that the oil giants are currently producing. Therefore, major oil producers need to swiftly reduce output volumes in order to restore prices. The pandemic crisis will end sooner or later. In the US and some EU countries, they governments are planning to gradually ease the quarantine restrictive measures.

However, no one can predict knows the actual consequences of such measures. On the one hand, they end of the lockdown may be followed by a gradual economic recovery, an industrial production growth, a recovery in the service sector, and a rise in oil demand. On the other hand, the lifting of restrictive measures may result in the second wave of the coronavirus epidemic. Unfortunately, the second scenario is more likely for the US and some European countries.

After all, the governments of the EU and the US who seek to end the quarantine are worried mostly about the economic impact of the pandemic and tend to forget about people’s health and life. To be honest, they have little choice right now as it is hard to stay on the lockdown all year long and maintain the same standard of living. The standard of living is steadily declining in those countries, so people need to go back to work despite the risks of a new coronavirus outbreak.

Conclusion and recommendations:

The euro/dollar pair continues to form the estimated upward wave 3 in C. Therefore, now I recommend waiting for the MACD buy signal and buying an instrument with the targets at the levels of 1.1165 and 1.1295 which correspond to the 61.8% and 76.4% Fibonacci levels. I recommend placing Stop Loss orders below the low of the wave 2.

GBP/USD

GBP/USD pair lost about 50 basis points on April 20, and another 150 were lost on Tuesday morning. Thus, in accordance with the current wave markings, the wave 2 or B will continue to form further with the targets located near the 38.2% and 50.0% Fibonacci levels. When the wave completes is formation, I expect the quotes to rise within the framework of wave 3 or C of the upward trend section.

Fundamental factors:

There was no relevant background for the GBP/USD pair on April 20. Unfortunately, the spread of the coronavirus disease in the UK does not show any signs of slowdown. According to medical experts, in the near future Britain could become the next epicenter of the pandemic in Europe. In this case, the British economy could suffer much heavier losses than estimated earlier.

Today, the following reports were issued in the UK: the report on the unemployment rate (4.0% + 0.1% to the previous reading), the data on average earnings with and without bonuses (+ 2.8% and + 2.9%, respectively), and the data on initial jobless claims(total +12 100 claims in March compared to expectations of +172.5). Thus, the statistical data can even be viewed as positive. However, the markets did not see any positive signs and the pound fell by more than 150 points in the early trade.

Conclusion and recommendations:

The pound/dollar pair has supposedly completed the formation of the first wave of a new upward trend. Therefore, now I recommend selling the pound with the targets located at the levels of 22 and 21 with further formation of correctional wave 2 or B. Otherwise, we can wait for the wave to complete its formation and then open buy positions at the beginning of upward wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom