EUR / USD

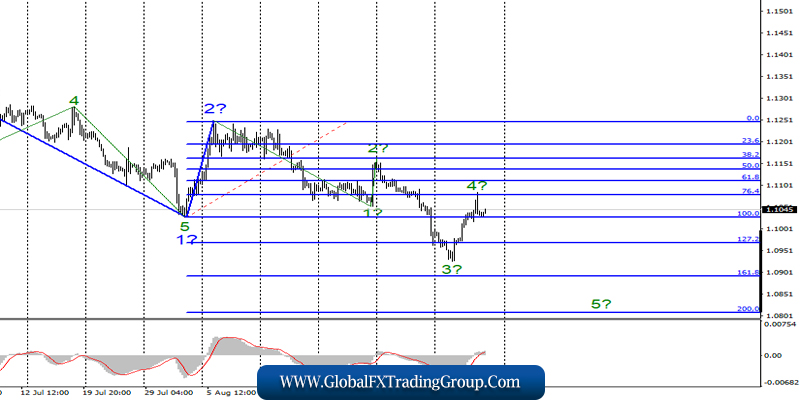

On Thursday, September 5, the EUR / USD pair ended without any price changes, although the instrument reached the level of 76.4% during the day, and made a puncture of this level and an unsuccessful attempt to break through.

Thus, the internal wave structure of the alleged wave 3 took a non-standard form, since wave 4 went beyond the minimum of wave 2. Nevertheless, the fifth wave in the composition of proposed 3 can still be constructed. Its targets are located near the levels of 161.8% and 200.0% Fibonacci. In order for the markets to return to sales of the euro-dollar pair, we need strong economic reports from America.

Yesterday, the beginning was made thanks to the report on ISM business activity in the service sector, which exceeded the expectations of the foreign exchange market (56.4 with a forecast of 54.0).

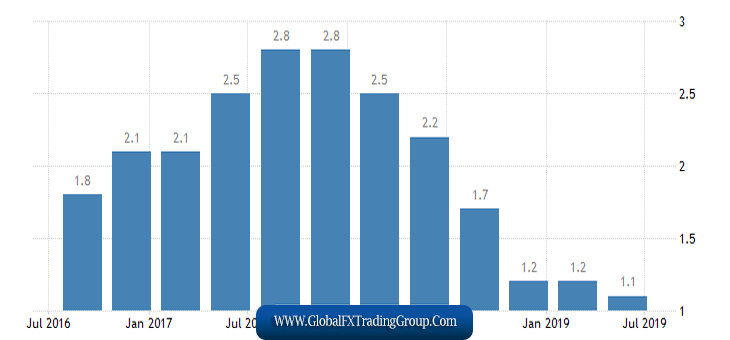

Well, today, GDP will be published for the second quarter of 2019 in the European Union. It is unlikely that market expectations to see + 1.1% y / y will be exceeded. Thus, at best, the European GDP report will not disappoint markets.

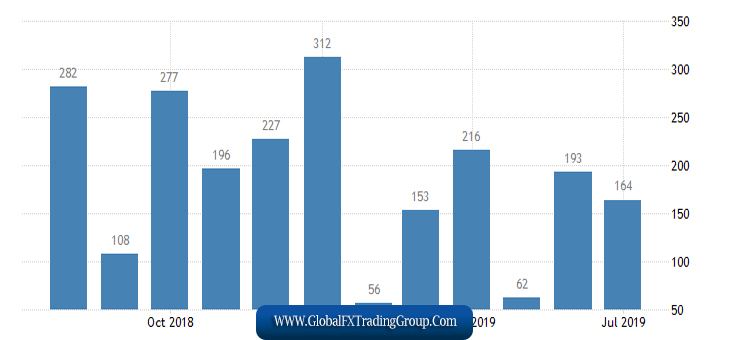

Meanwhile, in America, today is a very important report on the number of new jobs outside the agricultural industry, or Nonfarm payrolls. The last two values of this indicator were quite high.

Based on Non-farm’s annual data, we see that every third month is often a failure. The forecast for August is 163,000 new jobs, but I believe that they may be slightly less in reality. However, to build the fifth wave of the downward trend, you need Nonfarm to please the Forex currency market.

Purchase goals:

1.1248 – 0.0% Fibonacci

Sales goals:

1.0893 – 161.8% Fibonacci

1.0807 – 200.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build bearish wave 3 and its internal correctional wave 4. I recommend selling the pair with targets near the calculated levels of 1.0893 and 1.0807, which corresponds to 161.8% and 200.0% Fibonacci, for the MACD signal is down.

GBP / USD

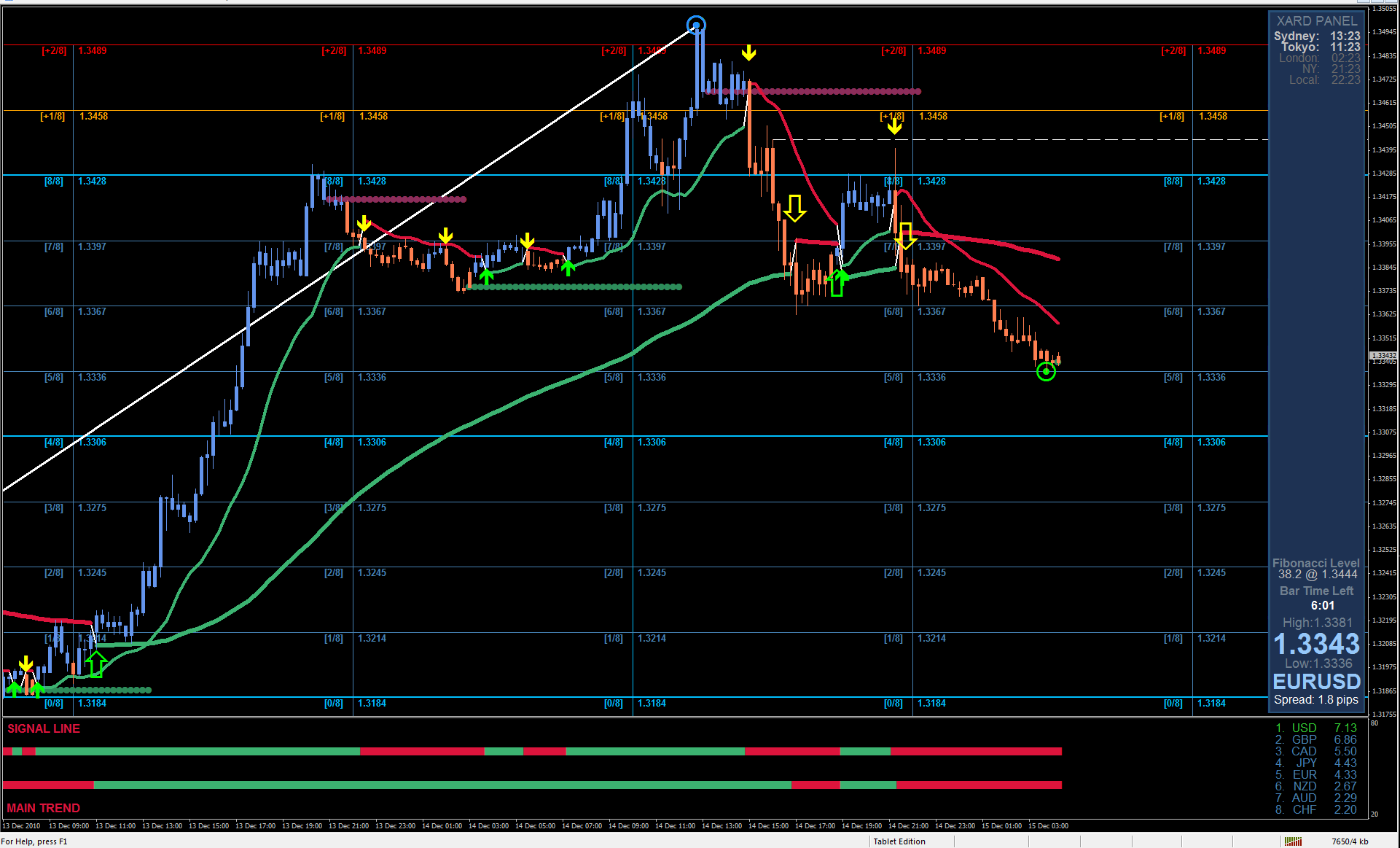

On September 5, GBP / USD gained another 80 base points. Thus, the construction of the proposed wave c, comprising at least the correctional part of the trend, continues. The wave c itself can take a more complex, pronounced five-wave form.

In this case, quotes may already begin to move away from the maximums reached as part of the construction of correctional wave 2 in the future c. In turn, news background can help if US economic reports are strong. In Great Britain, political passions calmed down a bit, as the main events that worried and interested the whole world gave answers to important questions.

The most important of them – Brexit – was postponed to January 31, 2020, and without the consent of parliament, Boris Johnson will not be able to withdraw the country from the European Union without an agreement.

Sales goals:

1.2016 – 0.0% Fibonacci

Purchase goals:

1.2401 – 50.0% Fibonacci

1.2489 – 61.8% Fibonacci

General conclusions and recommendations:

The downward trend section is still considered completed. Thus, now, the construction of the rising wave is expected to continue with targets located near the calculated levels of 1.2401 and 1.2489, which corresponds to 50.0% and 61.8% Fibonacci. You can buy a pound now when the news tension has subsided a bit, but I still do not recommend doing so in large volumes.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom