EUR / USD

Thursday, September 19, ended for the pair EUR / USD with an increase of 10 basis points. Thus, the chances of continuing the construction of the alleged wave 3 or c as part of a new upward trend section remain. At the same time, given the reluctance of the market to invest in Euro currency right now, despite the Fed’s decision to lower the key rate by 25 basis points, there are doubts that the instrument will not return to building a downward trend section.

In the second case, wave 3 or c will be interpreted as c in 4, and the euro-dollar pair will resume its decline within wave 5. One way or another, before a successful attempt to break through the minimum of wave 2 or b, the pair remains likely to grow above 11th figure in any case. Fundamental component: Friday for the euro-dollar pair will be another rather boring day of the week.

The news background on September 20 will be absent again. Thus, today, I do not expect major changes again in the wave pattern of the instrument. Certain hopes in determining the mood of the markets were associated with the results of the Fed meeting, but, as we can see, Jerome Powell only added more uncertainty to the foreign exchange market, without clarifying which direction the Fed would look in the near future.

Towards a new easing of monetary policy or towards stabilization after 2 cuts in the key rate?

Purchase goals:

1.1128 – 61.8% Fibonacci

1.1175 – 76.4% Fibonacci

Sales goals:

1.0927 – 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of a bearish wave 3 or C, as well as wave 2 or b as part of a new trend section, which originates on September 12. If this is true, then the pair is still expected to increase quotes.

I recommend buying a pair with goals near the calculated levels of 1.1128 and 1.1175 calculated on the construction of wave 3 or c. Also, do not forget about protective orders below the minimum of wave 2 or b.

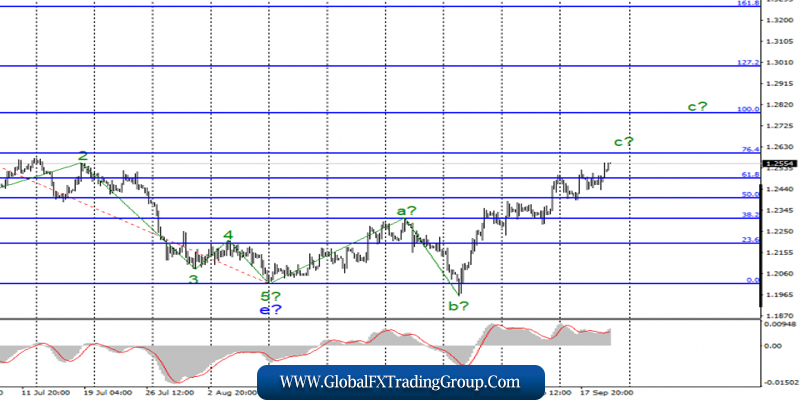

GBP / USD

GBP / USD pair gained 50 base points on September 19 and continues to build an upward trend section within the framework of the proposed wave c, which takes on an increasingly complex and extended form. On the other hand, the new economic report from the UK was no better than the inflation report released a day earlier.

Retail sales in August 2019 increased by 2.7% YoY, although markets expected growth of 2.8%. Excluding fuel costs, retail sales also increased by 2.2% against market expectations of 2.3%. After this not the best report, all attention was focused on the results of the meeting of the Bank of England, although no changes were expected here.

However, the meeting of the Central Bank is always and in any case a significant event. But this time, nothing interesting really happened. The key rate has remained unchanged. When voting for a change in a key parameter of monetary policy, all 9 members of the committee voted “against” any changes. Fundamental component:

On Friday, September 20, traders can breathe a little freely, as the news background will be extremely weak or completely absent today. We only hope for any new information from the fields of Brexit. If it does not exist, then the news background will be neutral.

True, in the current environment, the pound sterling news background is not too necessary. Since September 3, the pound-dollar pair has been growing almost non-stop, although, as I already said, the latest economic reports from the UK were much worse than expectations of the Forex currency market.

Nevertheless, the general good mood of the market regarding Brexit’s prospects, or rather its postponement for three months, continues to push the pound up.

Sales goals:

1.2016 – 0.0% Fibonacci

Purchase goals:

1.2602 – 76.4% Fibonacci

1.2784 – 100.0% Fibonacci

General conclusions and recommendations:

The upward trend section continues its construction. Thus, quotes are now expected to increase with targets located near the calculated levels of 1.2602 and 1.2784, which corresponds to 76.4% and 100.0% Fibonacci. Wave c can still complete its construction in the near future, however, a successful attempt to break through the 61.8% Fibonacci level indicates that the market is ready for a new increase in the instrument.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom